FX Daily Strategy: Asia, June 26th

USD could slip on US claims data

Equity strength looks overdone

JPY weakness on the crosses is extreme, particularly versus CHF

SEK can slip back against EUR and NOK

USD could slip on US claims data

Equity strength looks overdone

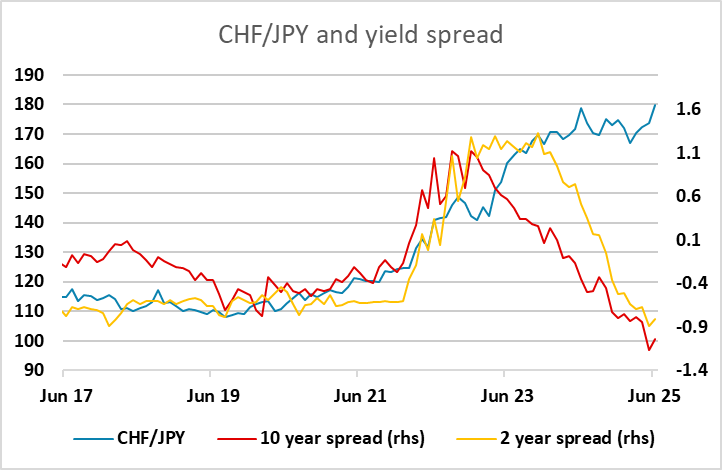

JPY weakness on the crosses is extreme, particularly versus CHF

SEK can slip back against EUR and NOK

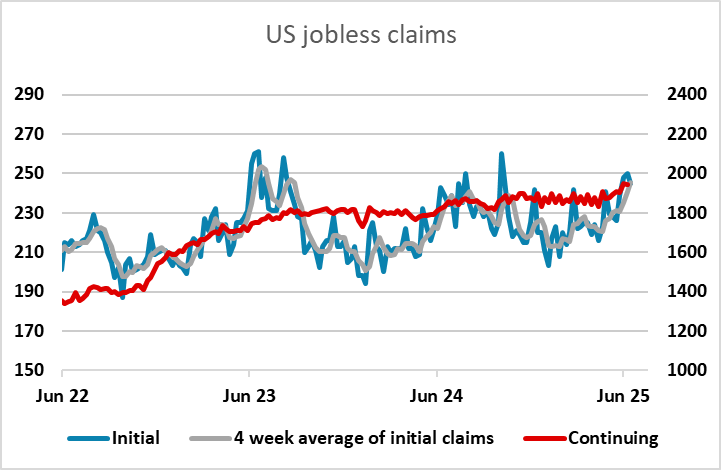

Thursday sees a raft of largely second tier US data, including revised Q1 GDP, durable goods orders and jobless claims. Of these, the claims data is the most likely to be market moving. The initial claims data has shown a clear uptrend in recent weeks and the 4 week average is at its highest since 2023. The survey week for the US employment report was last week, so it already looks like there is some downside risk for the June payroll data based on the recent uptrend. Another high claims number could lead to renewed downward pressure on the USD. The GDP data is unlikely to move the market, and the durables data will be strong but due to aircraft, so is unlikely to have much impact.

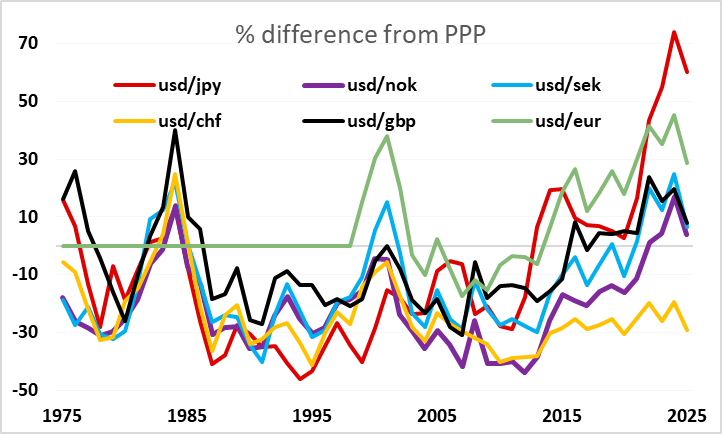

Another strong claims number may lead to some downward pressure on equities, which continue to trade firm and threaten the February all time high on the S&P. This strength came in spite of firmer US yields on Wednesday, and we continue to see valuations as being very stretched. The corollary of this in the FX market is that the JPY’s weakness is extreme. Such misvaluations are not unusual in the summer months, but we often see the market receive a dose of reality in the autumn. A weak employment report could mean this comes sooner the year. Alternatively, there could be renewed concerns around tariffs, if Trump sticks to the July 9th deadline for the decision in the rates for the EU. Geopolitical issues have distracted the market from these topics in the last couple of weeks, but we would expect to see them re-emerge before too long.

FX wise the clearest overvaluation is in JPY crosses, with CHF/JPY looking the most dramatic, having hit a new all time high this week above 180. To some extent, this is due to the CHF benefiting from geopolitical uncertainty, but in real terms EUR/CHF is still within the range seen since the 2015 spike when the SNB stopped defending the parity level. But most of the issue is the weakness of the JPY, which in real terms has fallen more than 50% against the USD since the pandemic. Against the CHF, the JPY is down more than 60% in the past 5 years, even though yield spreads have moved in its favour. But the correction to this is only likely to come with a weaker equity market, or at least higher equity risk premia (lower US yields).

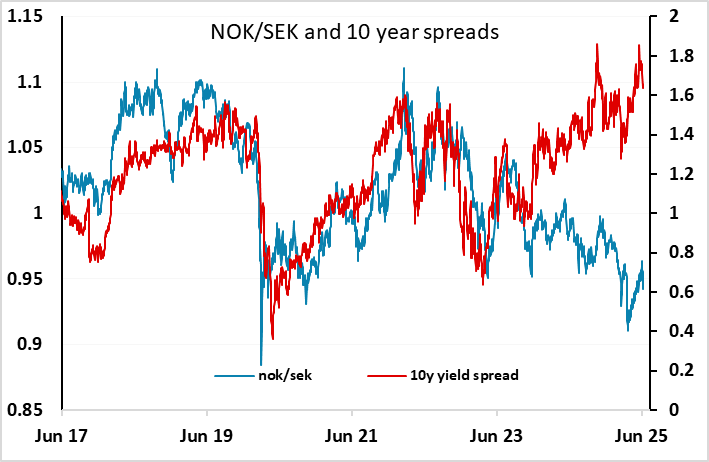

There isn’t a great deal on the European calendar, but there is confidence data out of Sweden and unemployment data out of Norway. The NOK has suffered n the last week, initially due to weak risk sentiment and subsequently due to the dip n the oil price as Middle East concerns waned. But weakening confidence in Sweden suggests general downside risks for the SEK, and the NOK has scope for a general recovery.