FX Weekly Strategy: December 23rd - January 3rd

Limited data and events to move the market

JPY weakness is extreme – risks on the JPY upside

USD strength hard to oppose, but Trump effect could be negative

GBP strength hard to square with economic weakness

Strategy for the 2 weeks ahead

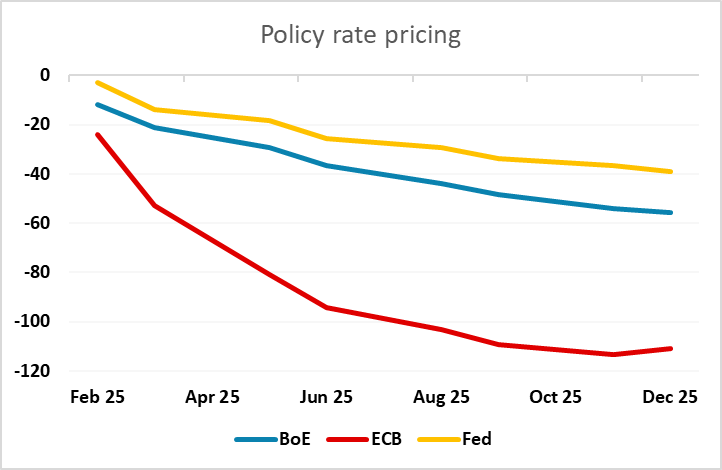

There’s not a great deal data or eventswise that’s likely to move markets over the Christmas period. After the December FOMC meeting the market has revised its expectations of Fed policy to the hawkish side, with less than two rate cuts now priced in for 2025. In comparison there are two rate cuts priced in for the Bank of England, 110bps for the ECB, and 40bps of rate hikes priced in for the BoJ. There is unlikely to be much adjustment to this in the coming week, but given the expectation of higher rates in Japan, and significantly lower rates elsewhere, we continue to see the risks as being weighted to a much stronger JPY in the coming year.

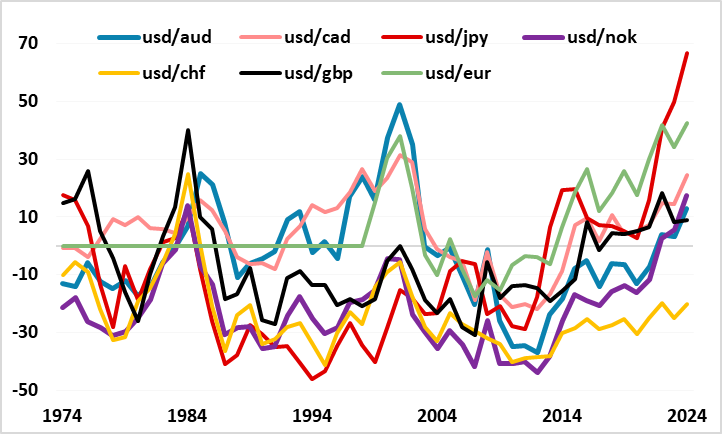

% differences from PPP

The starting point is USD/JPY trading near the highs seen back in July, and around 65% above Purchasing Power Parity. This puts the JPY not only at the lowest level it has ever been, but lower than any G10 currency has ever been. While the correlation with yield spreads provides short term justification for JPY weakness, any longer term view makes it clear that the level of JPY weakness is hugely out of line with any historical correlation and any genuine estimate of fundamental value. It is of course possible that we see USD/JPY move to new highs, but even though the BoJ’s reluctance to tighten in December suggests they are not too concerned about JPY weakness, the Japanese authorities have shown a willingness to oppose JPY weakness with intervention at these levels, and are unlikely to allow a move beyond 160.

USD weakness at the beginning of the first Trump presidency

Even so, it will be difficult to oppose USD strength with the upcoming Trump presidency generally seen to be likely to maintain relative US economic strength and support US yields via the combination of lower taxes and tariffs ensuring there is little Fed easing. But the first Trump presidency should be a warning not to be complacent about the strength of the USD. While the last 4 years have seen the USD behave very regularly, moving in line with yield spreads, 2017/18 saw the USD weaken significantly even though yield spreads moved broadly in its favour. Not only is there a lot of uncertainty about Trump’s policies, it isn’t clear where the USD will go even if we knew his policies for certain. So with the USD starting from very strong levels, we would see risks on the USD downside in most scenarios that deviate from the central case.

