FX Daily Strategy: N America, July 25th

JPY weaker after softer Tokyo CPI

Potential for earlier BoJ easing to be priced in

GBP slips on retail sales data

EUR supported by Lagarde comments

JPY weaker after softer Tokyo CPI

Potential for earlier BoJ easing to be priced in

GBP slips on retail sales data

EUR supported by Lagarde comments

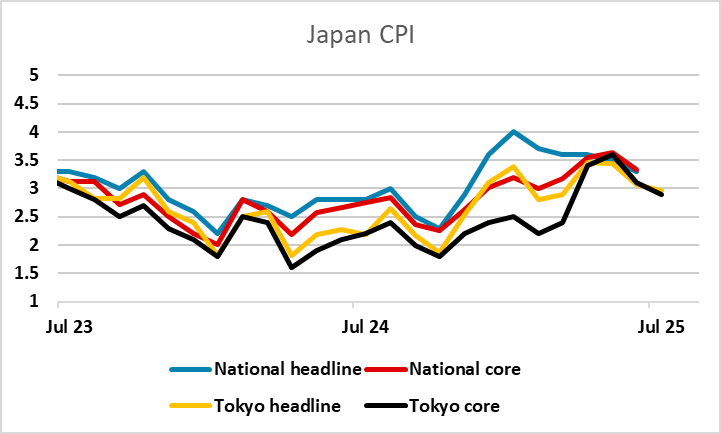

Once again all y/y measures remain elevated with ex fresh food at 2.9% and ex fresh food & energy at 3.1%. While it does implicate a certain level of moderation, the inflationary pressure is above BoJ's target of 2%. With trade uncertainty fading into the backdrop, BoJ's hands could be untied. Yet, the forward guidance in the July meeting is unlikely to change along the inflation forecast revision.

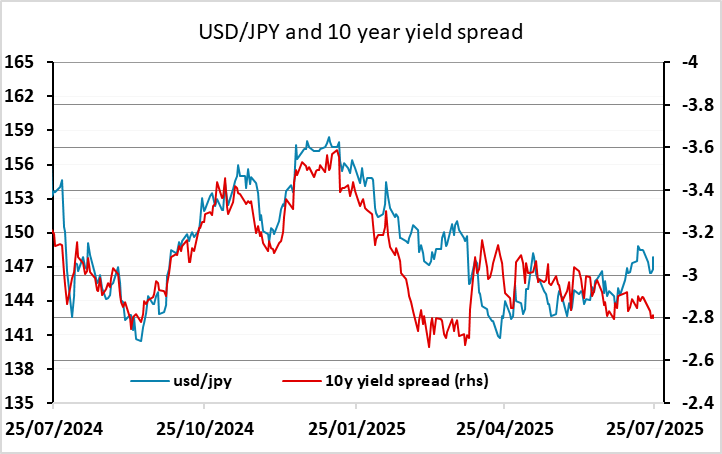

As it stands, the market is only pricing around a 30% chance of a September hike, so we do see some upside risks for the JPY, although there is already a case for a stronger JPY based on yield spreads. It continues to be the resilience of equity markets limiting the JPY upside, so while domestic factors could argue for a decline in USD/JPY, we are unlikely to see much of a move unless there is also general USD weakness or a significant decline in risk sentiment, neither of which looks likely to be triggered by any of Friday’s scheduled events.

