FX Weekly Strategy: Europe, April 14th-18th

Tariff situation unlikely to change materially

Central bank reactions could be key this week

Hard to reverse loss of confidence in the USD

JPY may recover against the EUR

High yielders can improve if volatility declines

Strategy for the week ahead

While it is possible that there will be some new tariff policies announced in the coming week, we assume here that the current position will remain the status quo. That is, the 10% universal tariff will remain in place, the 90 day pause will be retained, and the current 100%+ tariffs between the US and China will stay or even increase. How the markets behave in the coming week will therefore depend not on new information on the tariff front, but on any reactions to this set of circumstances from other players, notably central banks, and any revision of perceptions of the implications of the tariff situation.

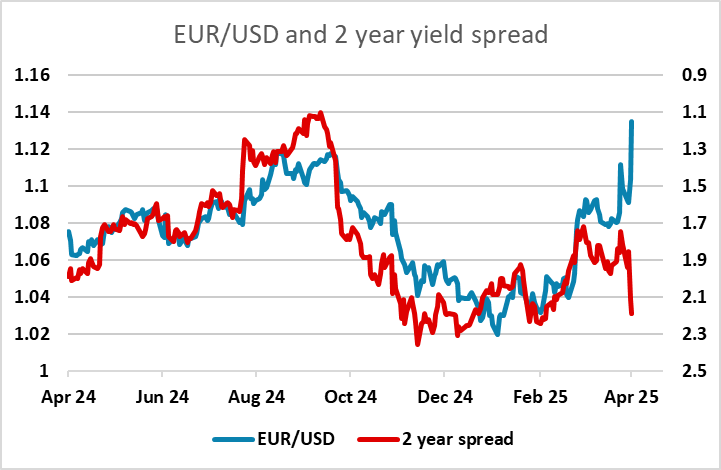

Last week saw the second consecutive week of sharp declines in the USD across the board, but was notable for the fact that the decline came in tandem with higher US yields, and higher spreads in favour of the USD, as markets appeared to lose confidence in US bond as well as equities. There are other interpretations as well, with some seeing the rise in US yields as partly a technical basis driven trade, while the rise could also be seen as being due to an expectation of higher US inflation persisting due to a dovish Fed response to tariff induced inflation. But either way, the USD decline against the background of higher US yields is notable, and does suggest a loss of confidence.

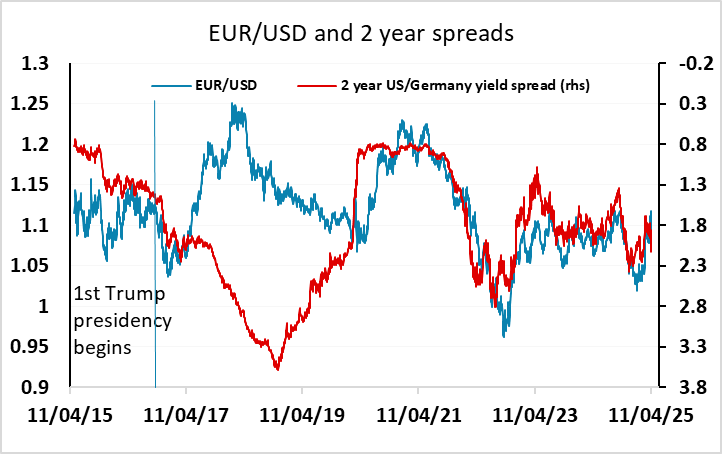

It is consequently hard to oppose USD weakness at this stage without some change in tariff policy. The USD is starting at expensive levels, which are only partly justified by the relatively high US yields. USD/JPY in particular remains at extreme levels, due to the relatively low Japanese inflation in recent years implying a big real JPY depreciation. However, it is possible that the speech from Powell this week could help stabilize markets if he plays down the likely risks to the US economy from tariffs and indicates a pragmatic Fed policy that will not allow inflation to become embedded. Nevertheless, he has a difficult job, and it will be hard for him to do more than stabilise markets.

