FX Daily Strategy: Europe, February 28th

EUR may fall further on CPI

End of month likely to be USD positive

US PCE unlikely to move the market

CAD vulnerable but GDP may be supportive

EUR may fall further on CPI

End of month likely to be USD positive

US PCE unlikely to move the market

CAD vulnerable but GDP may be supportive

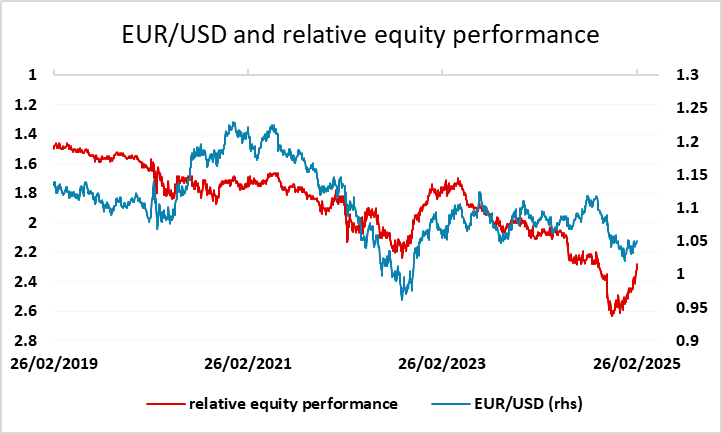

Preliminary February CPI from France, Italy and Germany is probably the data of most interest on Friday. Spanish CPI on Thursday was in line with expectations, but the easing of the core rate suggests some downside risks elsewhere. The market consensus suggests a small decline in the German HICP basis y/y data to 2.6%, but a much larger decline in France to 1.2%. Much of this is energy related, but nevertheless should maintain the expectation of 25bps of easing from the ECB at the March meeting, and perhaps increase the chances of a further 25bps at the April meeting, which is currently seen as around a 65% chance. The decline in European gas prices seen since Trump made his proposals to end the Ukraine war also suggests some increased scope for rate cuts, even though this only reverses the rise seen since December.

All this suggests that the EUR may remain under pressure, having lost ground on Thursday. This looked to be a consequence of general USD strength rather than EUR weakness, and may have been partially end of month flow related. Most models are suggesting USD demand at end of month with US funds needing to increase FX hedges on European equity holdings due to European equity outperformance. If so, more of the same is likely on Friday, suggesting some risk of a break below 1.04.

In North America we have the core PCE price index from the US and Q4 GDP from Canada. We expect a 0.3% rise in January’s core PCE price index, slower than the 0.4% seen from core CPI, while we expect a modest 0.3% rise in personal income to outpace an unusual 0.1% decline in personal spending. This is in line with consensus, so shouldn’t have any notable FX impact.

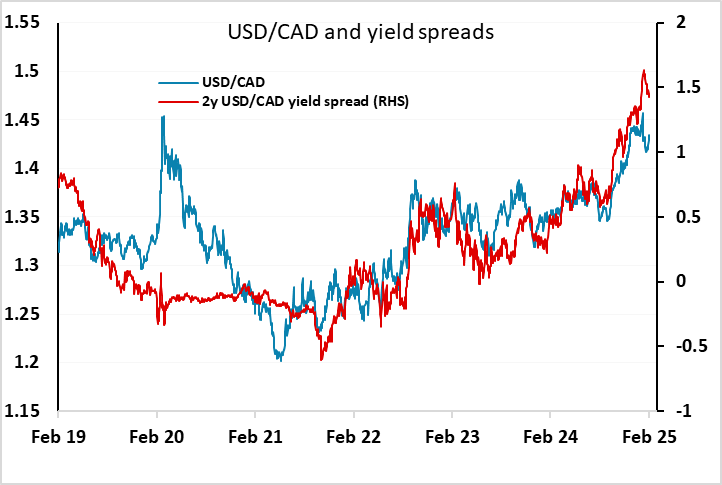

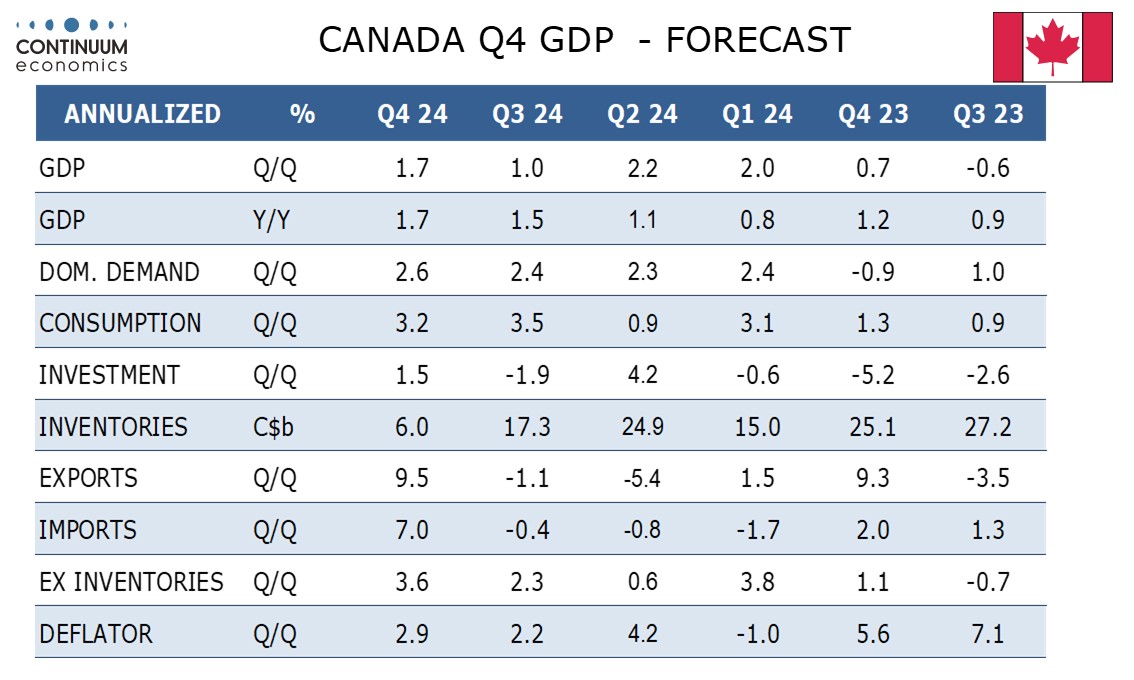

We expect Q4 Canadian GDP to rise by 1.7% annualized, marginally below a 1.8% estimate made with the Bank of Canada’s January Monetary Policy Report (which is also consensus) but with positive details outside inventories. We expect a 0.1% increase in December GDP, slightly below a 0.2% estimate made with November’s data. The CAD still looks vulnerable with the tariff threat still significant, even if Trumps comments this week suggested a decision may be delayed for another month. But even without any further negative impulse, USD/CAD looks high relative to the normal yield correlation