EUR, GBP flows: GBP recovers slightly after UK PMI

EUR/GBP slips back after UK PMI following gains after stronger Eurozone data

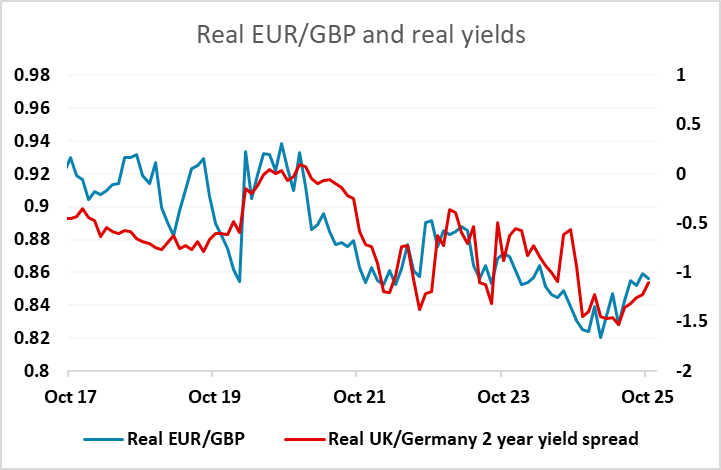

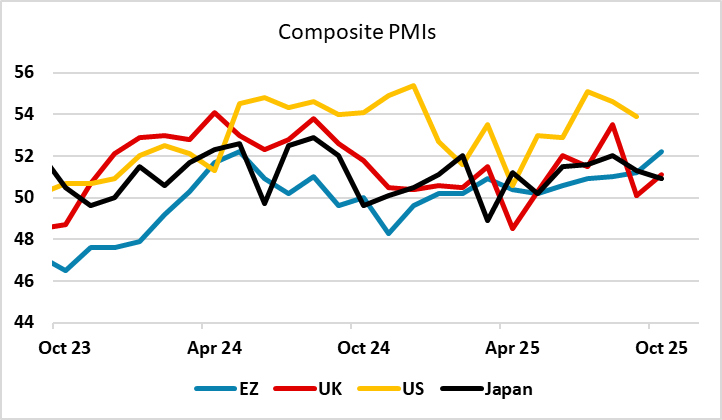

UK PMI also slightly better than expected, allowing EUR/GBP to fall back after the rise following the stronger than expected German and Eurozone PMI. We are a little sceptical that the German number is genuine, but even if it is, the fact that the German index rose and the French index fell is potentially a bigger issue than the rise in the Eurozone composite index, as most of the concerns around the EUR relate to the problems in France. The UK PMI data is as a rule a less reliable contemporaneous indicator for the UK than the Eurozone indicator is for the Eurozone, so the modest rise is of limited GBP significance. We still doubt that EUR/GBP can make a proper test of the 0.8763 high of the year, as we still regard a November 6 UK rate cut as unlikely.