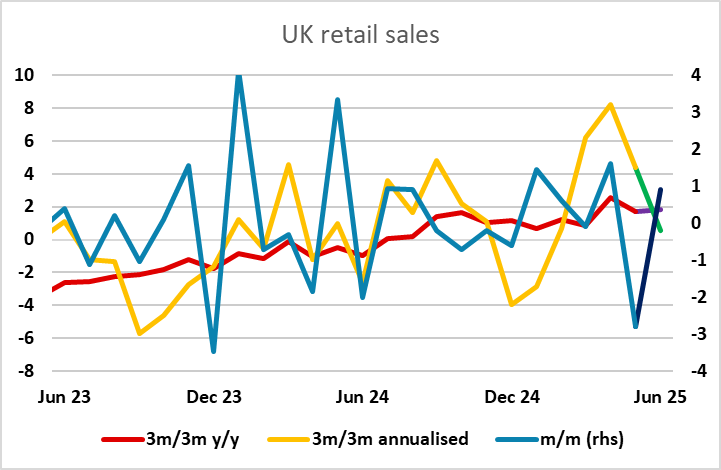

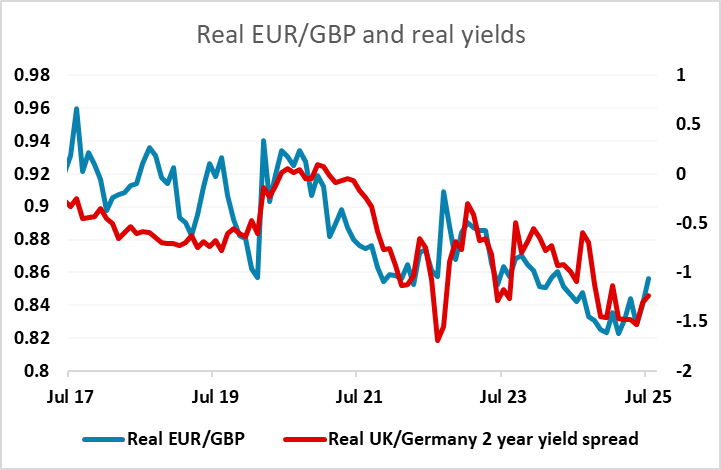

UK retail sales rose a little less than expected in June, after a sharp decline in May. The underlying trend appears to have weakened in recent months, but on a longer term basis it still looks fairly stable, with the y/y growth rate having improved slightly in the last year and now close to flat. However, the data was weak enough to propel EUR/GBP to 3 month highs, approaching the highs of the year at 0.8738 seen in April. We doubt that this high will be broken on the basis of today’s data, but the underlying trend does look to be higher for EUR/GBP, with yield spreads gradually contracting as the BoE looks likely to become more dovish while the ECB comments yesterday suggest a period of stability.

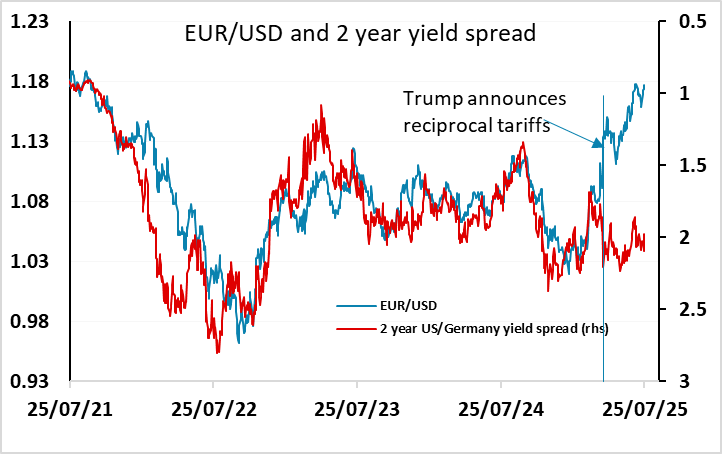

The German IFO survey was a little below consensus but had little impact. However, there was a significant move in EUR yields on Thursday. Lagarde sounded more hawkish than expected at the ECB press conference, particularly with her comment that she would not exclude a shift to considering rate rises. Front end EUR yields were up more than 10bps on the day and the market is now no longer fully pricing another rate cut this year, with this being priced as just a 60% probability by December. The EUR rallied on the statement, gaining across the board, but EUR/USD hasn’t been particularly rate sensitive of late, so the upside for the EUR may be more clear cut against the CHF, GBP and scandis.