FX Weekly Strategy: Oct 20th-24th

USD risks on CPI to the upside

CAD could drift lower on as expected CPI data

JPY has upside potential but politics remains a wild card

Limited scope for EUR movement but CHF looks very expensive

Strategy for the week ahead

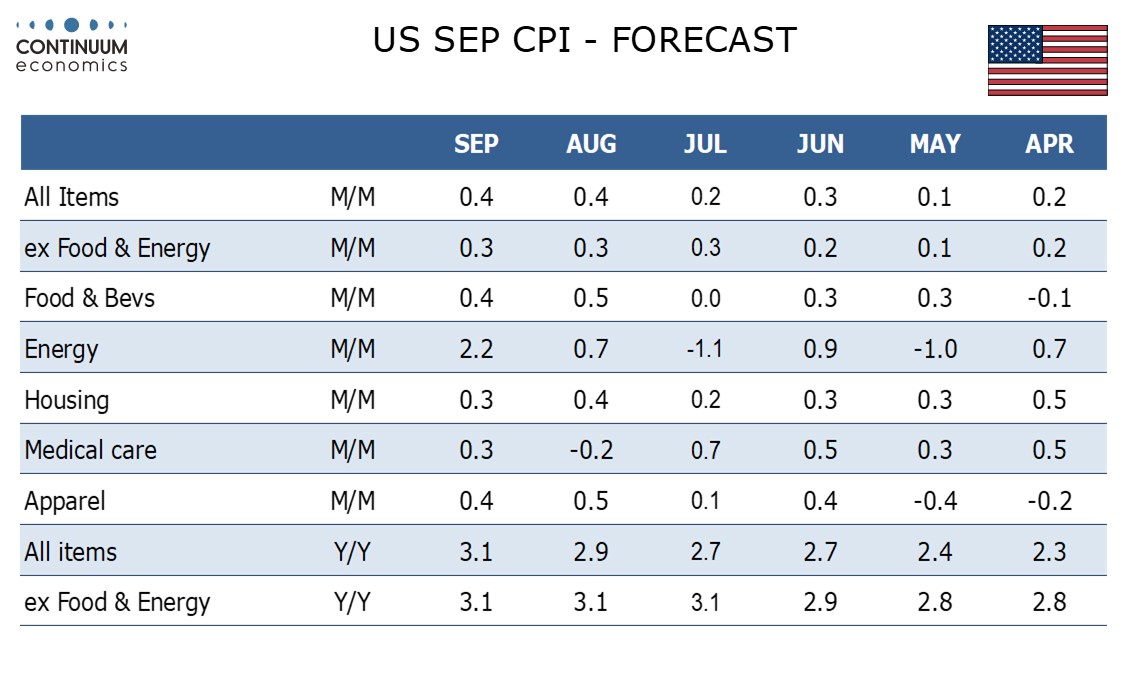

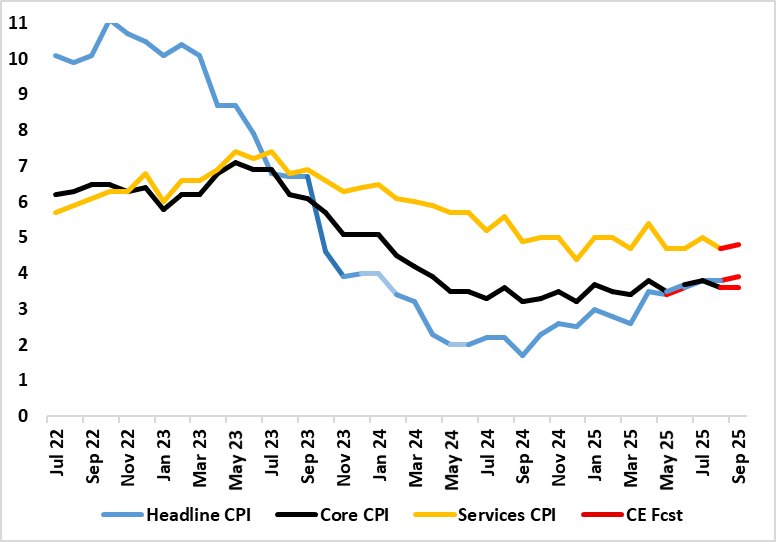

We finally get some official US data this week, with the September CPI data released on Friday. Our forecast of a 0.4% headline is above the consensus of 0.3%, but our core forecast is in line with consensus at 0.3%. The Fed is fully priced to cut rates 25bps on October 29, with a further cut slightly more than fully priced for December, so it will be hard for the data to be soft enough to increase market expectations of easing. Easing is happening despite rather than because of inflation data, with the CPI y/y rate edging up slightly in recent months in both the core and headline measures. It is the softness in employment data that has generated market expectations of easing, and if that continues we probably will get two more cuts this year. But stronger CPI data could create some doubts, so the USD risks on the data are more to the upside than the downside.

