FX Daily Strategy: Asia, February 11th

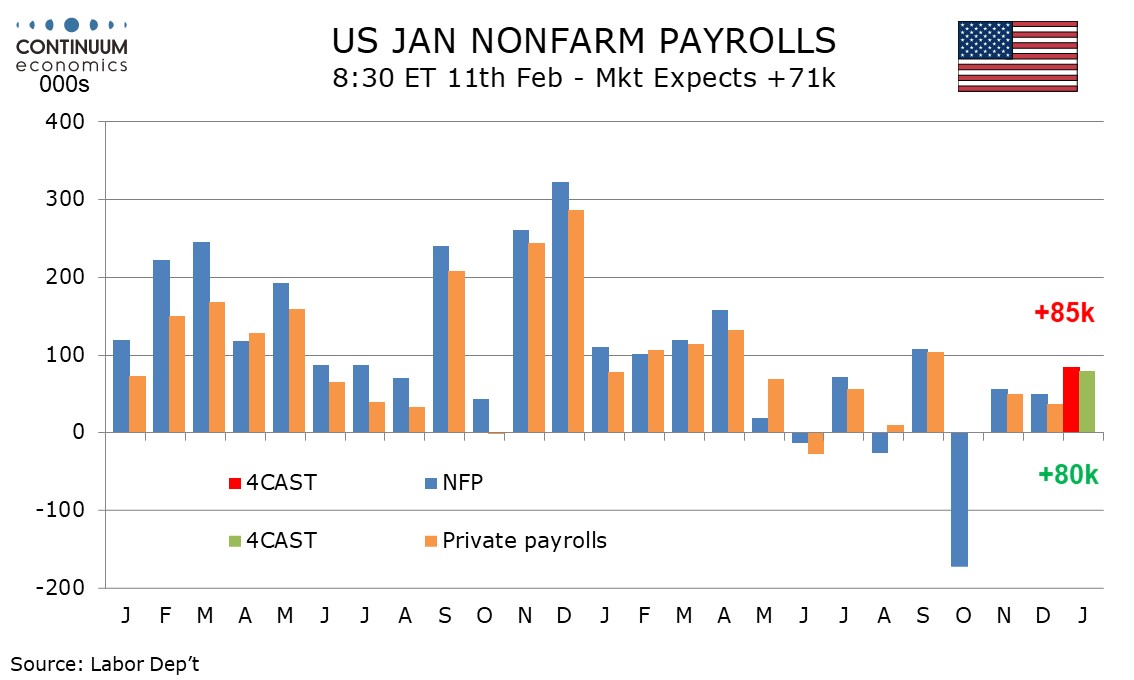

U.S. January Non-Farm Payrolls Above trend but with higher unemployment

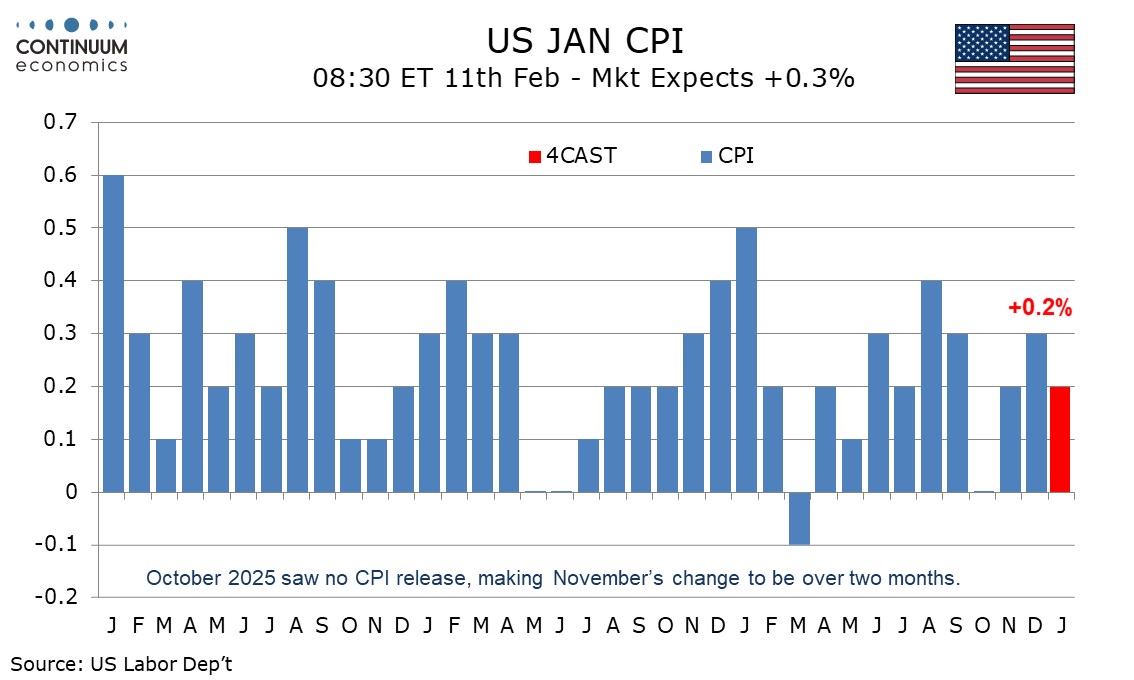

U.S. CPI A Stronger month but slower yr/yr

Aussie May Need A Push Or Risk Retesting Support

We expect January’s non-farm payroll to rise by 85k overall and by 80k in the private sector, which would be on the firm side of trend and could be even more so after what could be substantial negative historical revisions. However, we expect unemployment to rise to 4.5% from 4.4%. We expect average hourly earnings to rise by 0.3%, in line with recent trend. Initial claims remained low in January’s payroll survey week, suggesting layoffs remain limited too. While signals on hiring are also weak January is a month in which before seasonal adjustment payrolls fall sharply, meaning that a low level of layoffs could be more significant than a low level of hirings in seasonally adjusted data. ADP reported a slower 22k rise in private payrolls, but we expected ADP data to underperform.

A sector to watch this month is retail. We have seen three straight declines of near 20k in this sector, despite retail sales holding up well. Limited seasonal hiring before Christmas may mean fewer layoffs than the seasonals assume in January. We expect private services to rise by 70k in January, the strongest since September, the last month in which retail employment increased. An improvement from a 58k increase in December private services will be more than fully explained by the swing in retail.

We expect a 0.2% increase in January’s CPI, with a 0.3% rise ex food and energy, though risks are to the upside with our forecasts before rounding being for gains of 0.24% overall and 0.34% ex food and energy. The latter would be the strongest since August. Pricing decisions are often made at the start of the year and January data in recent years has tended to be quite strong, with ex food and energy gains of 0.4% in January of 2025, 2024 and 2023 and 0.6% in 2022, though only the January 2025 gain was clearly above the trend seen at the time.