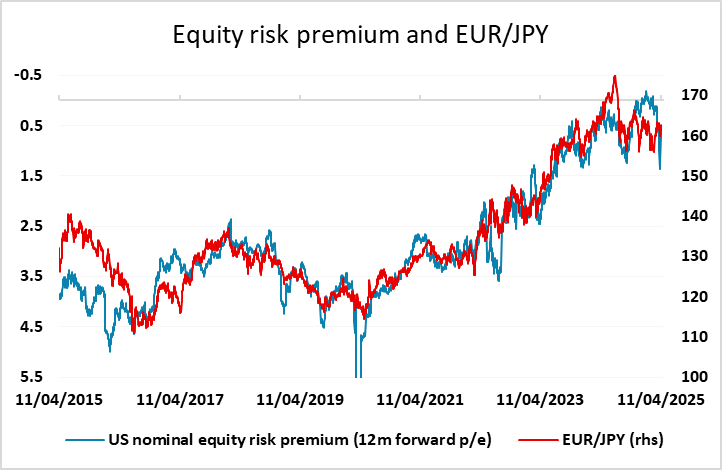

In FX, it has been notable that the riskier currencies have suffered, but also notable that the EUR and CHF have outperformed, with the EUR actually gaining against the JPY in the last week. This may in part relate to the fact that the US equity market has stabilized while yields have risen, implying a decline in the equity risk premium which corelated well (inversely) with EUR/JPY. This doesn’t seem likely to persist, as either yields or equities are likely to decline from here, so we would see downside risks for EUR/JPY.

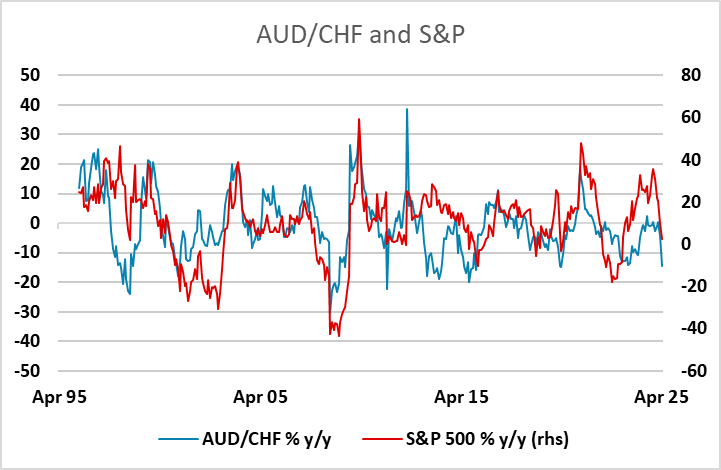

As for the riskier currencies, declines against the EUR may be a little overdone if we see some decline in volatility in the coming week. EUR/NOK, EURGBP, and EUR/AUD could all see some retracement of the gains seen in the last couple of weeks if volatility declines. Similarly, the strength of the CHF may fade a little if we see any stabilization, with the SNB also likely to want to prevent further CHF gains.

Data and events for the week ahead

USA

Tariff headlines have the potential to outweigh anything on the calendar, but the US weekly calendar is busy. Monday has no significant data but will see Fed’s Harker and Bostic speak. Tuesday sees the April Empire State manufacturing survey and March import and export prices, data which will not include tariffs.

