FX Daily Strategy: Asia, December 3rd

EUR to remain under pressure on French uncertainty

GBP and CHF both look likely to outperform EUR

JPY and USD the favoured safe havens

EUR to remain under pressure on French uncertainty

GBP and CHF both look likely to outperform EUR

JPY and USD the favoured safe havens

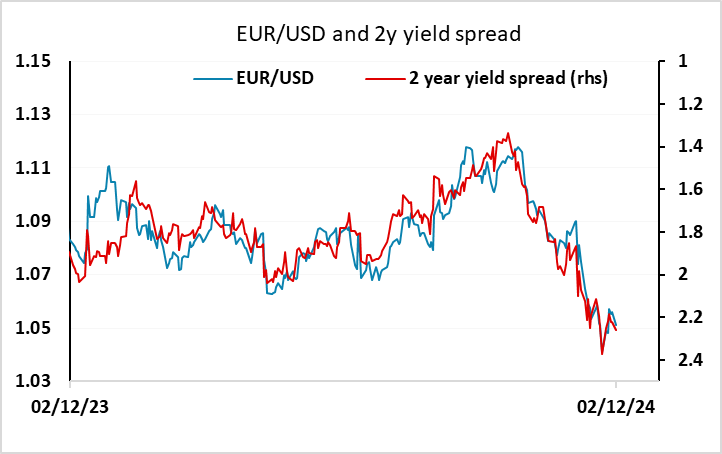

Tuesday’s calendar is quiet, and the market focus will remain on the US data at the end of the week and any political developments. This could include more initiatives from Trump or developments in the French budget situation. As it stands, the EUR is on the back foot, with EUR yields edging lower, partly because of concerns about the French political situation, partly because of the recent weakness in the Eurozone PMIs and other Eurozone data, and partly because there is still a risk that Trump directs his tariff fire towards Europe. It’s hard to see sentiment turning in the short run with a vote of no confidence in the French government possible as soon as Wednesday and Monday’s US ISM manufacturing data supporting the impression of an outperforming US economy.

Still, EUR/USD has move tightly with front end yield spreads in the last year, and it will be hard for these to widen much further as long as the market doesn’t anticipate a 50bp cut from the ECB this month. There may be scope for US yields to move this week on the back of expectations for the Fed decision on December 18, but major moves seem unlikely ahead of the employment report.

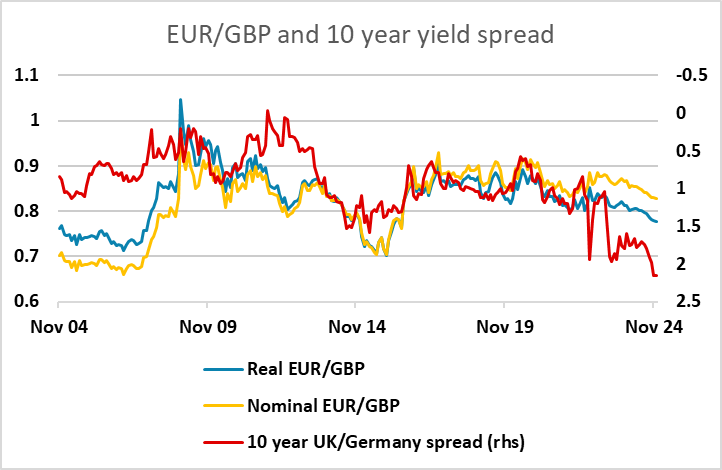

EUR weakness has been seen across most currencies in recent days, although the decline against the CHF that was seen for much of the last few months has stalled. This may reflect growing expectations of a 50bp cut from the SNB on December 12, but it’s hard to see the decline in EUR/CHF halting if the French government lose a no confidence vote this week. EUR/GBP has also been soft, and while the UK economy may well not outperform the Eurozone in the coming months, GBP’s yield advantage and the perception that Trump may be less hard on the UK tariff-wise suggests this is unlikely to turn around either while political uncertainty in the Eurozone continues.

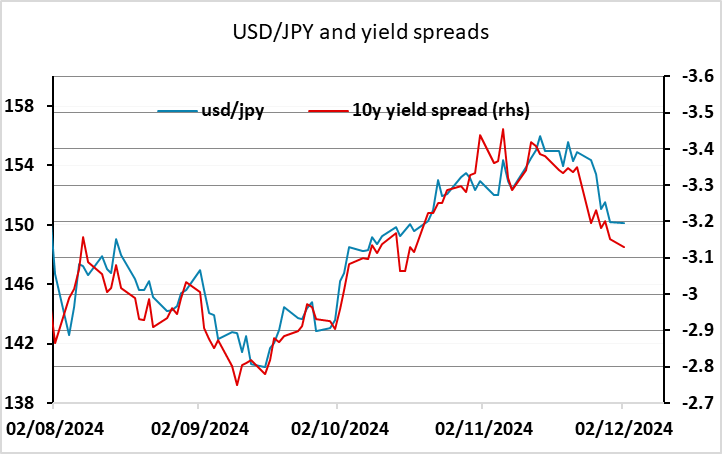

JPY strength remains a feature of the market, but has also tended to stick fairly closely to yield spread moves in recent months, even though longer term spread correlations suggests scope for the JPY the strengthen significantly further. For now, it looks unlikely that USD/JPY will move far from 150 ahead of the US employment data, although if we see equity markets start to suffer because of the French uncertainty, Trump tariff threats, or geopolitical concerns around Ukraine, Syria there is potential for significantly more JPY upside