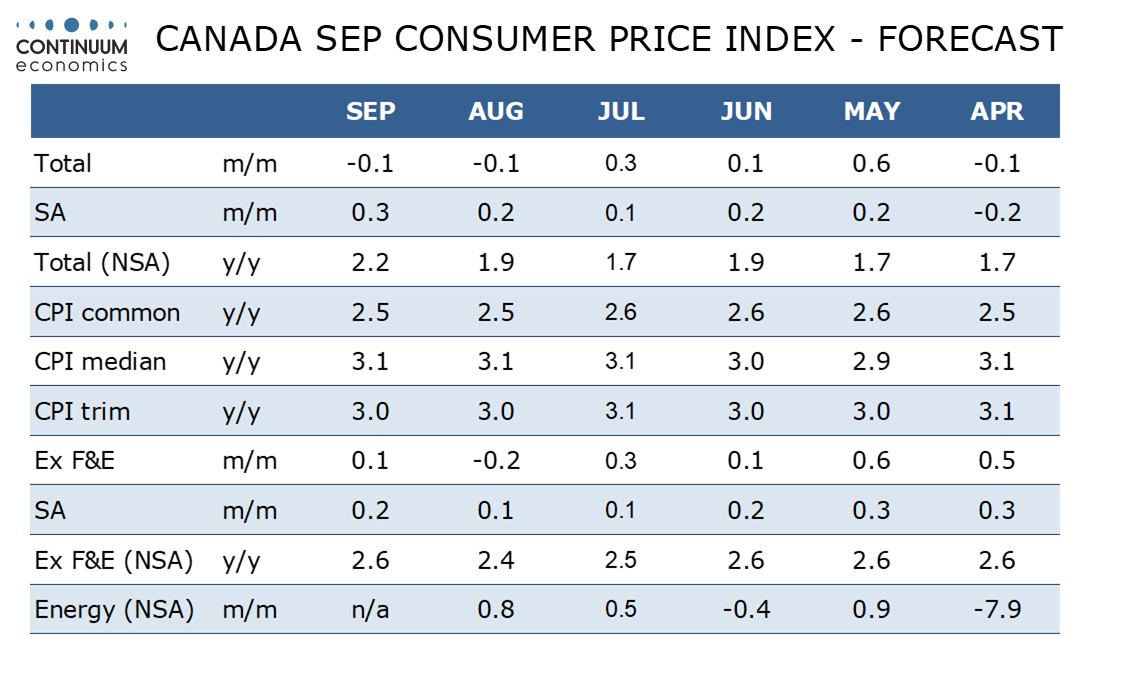

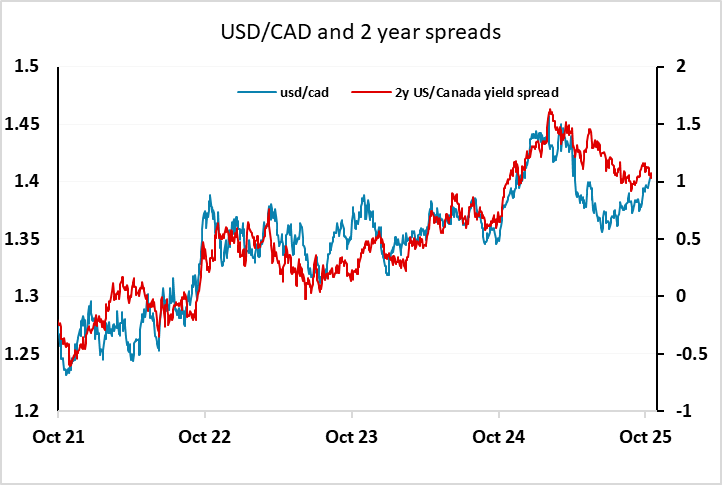

The BoC decision I not yet fully priced for a 25bp cut on October 29, so this week’s Canadian CPI and business outlook data has two way risks. Our forecast is in line with the consensus expectation of a rise in y/y inflation to 2.2%, but we see no change in the core rates and as long as this is the case the market is likely to move further towards expecting a BoC rate cut, which may prove slightly CAD negative. The net implication of the US and Canadian data suggests some upside risks for USD/CAD towards 1.41.

