FX Daily Strategy: APAC, December 19th

BoJ and BoE both deliver rate decisions

Still a risk of a BoJ hike…

…while BoE may suggest larger rate cuts next year than is currently priced in

US initial claims may be the US data that grabs the most attention

BoJ and BoE both deliver rate decisions

Still a risk of a BoJ hike…

…while BoE may suggest larger rate cuts next year than is currently priced in

US initial claims may be the US data that grabs the most attention

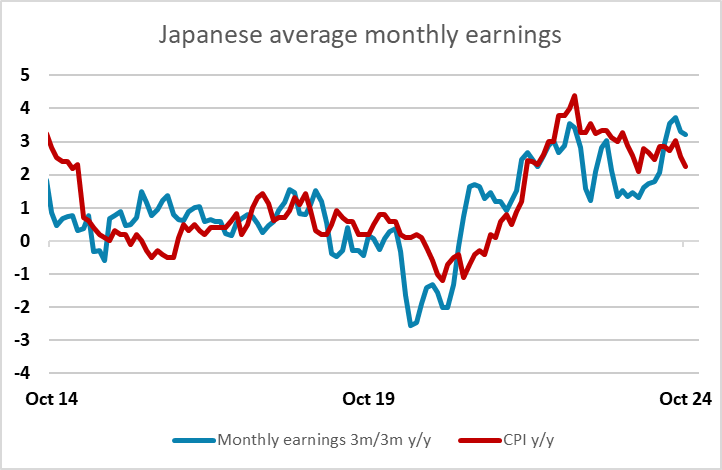

Thursday sees monetary policy decisions from the BoJ and BoE. The BoJ is the more uncertain. At the beginning of the month the market was pricing a 25bp hike form the BoJ with better than a 50% probability. Now there are only 4bps of tightening priced in for this meeting, after comments from BoJ officials last week indicated they felt there was little risk in waiting before hiking again. Even so, we still see every chance of a 10bp hike this month. The BoJ are committed to tightening policy, provided they see the required rise in wage growth and inflation, and while wage growth may not be rising quite as fast as the BoJ desire, it is strong enough to justify them continuing with the tightening cycle. Additionally, if they don’t tighten there is an increased risk of further JPY weakness. While BoJ officials suggested that further JPY declines would not be overly worrisome at this stage, it would seem strange to risk a renewed USD/JPY move to the upside.

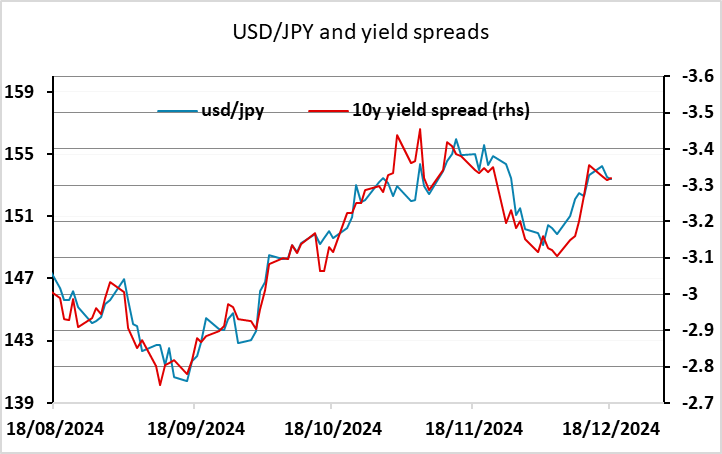

We would therefore favour a 10bp tightening this month, which should allow a modest JPY rally. In practice, it is still the case that most of the volatility in US/Japan spreads, and consequently in USD/JPY, comes from the US side, so JPY gains are unlikely to be large base don this modest move. While trend JPY gains may be seen on the back of gradually higher JPY rates and gradually lower rates elsewhere, moves are likely to be slow unless there is some significant weakness in equities that triggers some unwinding of carry trades.

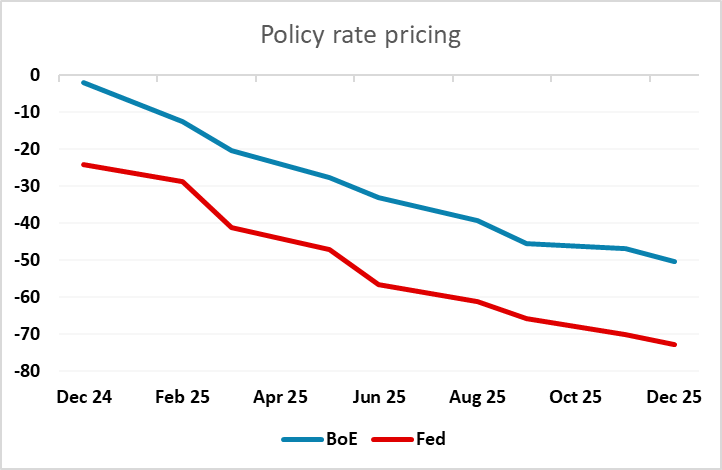

There is less uncertainty about the BoE decision, with the stronger than expected average earnings data this week supporting the hawkish case for only very gradual easing. Even though we saw the labour market data as somewhat more mixed than the market reaction suggested, most of the committee are likely to vote for no change, with only one possible vote for a rate cut. But while we see no cut this time around, it still looks like the UK curve underprices the risk of cuts next year, with just two priced in. The statement may challenge this view so we would see most of the GBP risk as being on the downside.

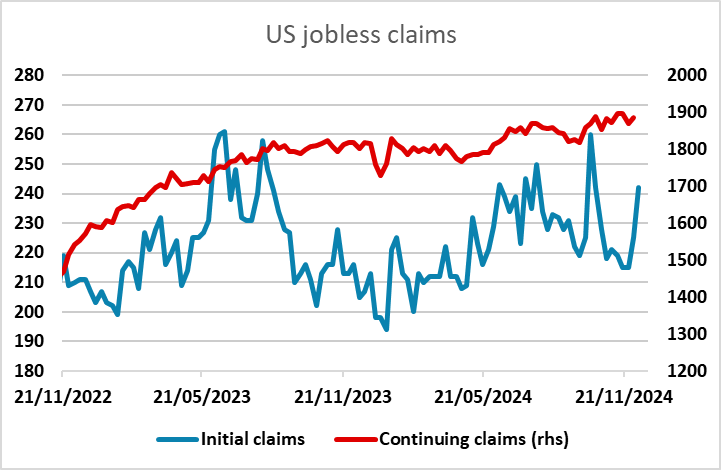

US jobless claims may attract the most attention of Thursday’s batch of US data. The GDP revision is unlikely to be significant, and the Philadelphia Fed survey has been choppy, but after last week’s higher than expected initial claims figure, there is potential for the market to take a more dovish Fed view if we see further evidence of an increase in labour market slack.