GBP flows: GBP firms after UK labour market data

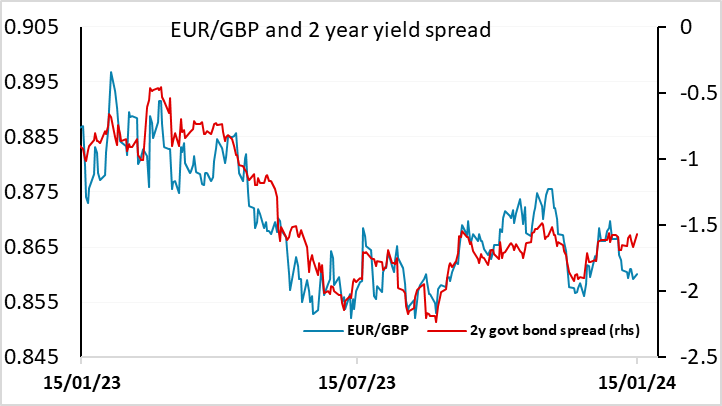

Softening earnings growth helps EUR/GBP to edge above 0.86.

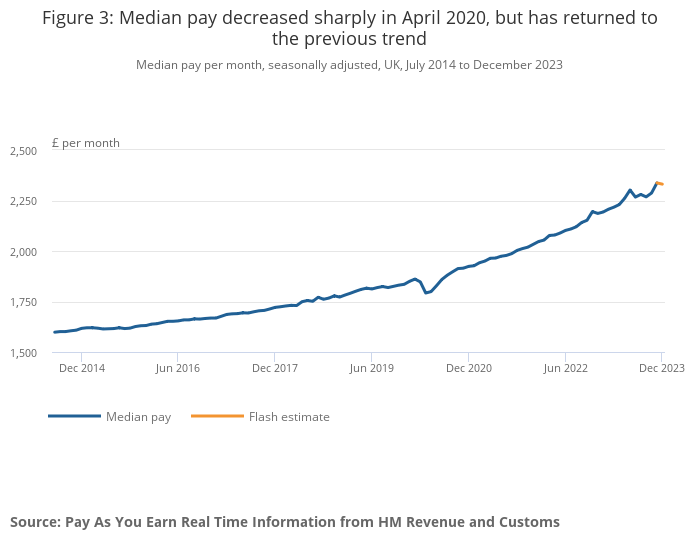

EUR/GBP is modestly higher after the UK labour market data, which could be seen as mixed but crucially saw a decline in the growth of average earnings in the official ONS data for the 3 months to November. While the more up to date (and possibly more accurate) HMRC data for December showed a small increase in the y/y growth of earnings, this was due to a base effect and the level of earnings actually fell in December. Unusually, and coincidentally, the HMRC data for December and the ONS data for November both show earnings growth of 6.6% y/y. This is clearly still too high, but if we see earnings staying flat or even negative in the coming months, the y/y rate will decline rapidly.

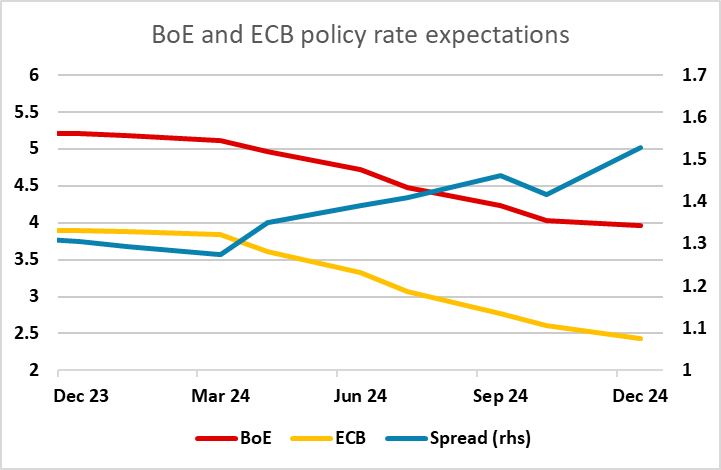

For GBP, the risks were always to the downside as EUR/GBP was trading on the low side relative to the normal yield spread correlation going into the data. It is also the case that the market is pricing in fewer rate cuts from the BoE than from the ECB over the next year, despite the higher starting point for UK rates. While today’s data, which showed a dip in the unemployment rate to 4.2% from 4.3% as well as the decline in earnings, won’t lead to an immediate change in BoE stance, there is potential for a decline in UK rates relative to the ECB, given the likelihood of similar growth and inflation profiles going forward. Tomorrow’s CPI data will also be important, but the bias is towards a EUR/GBP move up to 0.8650.