Of course, much will depend on whether there are any further jitters around US regional banks and consequent risk negative market moves as were see at the end of the last week, or indeed any other news that undermines the generally risk positive tone. There have been warnings from the IMF, ECB and BoE about the extended valuations in equity markets, and the China tariff threat also hangs over the market. Risks consequently look weighted to the equity market downside, particularly since the risks also seem weighted towards the market pricing out some Fed easing expectations if inflation data disappoints. A risk negative bias would tend to undermine the AUD, particularly if it relates to China, and favour the JPY and CHF.

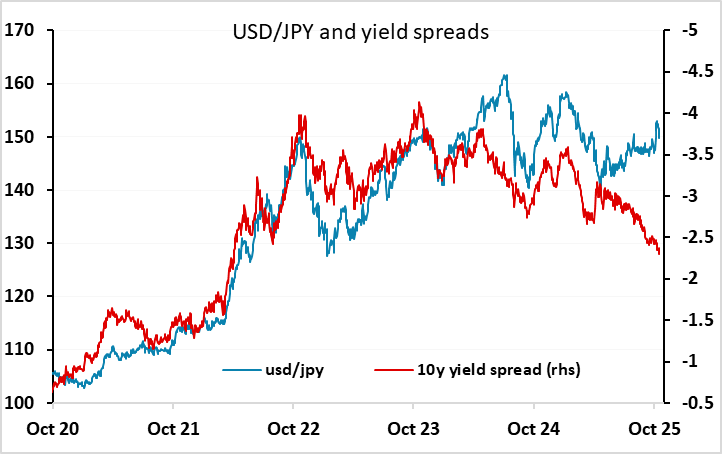

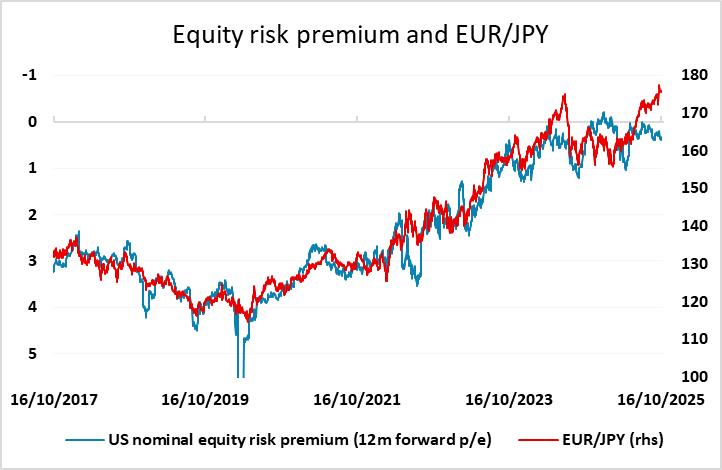

We continue to see upside risks for the JPY, which remains below the level seen before the election of Takaichi as LDP leader despite substantial yield spread moves in its favour and rises in equity risk premia since then, both of which tend to benefit the JPY. However, there is still likely to be politically related volatility, with this week expected to see a government formed with a new Prime Minister. Takaichi remains the favourite to be the new PM as leader of the LDP, but with the LDP having lost its long time coalition partner Komeito, it is not 100% clear that they will be able to command a majority. If Takaichi is confirmed, the JPY may see another leg down, although we remain sceptical that Takaichi will be able to influence monetary policy, and we may hear more comments from BoJ governor Ueda ahead of the BoJ meeting on October 29 that suggest a rate hike is possible. Either way, a resolution of the political uncertainty should eventually pave the way for a JPY recovery, even if it’s a bumpy road.

There's plenty of European data this week, but European currencies look relatively becalmed as there is little reason to expect an change in monetary policy any time soon, and EUR/USD tends not to be much affected by moves in risk appetite in recent times. GBP and NOK may be more vulnerable to any risk downturn, while the CHF should benefit, but with EUR/CHF already at such low levels, any break below 0.92 might be hard to sustain unless there is a very significant risk negative event.

Data and events for the week ahead

USA

The key release for the US will be September CPI on Friday, which will be released even if the government shutdown continues, as it is considered essential for annual cost of living adjustments to Social Security. We expect a 0.4% increase overall, with a third straight 0.3% increase ex food and energy, though we expect September’s core rate to be slightly below 0.3% before rounding, contrasting the two preceding gains that were slightly above.

