FX Daily Strategy: APAC, Oct 21st

USD risks on CPI to the upside

CAD could drift lower on as expected CPI data

JPY has upside potential but politics remains a wild card

Limited scope for EUR movement but CHF looks very expensive

CAD risks slightly on the downside from Canadian CPI

UK PSNB could be a focus for GBP

JPY watching politics and BoJ

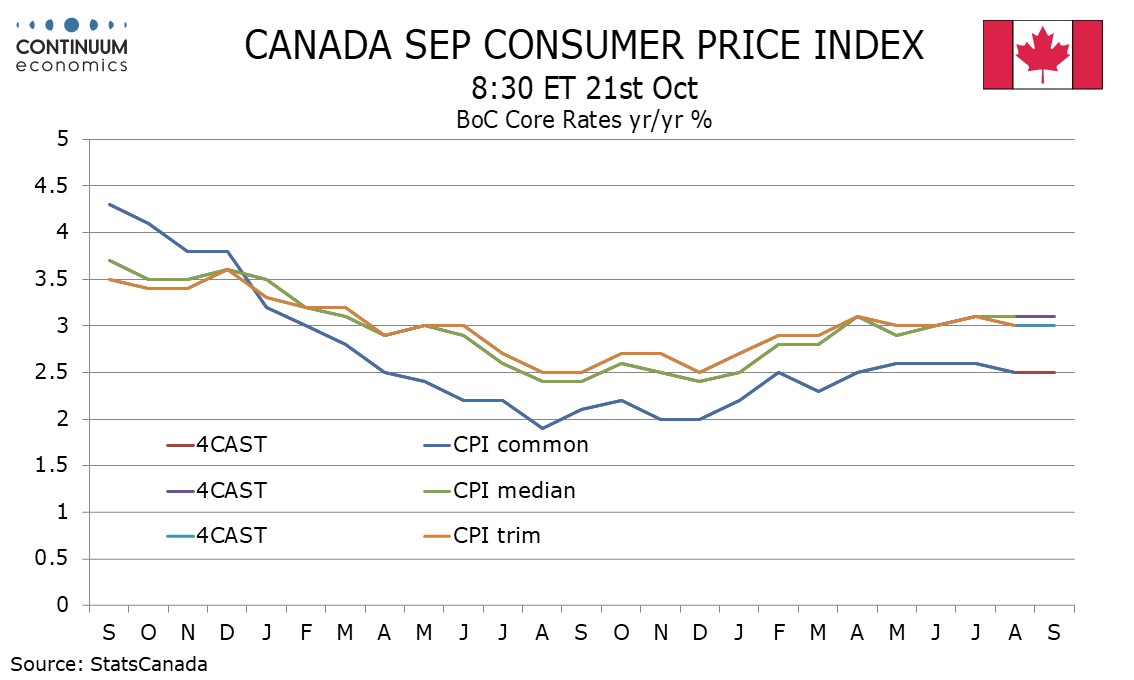

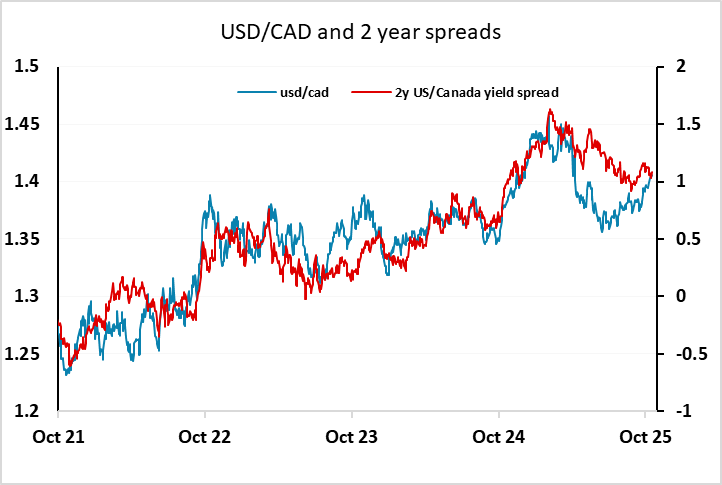

Tuesday sees Canadian CPI data, which will get more attention than usual given the lack of any US data at the moment. The BoC is not yet fully priced for a 25bp cut on October 29, so today’s data has two way risks. Our forecast is in line with the consensus expectation of a rise in y/y inflation to 2.2%, but we see no change in the core rates and as long as this is the case the market is likely to move further towards expecting a BoC rate cut, which may prove slightly CAD negative. Of course, there will be more focus on the US numbers due on Friday, but with the Fed already fully priced to cut rates on October 29, there may be more potential for the Canadian data to affect rate expectations.