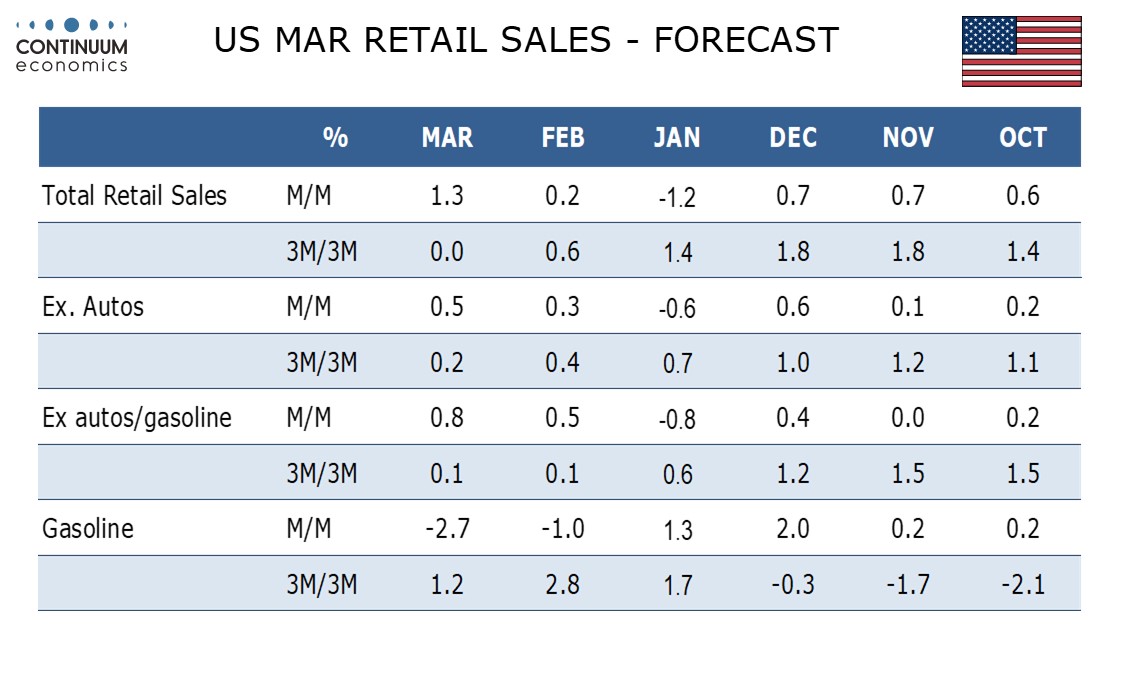

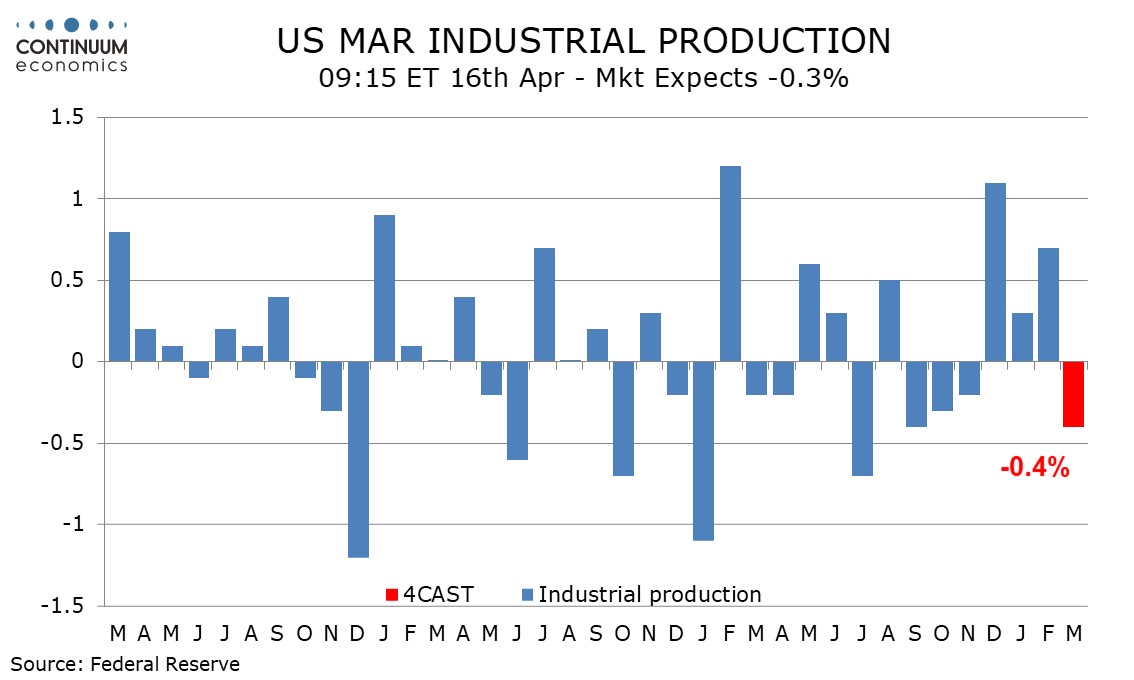

The week’s most significant data release is likely to be March retail sales on Wednesday, where we expect a strong 1.3% increase, 0.5% ex autos and 0.8% ex autos and gasoline. Improved weather and a desire to beat tariffs, particularly in autos, will support the bounce. We expect this to be followed by a 0.4% fall in March industrial production, hit by a weather-induced plunge in utilities, but we expect a 0.4% increase in manufacturing. February business inventories and April’s NAHB homebuilders’ survey are also due. Wednesday’s Fed speakers include Hammack, crucially Powell, with Schmid following.

On Thursday we expect March housing starts to fall by 2.1% to 1470k, while permits rise by 0.1% top 1460k. April’s Philly Fed manufacturing survey is also due while weekly initial claims will cover the survey week for April’s non-farm payroll. Markets will be closed on Friday for Good Friday.

Canada

Canada releases February wholesale sales on Monday and February manufacturing sales on Tuesday. Preliminary estimates were for a rose of 0.4% and a fall of 0.2% respectively. Tuesday’s most significant release will be March CPI, which we expect to rise to 2.7% yr/yr from 2.6% with gains in the BoC’s core rates too. March housing starts and existing home sales are also due on Tuesday.

