FX Daily Strategy: Asia, February 20th

National CPI To Be Closer to Target Range

U.S. Q4 GDP and Core PCE Prices both seen at 2.6%

U.S. December Firmer prices matching income and spending

Other U.S. Data

The National CPI for Japan will be released on Friday Asia and it will likely print another low read as Takaichi's stimulus start to take effect. Headline and core CPI has been edging closer to the 2% target range while core-core CPI stay stubborn around 3%. We expect the latest headline read will stay close to the 2% target range but core-core will likely also edge slightly lower. It will be a hawkish surprise if all three item rises instead.

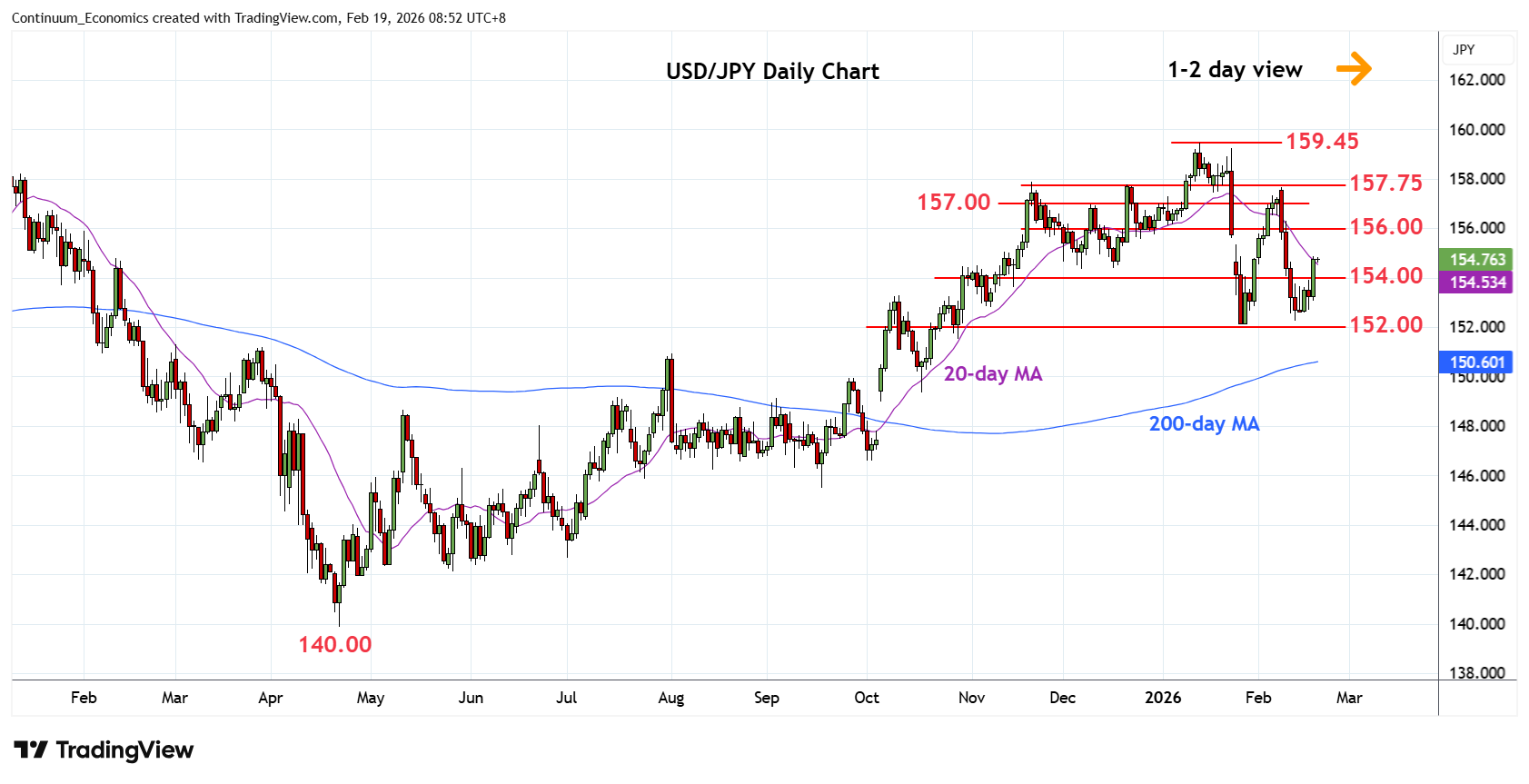

On the chart, the pair is regaining the 154.00 level see prices extending bounce from the 152.27 low to retrace sharp losses last week from the 157.66 high. Bounce seen corrective with resistance at the 155.00/156.00 congestion area expected to cap and give way to