FX Daily Strategy: N America, March 13th

GBP little changed on GDP, but...

...GBP already stretched relative to yield spreads and positioning

Watch on FOMC comments after CPI

JPY strengthens after Toyota wage announcement

GBP little changed on GDP, but...

...GBP already stretched relative to yield spreads and positioning

Watch on FOMC comments after CPI

JPY strengthens after Toyota wage announcement

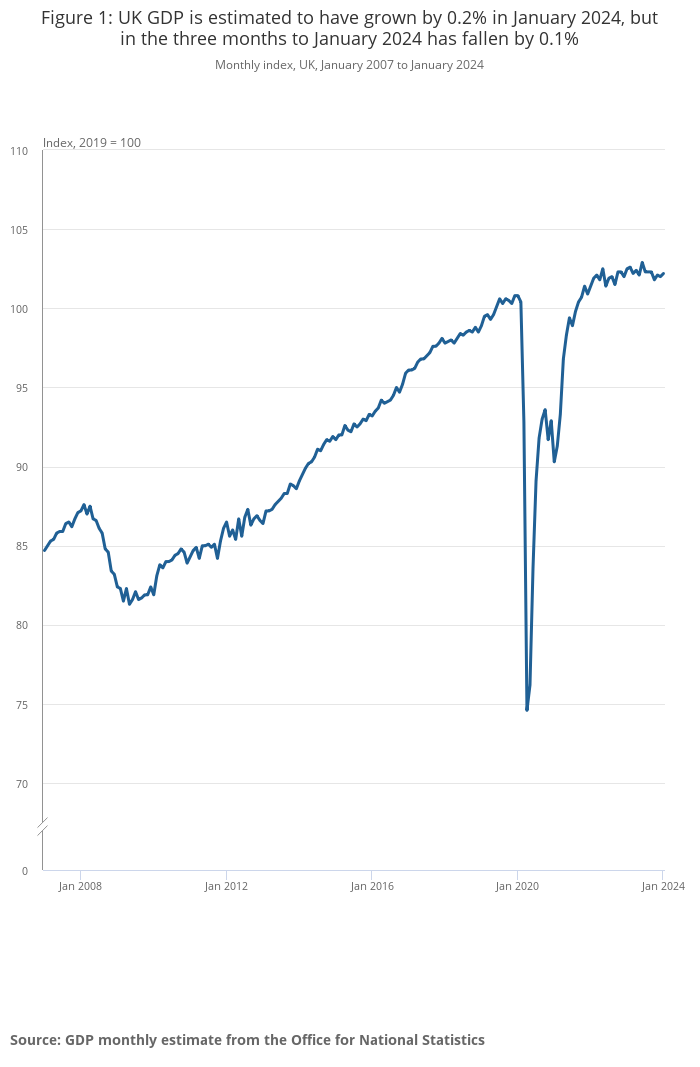

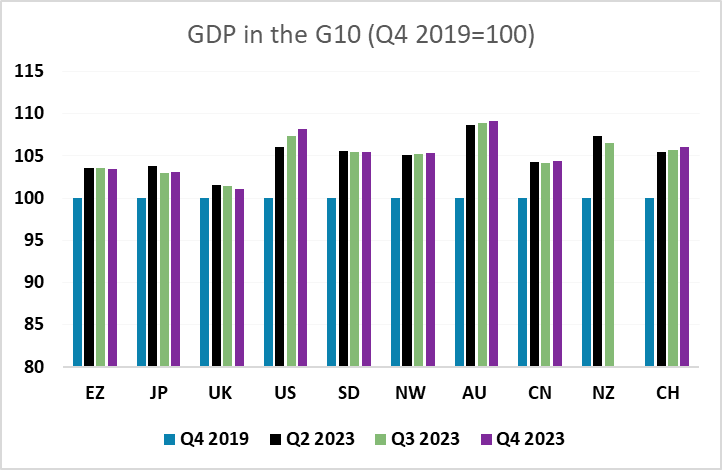

GBP is not much changed after the UK January GDP data came in in line with expectations, rising 0.2% after the 0.1% decline in December. However, on a 3m/3m basis, GDP is down 0.1%. GDP is also down by 0.3% in January 2024 compared with the same month last year and has fallen by 0.2% in the three months to January 2024 compared with the three months to January 2023. So although the monthly data is positive, there is little evidence that the UK is showing any underlying growth, and the UK performance since Q4 2019, the last quarter before the pandemic, remains the weakest in the G10.

