EUR, SEK flows: EUR holds gains but upside limited. SEK unimpressed by stronger GDP

EUR holding onto Thursday gains but little impact from German production data as downward revisions offset stronger January. SEK benefits slightly from better January GDP, but data tends to be unreliable

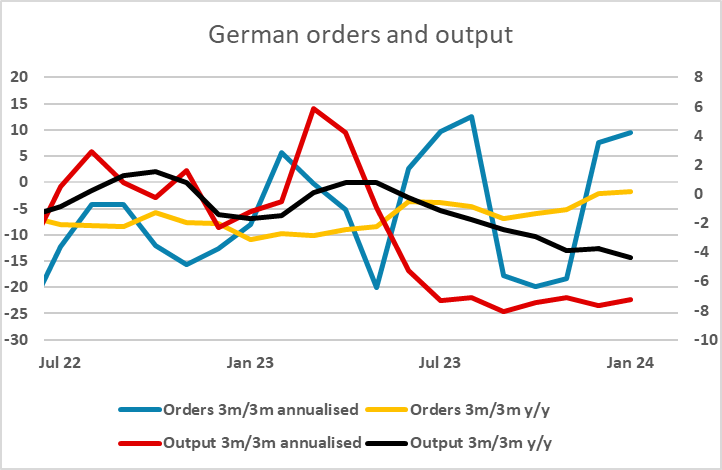

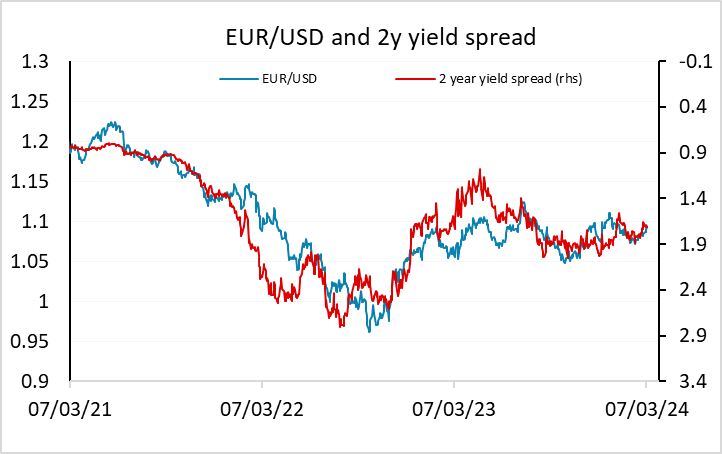

German industrial production was stronger than expected in January, rising 1.0% on the month, but the significance is minimal as the December data was revised down to -2.0% from -1.4%. The underlying trend remains weak. EUR/USD has held Thursday’s gains overnight, but we see upside as quite limited form here. Thursday’s gains came in spite of a decline in EUR front end yields after the ECB meeting, but spreads were already supportive of EUR gains after the decline in US yields following Powell’s comments on Wednesday. We still think Powell’s comments were less dovish than the market interpretation, and a solid employment report today may see US yields move back up and EUR/USD slip back towards 1.09.

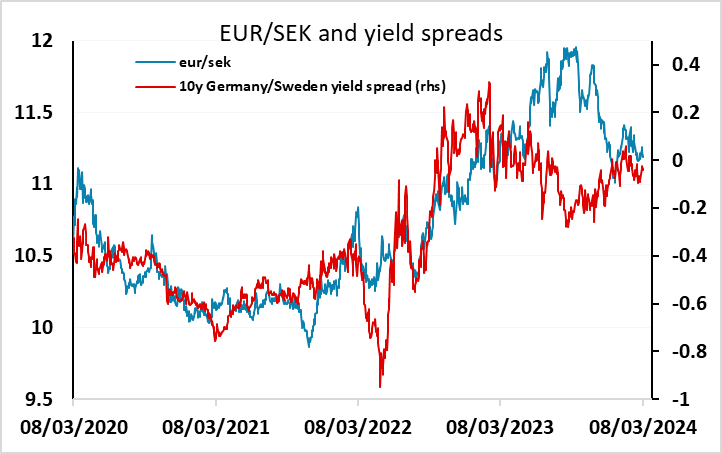

We have had some strong January GDP numbers from Sweden, triggering some modest SEK gains, but markets will be wary of the reliability of these numbers, so upside is likely to be quite modest in the short term. January GDP is reported up 0.8% m/m, but the strength owes a lot to government spending and weak imports, so will not be taken too seriously at this stage. Yields spreads still suggests EUR/SEK stability close to 11.20.