renewed selling pressure later. Clearance, if seen, will open up room for stronger bounce to 157.75.90 resistance. Meanwhile, support is raised to the 154.00/153.00 area. Would take break here to return focus to the downside for retest of the 152.27 and 152.10 lows.

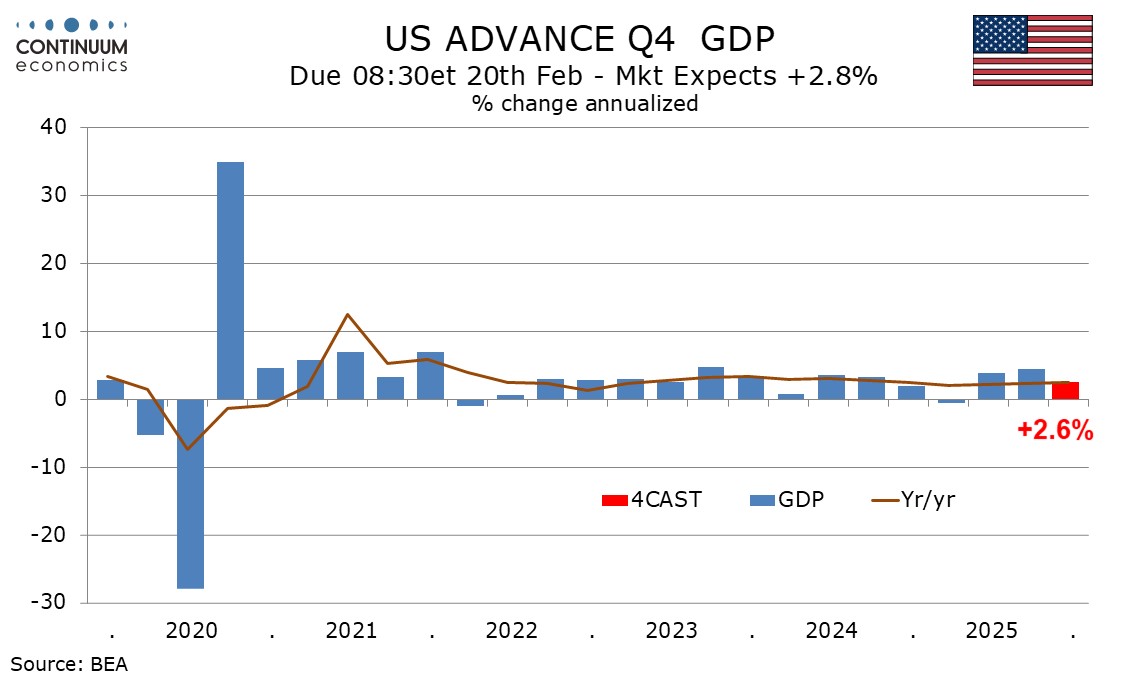

We expect a 2.6% annualized increase in Q4 GDP, well above a flat forecast we had entering the quarter, but off a peak estimate of 3.6%, with weaker November trade and December retail sales data having trimmed the forecast. December trade data, due on February 19, remains a significant source of uncertainty. We also expect core PCE prices to ruse by 2.6% in Q4. We are assuming a slight increase in December’s trade deficit, though Q4 is still likely to see a positive contribution from net exports due to a sharply narrower deficit in October. We expect exports to increase by 4.1% and imports to fall by 2.5%, with net exports adding 0.9% to Q4 GDP.