If the government shutdown is resolved most postponed releases may take some time to arrive, though September’s non-farm payroll, which was probably mostly prepared before the shutdown, could come quite quickly. Despite the negative ADP report, we continue to expect a modest increase of 45k. Before the shutdown, this week’s calendar was quiet in terms of government releases.

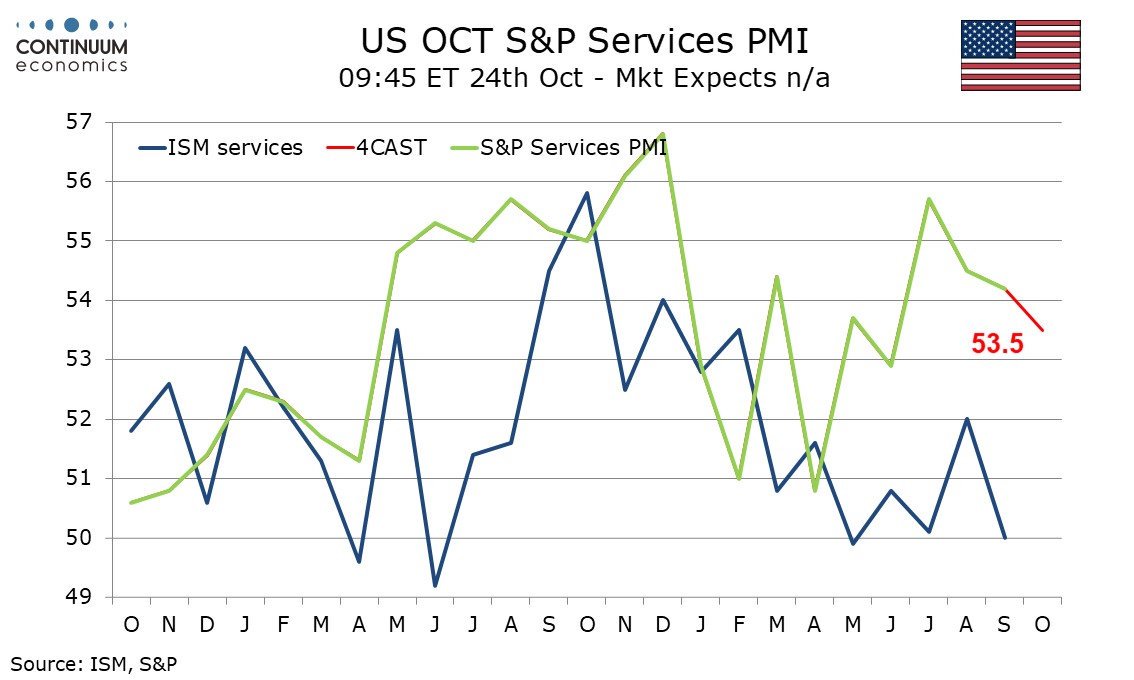

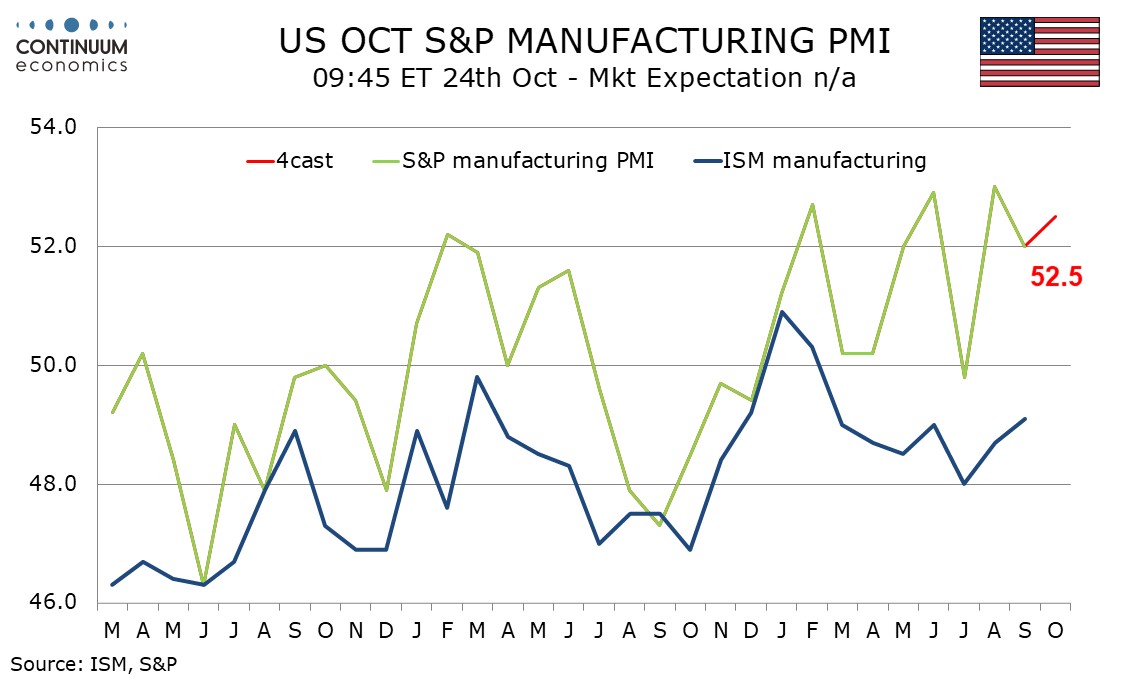

Private sector data that will be released includes September existing home sales on Thursday, where we expect a 2.5% increase to 4.10m. Friday sees preliminary S and P PMI surveys for October. We expect manufacturing to increase to 52.5 from 52.0 but services to slip to 53.5 from 54.2. Friday also sees October’s final Michigan CSI. The preliminary index was little changed at 55.0. There will be little Fed talk ahead of the October 29 meeting.

Canada

Canada will release some data that could influence the October 29 Bank of Canada decision. Monday sees the BoC’s quarterly business outlook survey and IPPI/RMPI data for September. Most importantly, Tuesday sees September CPI, where we expect an increase to 2.2% yr/yr from 1.9%, but no change in the BoC’s core rates. August retail sales are due on Thursday. A preliminary estimate made with July’s report was for a 1.0% increase.

UK

The coming week sees several important economic updates looming, most notably the CPI (Wed). Despite adverse rounding and fuel (and food) costs, the headline stayed at 3.8% in the August figure, this foreshadowing a likely rise this month to what we (and the BoE think) will be the inflation peak in September of up to 4.0%, although we think food prices may slow, allowing a peak of 3.9% instead, this rise largely due to fuel. The September data is likely to see the core rate retain the August drop of 0.2 ppt to three-month low of 3.6%. After some further aberrant factors, the rate in August saw services inflation reverse the rise to 5.0% in July, back down to 4.7% and may edge higher due to airfares. Also of note PPI data updates are due to reappear after a prolonged lull.

Headline to Nudge Higher Still, Core Stable?

Source: ONS, Continuum Economics

Tuesday sees public borrowing numbers which are already some £16.2 billion above the same period last year and £11.4 billion above the monthly profile consistent with the OBR March forecast and where a likely further overshoot will increase focus on the looming November Budget. Friday sees September retail sales data where a m/m correction is seen with it unclear if wetter and cooler than average weather may have affected spending.