Reasons to expect a bounce this year include the January 14 Fed Beige Book stating that several contacts that initially absorbed tariff increases were starting to pass them on, and also that Q4 CPI data slowed more than did most other inflationary indicators, suggesting scope for a correction. However gasoline prices look weaker and we expect food to moderate after a strong 0.7% increase in December. December core CPI rose by only 0.24% before rounding despite strong gains in two of the most volatile components of services, air fares and lodging away from home, the latter part of housing which is expected to gradually lose momentum. Against this, autos, one of the more volatile components of goods, have scope to correct from a weak December. Upside risks appear more pronounced in goods, particularly if there is some tariff feed-though. We expect a 0.5% increase in commodities less food and energy but only a 0.3% rise in services less energy. We expect supercore CPI, excluding food, energy and housing, to rise by 0.3% in January, with housing converging towards the core.

The Aussie has broke through the figure this week but is seeing partial retracement. Strong previcous metal and upbeat risk sentiment has always been the catalyst for the Aussie to propel in a short run. RBA's hawkish tilt will remain supportive for the Aussie in a medium turn as we will be seeing two more hikes. The timing would be where speculators bank. As we have little critical economic release for the Aussie this week, very likely the momentum will be driven by precious metal as we see Gold are steadily above 5000 USD/oz.

On the chart, the sharp bounce from strong support at 0.6900 has reached 0.7030. Intraday studies are mixed/positive, suggesting room for continuation towards minor resistance at 0.7050. But negative daily stochastics and the bearish daily Tension Indicator should limit any break in renewed selling interest/consolidation towards critical resistance at the 0.7095~ current year high of 29 January. Broader weekly charts are positive and longer-term readings are also rising, highlighting room for a later break and continuation of April 2025 gains towards strong resistance within the 0.7155~ year high of February 2023 and the 0.7200 Fibonacci retracement. Meanwhile, support is at congestion around 0.7000. A test back beneath here, if seen, should meet renewed buying interest towards 0.6900.