Recent movements in front end yields have brought USD/CAD back in line with the historic yield spread correlation, also suggesting that the risks are now two-way, although the recent rise in USD/CAD means the technical momentum is on the upside.

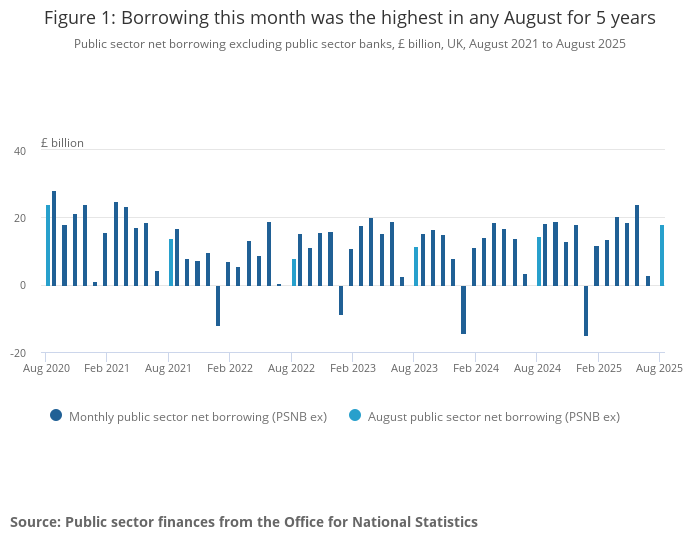

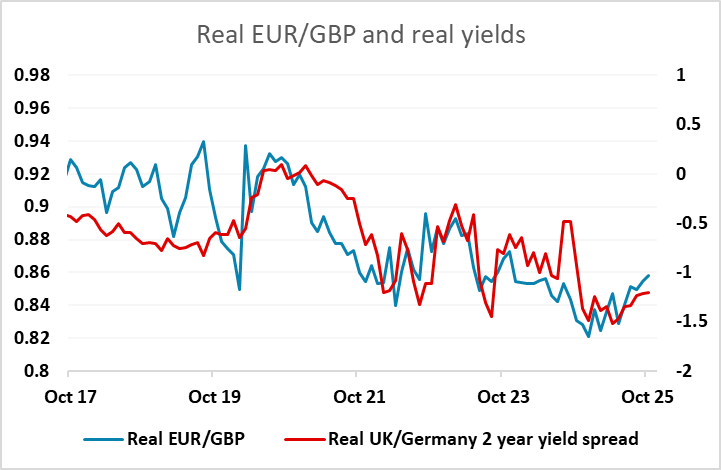

Otherwise, we have the UK public sector borrowing data for September, which had a modest impact on GBP last month and is an increasing focus as we approach the UK Budget in November. The data are quite seasonal and volatile. September usually shows a modest increase on August, and the trend is for the deficit to be up around 25% on the previous year, which would suggest he market consensus of a GBP20bn PSNB figure is on the low side. Risks of a higher borrowing number suggests downside risks for GBP, as the higher the borrowing, the greater the likely fiscal tightening in the November Budget. EUR/GBP still looks unlikely to break above the year’s high at 0.8763, but the lack of easing priced into the UK curve and the risk of a higher borrowing number suggest the risks for EUR/GBP are on the upside.

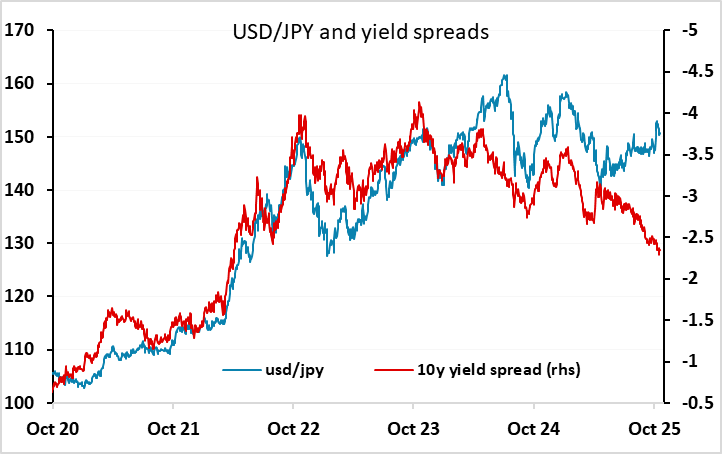

There is also a potential announcement that Takaichi will be the new Japanese PM, with the LDP having made a coalition deal with the Innovation party that comes close to guaranteeing a majority in parliament. There will probably not be much initial impact on the JPY, as this is now broadly expected, but a small JPY dip lower might result. However, we would be on watch for any comments from the BoJ as Ueda and Tanaka have both recently suggested that the October meeting is still live, and with the market only pricing around a 20% chance of a 25bp rate hike, the JPY could benefit from any more hawkish comments.