Earlier that data GfK consumer confidence data may show still subdued sentiment as may CBI industry numbers (Thu). But as far as survey numbers are concerned, the PMI flashes (Fri) take precedence in market eyes, especially after the poor outcome last time around which we think will be repeated. Indeed, at 50.1, down from 53.5 in August, the PMI Composite Output Index dropped to its lowest level for five months and signalled broadly unchanged volumes of business activity across the private sector economy.

Eurozone

More updated GDP and employment numbers appear on Monday while Thursday sees data on labor market slack. Construction figures are due (Wed) but we see little change in what may be the fresh insight into how companies have actually reacted to the EU-U.S. trade ‘deal’ this coming via the French INSEE update (Thu). But the focus will be on the flash PMI data (Fri). In September, the Composite PMI increased for the fourth month in a row to 51.2 in September, from 51.0 previously, signalling a further gradual acceleration in output growth across the EZ private sector but we see a small correction back. Additionally, there was a cooling of selling price pressures as output charges increased to the weakest extent since May. There are several ECB appearances, including from Lane and Lagarde (both Tue).

Rest of Western Europe

There are no key events in Sweden while Norway sees the Norges Bank climate change conference at which many European central bankers will appear.

Japan

National CPI will be released on Friday. Unfortunately, the weight it carries this time will be lower, at least until the political turbulence in Japan calms. It is expected headline CPI will moderate more than core-core CPI yet it could be choppy if not for base effect. Trade balance on Wednesday will be interesting for the impact of export remains important.

Australia

Rather empty calendar. Only PMIs on Friday.

NZ

The critical CPI will be released on Monday. The RBNZ has previewed a potentially higher Q3 CPI but remain committed to cutting as they see more long term benefit. If there is not a high read, there is a good chance the Kiwi will take a fast break downwards. There will also be trade balance on Tuesday.