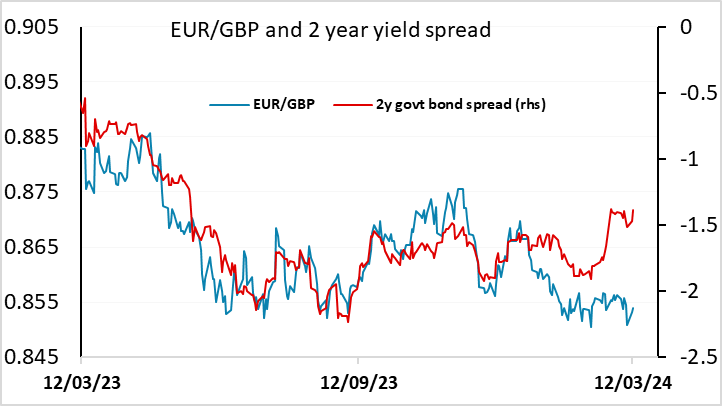

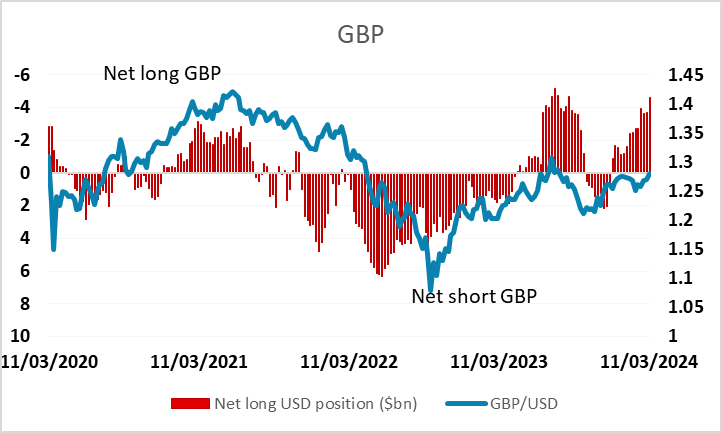

Of course, the BoE focus remains on inflation rather than growth, so that the weakness of UK growth is only relevant for monetary policy if it leads to lower inflation pressures. Up to now, the Bank have not seen weak demand as justification for easier policy because it has been offset by even weaker supply, particularly labour supply. However, there was evidence in yesterday’s labour market data that wage inflation is continuing to slow, and we would expect a more dovish tone at next week’s BoE MPC meeting. This suggests to us that GBP risks remain on the downside, with yield spreads against the EUR pointing that way and GBP net long positioning also looking extended in the latest CFTC data.

There isn’t a great deal else of real significance on the calendar, but the market will be on the lookout for any statements from the Fed after the stronger than expected February CPI released on Tuesday. US yields did eventually edge a little higher after the data, and the USD benefited, but any FOMC members expressing concern about inflation could lead to more US yield rises and more USD gains, particularly if we get such comments from established doves. EUR/USD risks consequently look to be on the downside.

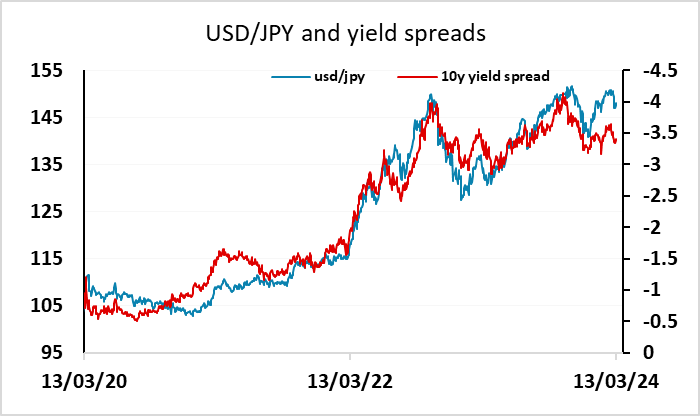

GBP IMM positioning

The USD/JPY picture is less clear, as there is mounting speculation of a tightening of BoJ policy as early as next week’s meeting, and yield spreads show a clearer case for JPY gains already. On top of this, we saw Toyota release details of wage settlements for this year. Toyota has agreed to union wage hike demand. The union has requested the highest wage increase since 1999. The requested annual lump sum amount was equivalent to 7.6 months of standard wages and exceeds last year's request for 6.7 months. The knee jerk reaction saw the JPY strengthen as it set a good tone for wage negotiations with big Japanese firms. Japan chief cabinet secretary Hayashi said it is important that wage rises spread to mid & small firms. It seems to suggest most officials are still waiting for the results of wage negotiation by the end of the week.Unions say most companies have agreed to a higher wage hike than the previous year with numbers floating around currently at 5.1% base pay and 6.2% overall pay increase. If the pay increases indeed reached 5%, it will be viewed as hawkish from the BoJ's standpoint because they are only looking for a 2% growth to sustain trend inflation in Japan. Realistically, anything above 4% will likely see the JPY strengthen.