EUR, USD, JPY, CAD flows: Better Eurozone data may provide some EUR support

Stornger French GDP and German retail sales help stabilise EUR

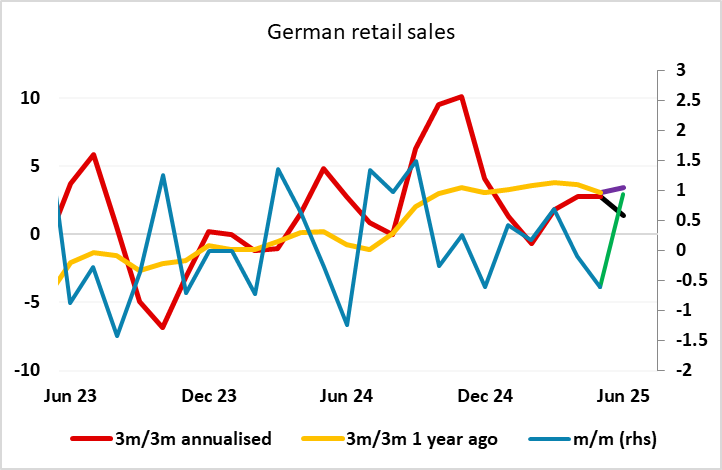

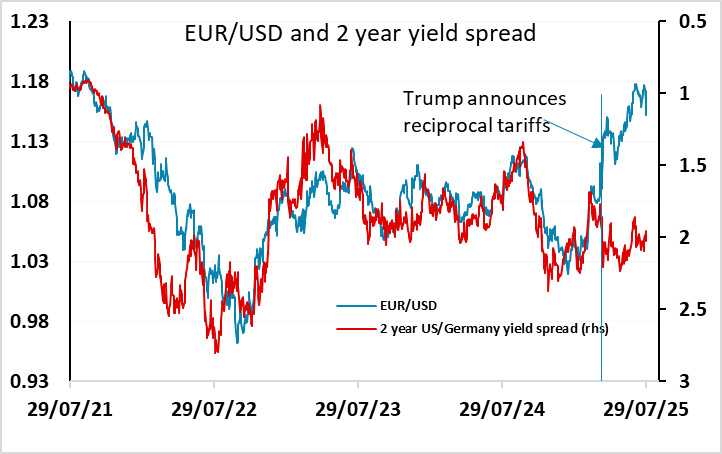

Wednesday kicks off with some stronger than expected European data. French Q2 GDP is up 0.2% q/q, while German retail sales rise 1.0% in June. The German data maintains the more solid trend seen in the last few months, while the French data suggests there is a decent chance of a positive EU Q2 GDP number, even though the German numbers due later today are expected to be negative. The data has had a mild positive impact on EUR/USD in early trade, following the slump seen yesterday. Given that the EUR decline seen yesterday was driven by the tariff deal rather than the current economic situation, today’s data isn’t likely to reverse it. EUR/USD had gained dramatically since the initial tariff announcement in April, and the perceived end of the tariff story with tariffs somewhat lower than originally threatened has triggered some reversal of the big EUR/USD rise. But solid European data will tend to provide the EUR with some support, so we would look for some stabilisation near current levels, even though a major recovery looks unlikely.

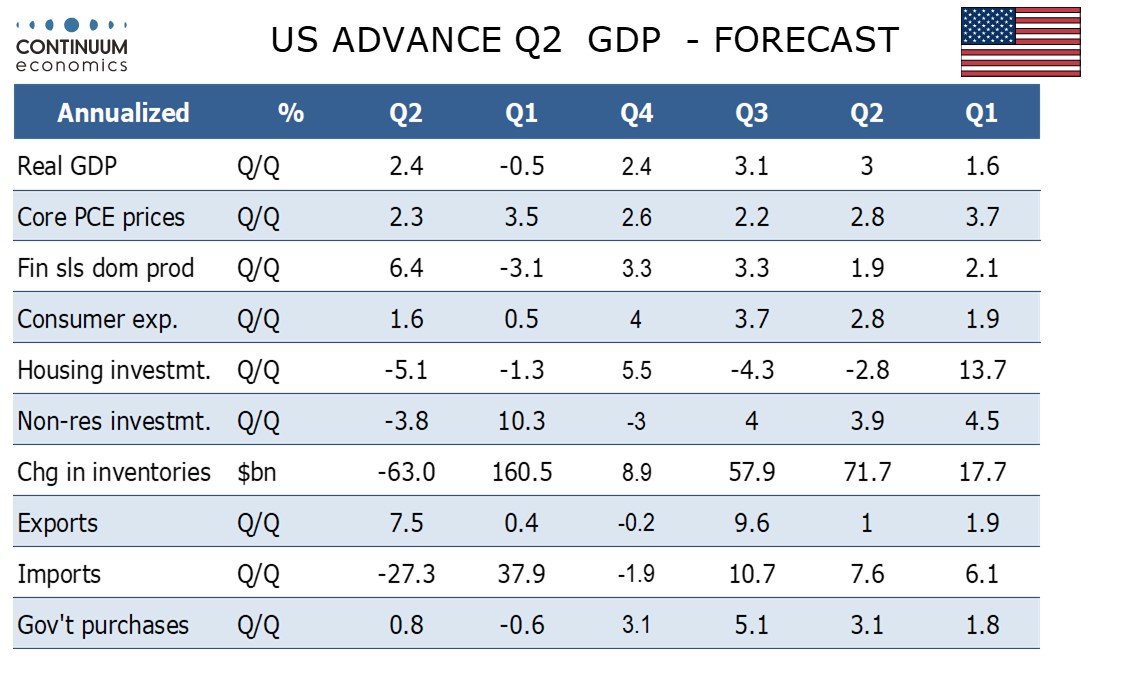

The German and US GDP data later could determine the direction of EUR/USD today. Yesterday’s lower than expected US trade deficit for June suggests there are some upside risks to the US numbers, so German GDP may need to be flat or better to sustain any EUR recovery.

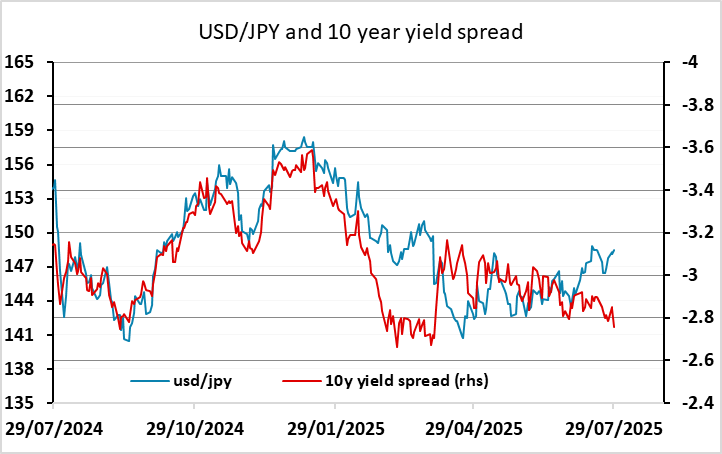

Central bank meetings in Canada, the US and Japan in the next 24 hours will be the other main focus, with all of the meetings about guidance for the next meeting rather than any expectation of action at this one. The risks may be towards less easing being priced into the US for September, which is currently priced at around a 65% chance, while there is much less priced in for Canada so risks may be to the USD/CAD upside. For the BoJ, risks looks to be towards a more hawkish bias and a stronger JPY.