FX Daily Strategy: N America, July 16th

GBP firms slightly after stronger UK CPI

USD strength continues, with the JPY the main victim

Strong equities underpin JPY weakness, and there is no obvious trigger for a turn despite extreme valuation

GBP firms slightly after stronger UK CPI

USD strength continues, with the JPY the main victim

Strong equities underpin JPY weakness, and there is no obvious trigger for a turn despite extreme valuation

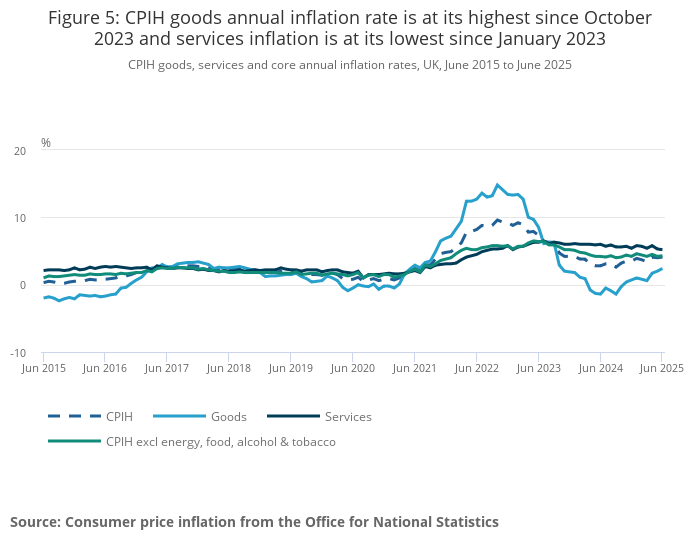

UK June CPI data has come in well above expectations at 3.6% y/y headline and 3.7% y/y core. Transport costs were the biggest positive contributor on the month, and the detail is a little less worrying than the headline, with services inflation falling to 5.2% y/y from 5.3% in May. Much of the rise in inflation looks to be supply rather than demand related, and is thus less of a reason for tight policy. But the data will nevertheless make it a little less likely that the BoE will cut rates aggressively. The market was pricing an August rate cut as an 85% chance ahead of the data, and this is unlikely to change much. There is also still likely to be one further cut priced in for the year. The scope for bigger cuts looks more likely to be in 2026, where there was only one cut priced ahead of the data.