As a consequence of trade policy shifts, net exports have been a major source of volatility within recent GDP data. However under our forecasts, for 2025 as a whole, exports would be up a modest 2.1% and imports up by a similar 2.0%. We expect inventories to take off a marginal 0.1% from GDP for a second straight quarter, declining at a similar pace to Q3 in a continued correction from a surge in Q1 ahead of April’s tariff announcement.

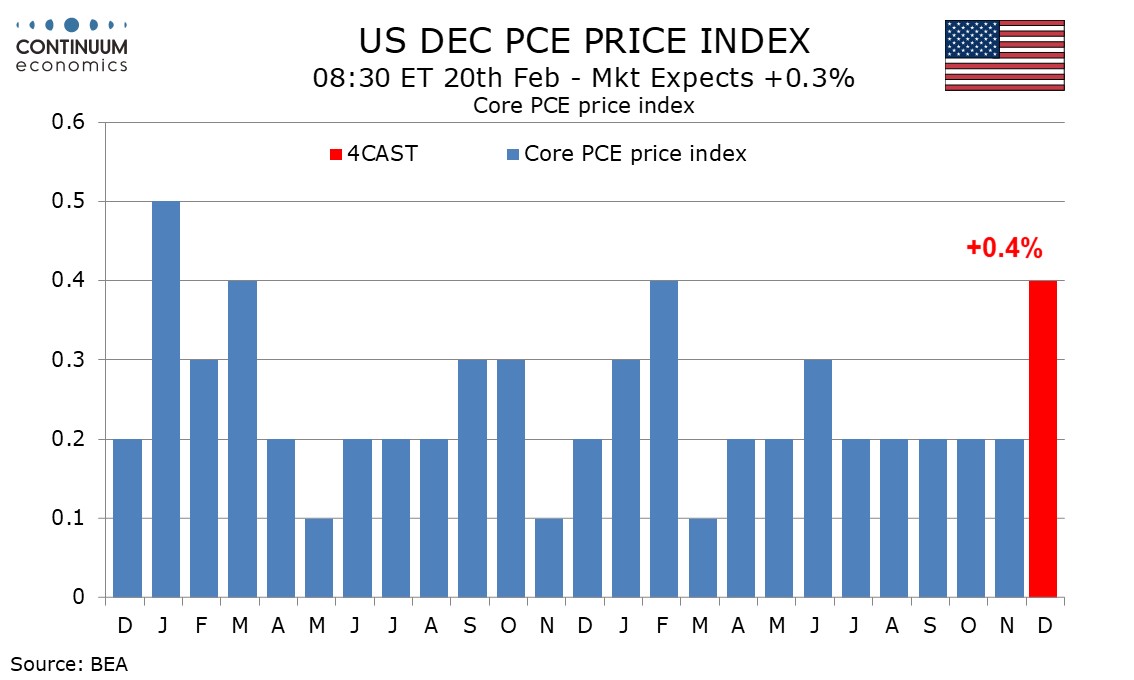

December’s personal income and spending report may be overshadowed by Q4 GDP data released at the same time, but is likely to see a strong core PCE price index increase of 0.4%, the highest since February. We expect personal income to rise by 0.3%, underperforming a 0.4% rise in spending, with both series soft in real terms. We expect 0.4% gains in both overall and core PCE prices, which would be stronger than their respective CPI counterparts, which increased by 0.3% and 0.2%, with core CPI on the firm side before rounding. PCE price data will be given a further boost from a strong December PPI. This would leave annualized Q4 gains of 2.8% in overall PCE prices and 2.6% in the core.