EUR/GBP and PPP

It is also notable that GBP has gained strongly against the EUR this year, helped by a relatively strong growth performance in H1 and a relatively hawkish Bank of England. Bt it’s hard to believe that the BoE will cut only 50bps in 2025 when the ECB is priced to cut 110bps, especially when the ECB have already cut rates 100bps against the BoE’s 50. While UK inflation has been slightly more stubborn, UK economic performance hasn’t been any better than the Eurozone, and isn’t expected to be in 2025. The BoE MPC statement last week and the three votes for a rate cut suggests that GBP is vulnerable to a more dovish view emerging. The starting point for GBP is also very high from a historic perspective, with the real level of EUR/GBP at its highest since before the Brexit referendum in 2016. The UK also doesn’t have the relative growth advantages of the US, so GBP, probably more than the USD, also has risks weighted to the downside.

Data and events for the coming 2 weeks

USA

Monday December 23 sees December consumer confidence. On Tuesday December 24 we expect November durable goods orders to rise by 0.6% with a 0.5% increase ex transport. Later we expect November new home sales to rebound from a weather-depressed October, rising by 21.3% to 740k. Thursday December 26 sees weekly initial claims. On Friday December 27 we expect November’s advance goods trade deficit to rebound to $108.9bn from a narrower October deficit of $98.3bn.

Monday December 30 sees November pending home sales, and Tuesday December 31 October house price data from S and P Case-Shiller and the FHFA. Thursday January 2 sees weekly initial claims. On Friday January 3 we expect a December ISM manufacturing index of 48.5, almost unchanged from November’s 48.4. November construction spending is also due.

Monday January 6 sees November factory orders. Tuesday January 7 sees November’s trade balance, November’s JPLTS report on labor turnover, and December’s ISM services index, which we expect to bounce to 55.5 from 52.1. On Wednesday January 8 we expect a 140k increase in December’s ADP estimate of private sector employment. FOMC minutes from December 18 follow as does November consumer credit. Weekly initial claims and November wholesale trade are due on Thursday January 9. The key release of the week is December’s non-farm payroll on Friday January 10, for which we expect a 175k increase, 140k in the private sector, with unchanged unemployment of 4.2% and a slightly slower 0.3% increase in average hourly earnings. The preliminary January Michigan CSI follows.

Canada

On Monday December 23 we expect a 0.1% increase in October GDP, slightly above a preliminary 0.1% estimate made with September’s data. November IPPI and RMPI data are also due. After that there is no significant Canadian data due until January.

Thursday January 2 sees December’s S and P manufacturing PMI. Services data follows on Monday January 6. Tuesday January 7 sees November’s trade balance. The most significant Canadian release will be December employment on Friday January 10. November building permits are also due.

UK

Revised GDP data may show modest revision in updates due on Monday alongside Q3 current account numbers for Q3 which (ex precious metals) may be similar to the 3.2% of GDP posted in the previous quarter.

UK

There is nothing of note until Friday when BoE data on money and credit arrive

Eurozone

Early insight in to December inflation arrive with Spanish HICP data (Mon). More survey data are due on Thursday in the form of final manufacturing PMI. German insight comes with (volatile) retail sales (Thu) and then labor market data (Fri). Thursday also sees ECB data on money and credit, numbers still showing weakness in regard to lending.

Rest of Western Europe

There are key events in Sweden, starting with household, lending (Mon) and minutes to the December Riksbank meeting (Thu). Switzerland sees the KOF survey (Mon).

Japan

We have the BoJ minutes on Monday, could provide us more details on why the BoJ decided to keep rates on hold when the latest data shows CPI continues to be above 2%. Followed by Tokyo CPI on Friday that is expected to stay strong above 2.5%. On the same day, we also have unemployment rate and retail sales.

Australia

Only RBA meeting minutes on Tuesday and that is unlikely to be market moving.