Wednesday sees the Bank of Canada meet and we expect a pause in rates at 2.75% given recent solid data and US tariffs on Canada, while significant, not meeting the worst fears. Uncertainty is likely to mean little forward guidance, and the accompanying Monetary Policy Report is likely to see the BoC deciding against delivering its usual economic forecasts. January forecasts assumed no tariffs.

UK

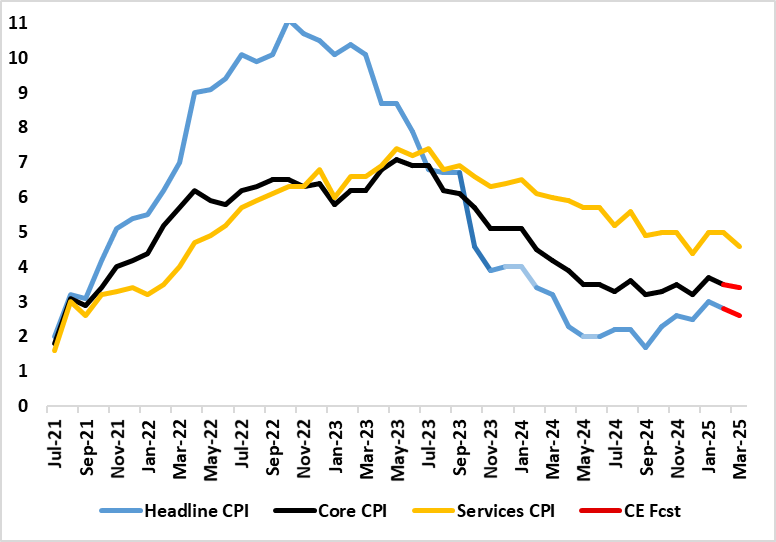

Although relegated by current market ructions and tariff threats, the main near-term inflation story was (and remains) what happens in the April CPI data when a series of energy, utility, post office and some other regulated and service price rises are due, albeit now possibly offset somewhat by a fall in petrol prices if the slump in energy prices persists. All of which would have made the March data due on Wednesday something of a side issue even though they may show headline CPI inflation retreating a little further; we see it dropping a further 0.2 ppt to 2.6%, a notch below BoE thinking. But we will be interested to see if there are more signs of softer clothing and rental inflation, both possible signs that weak consumers are starting to rein in company pricing power. Otherwise, the BoE credit conditions survey (Thu) is unlikely to offer much new, both as the FPC has just underlined banks’ resilience and also because the survey was made well before recent market volatility.

Tuesday sees the next set of labor market numbers, the apparent wage resilience having perturbed some MPC members. But this data release, now encompassing updates not just from the long-standing ONS but also real time figures from the HMRC (which we suggest are more authoritative data). The latter show that employment is continuing to contract and this may be the case even with regular average earnings data likely to show little change – the headline figure may drop 0.3 ppt.

March CPI Inflation to Slip Back Broadly – Albeit Temporarily?

Source: ONS, Continuum Economics

Eurozone

It is surely not a question of whether the ECB cuts rates again at its decision next Thursday, but what it communicates about policy thereafter. Not least given the manner in which financial conditions have tightened, the then-notable change in rhetoric last month to suggest the policy stance had become less restrictive is already out of date as the ECB instead grapples with increasing downside risks (to both growth and inflation that now require risk management as the theme driving policy ahead. These risks stem not just from the direct consequences to trade from the U.S. imposed tariffs but also from export diversions and the increasing threats of inter-twined slumping business confidence and capex intentions as well as the surging euro damaging competiveness, the latter accentuating already tighter financial conditions. And amid a backdrop where EZ banks have already shown fresh signs of tightening credit, heighted uncertainty may merely accentuate this downside risks as the Bank Lending Survey (Tue) may highlight.

As for data, EZ industrial production may drop afresh while ZEW survey numbers may be all over the place depending on when the results were taken

Japan

We will have the National CPI on Friday. The headline figure has stayed high for the past two months and we are only forecasting a moderate ease as cost pressure did not fall much. Else, we have industrial production on Monday and Trade balance on Thursday.

Australia

The RBA meeting minutes will be released on Tuesday but we expect little cues as they clearly stated data dependency. Labor data on Thursday will be interesting after the fall in February. The RBA is seeing the labor market remains solid and it would be surprising to see the continual cooling of the employment change.

NZ

CPI is on Thursday. It is very likely the headline Q1 number remain in the 2-3% range and play along RBNZ’s forecast.