Assuming no back month revisions, yr/yr growth in core PCE prices would then pick up to 3.0% from 2.8%, reaching its highest level since February, while overall PCE prices would increase to 2.9% yr/yr from 2.8%. This would be the highest since March 2024. Both of these yr/yr rates have been signaled by Fed officials. A subdued December non-farm payroll breakdown suggests a modest 0.2% increase in wages and salaries. We expect a slight pick-up in the other components of personal income after two weak months though at 0.3% personal income would still fall short of PCE prices. We expect real disposable income to fall by 0.3% annualized in Q4 after a flat Q3.

We expect improvement in February’s S and P PMIs, more significantly in manufacturing, to 53.5 from 52.4, with services seeing only a modest increase to 53.0 from 52.7. A sharp rise in December’s ISM manufacturing index to its highest level since August 2022 suggests upside risk to the S and P manufacturing index, though the ISM manufacturing level of 52.6 was only marginally above January’s S and P manufacturing index of 52.4. Still, we do expect the S and P index to move above the 2025 high seen in August, which was 53.0 for the final outcome and 53.3 for the preliminary.

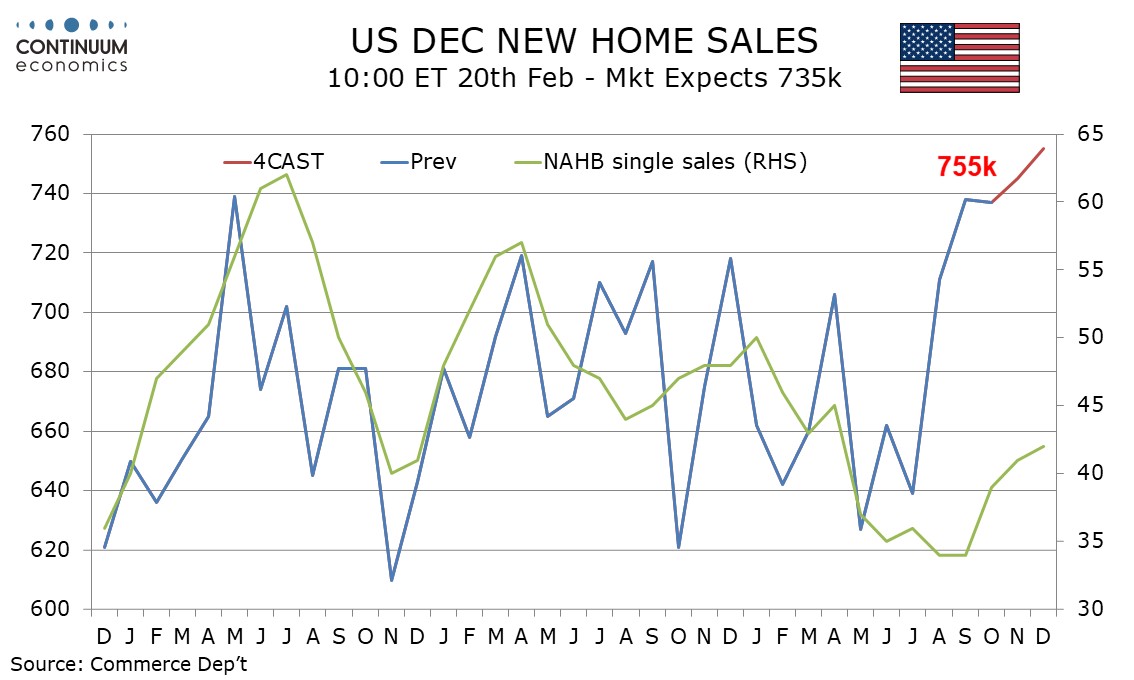

November and December new home sales data will be released on February 20. We expect moderate continuations of a recent improvement in trend, with November rising by 1.1% to 745k and December rising by 1.3% to 755k. This would be the highest level since February 2022. A recent pick up in housing demand has been supported by Fed easing. The NAHB homebuilders survey was picking up into December, if not particularly impressively, and slippage in January suggests new home sales momentum may fade in early 2026. December pending home sales, designed to predict existing rather than new home sales, slipped sharply in December, erasing four straight gains.