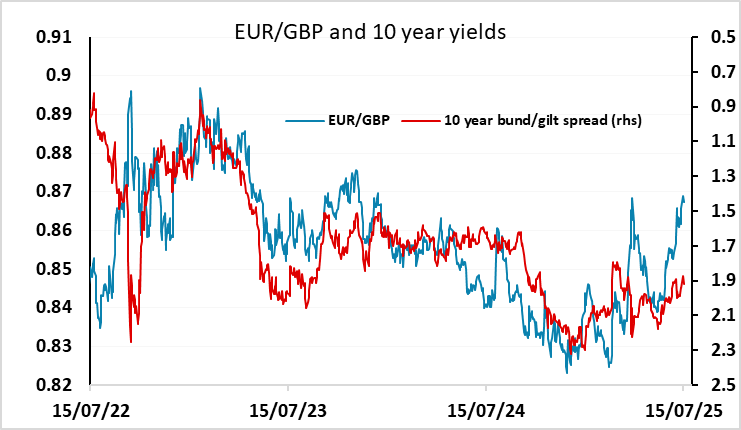

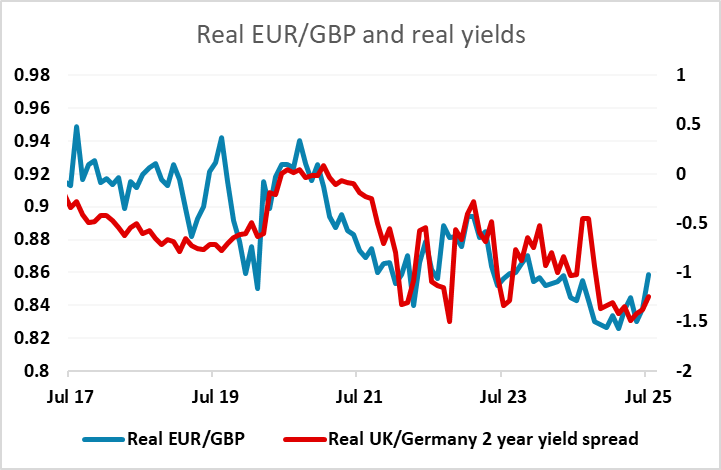

GBP has rallied modestly on the data., with EUR/GBP dropping 10 pips to 0.8665. As it stands, EUR/GBP has moved a little ahead of yield spreads in recent weeks, so there may be scope for a further modest decline, but we continue to see longer term downside for GBP as in real terms EUR/GBP remains cheap and has scope for a move above 0.90 if real rates converge with the Eurozone.

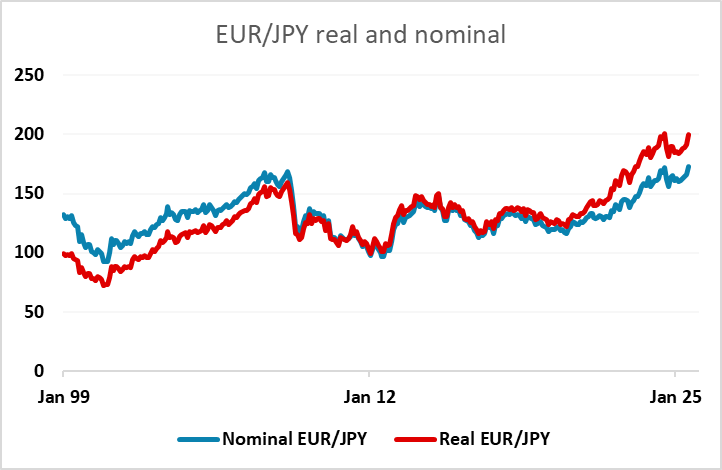

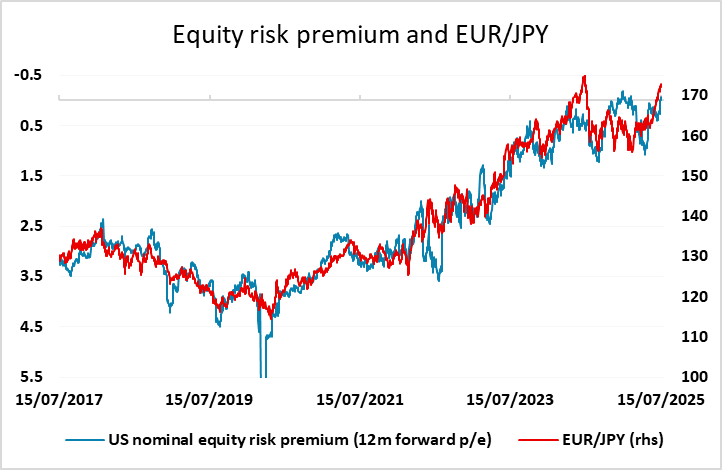

The US data shouldn’t be of any great significance after the softer than expected CPI data on Tuesday. Despite the softer data, US yields rallied after an initial dip and helped propel the USD higher across the board, helped by a strong US equity market supported by some positive earnings numbers from banks. The JPY continues to be the main victim of the USD recovery, helped by the positive equity tone and the continuing decline in equity risk premia implied by the combination of higher yields and higher equities. We are now in the eighth consecutive week of EUR/JPY gains, and the all time high of 175.42 from July last year is under threat. It continues to look like a turn lower in equities will be required to halt JPY weakness, and there is currently no obvious trigger for this, although equities are increasingly overvalued.

However, the USD was also generally stronger on Tuesday, bolstered by positive equity sentiment and a general belief that the tariff increases aren’t going to derail the US economy. The modest feedthrough so far is part of the reason for this, but there is also a general belief that the threatened tariffs against the EU and Mexico will in the end be well below the threatened 30%. Evidence that tariffs are being negotiated lower may even be seen as a reason for further equity market strength. We continue to expect a major equity correction come the autumn, as the current level of the market prices in above trend growth which, even without the threat of tariffs and the existing evidence of slowdown, would make little sense in an economy that is already at near full employment. But, as Keynes said, the market can stay irrational longer than you can stay solvent, so at the moment opposing the positive trend is only for those with deep pockets.