FX Daily Strategy: N America, May 9th

JPY weakness looks aberrant but could still extend

Japanese wage data will be a focus

CAD starting to look vulnerable to weak employment data

NOK has potential to recover further unless CPI weakens more than expected

JPY weakness looks aberrant but could still extend

Japanese wage data will be a focus

CAD starting to look vulnerable to weak employment data

NOK has potential to recover further unless CPI weakens more than expected

Friday has no significant US data but there is wage data out of Japan which is important for BoJ policy as well as the Canadian employment report and Norwegian CPI.

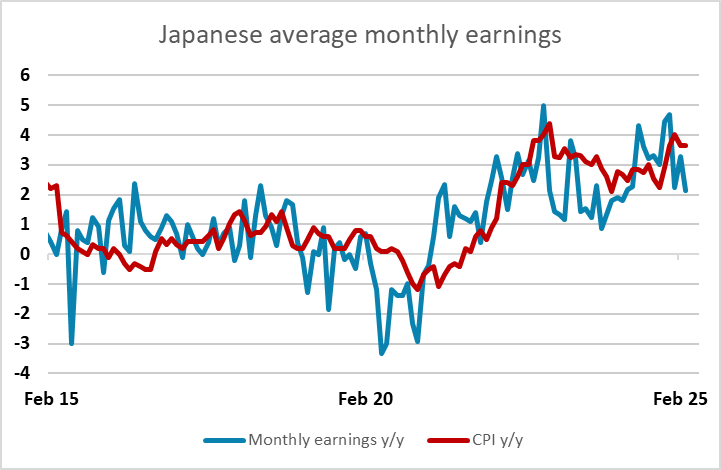

The March Japan labor cash earning continues to grow above 2% at 2.1% y/y but has slowed from the previous sub 3% level. While it is before the 2025 spring wage negotiation, the uncertainty from potential tariffs may have deterred the pace of wage hike in Japan. On the other hand, we have a recovery in household spending to 2.1% y/y, suggesting consumption is set to further recover on steady growth of nominal wage.

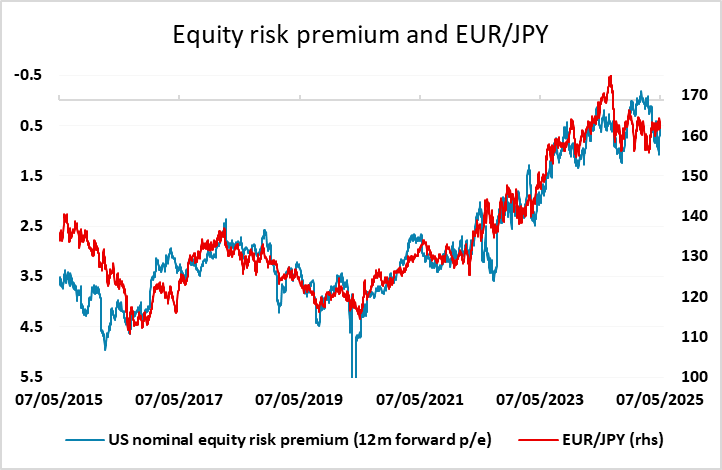

However, if the current more positive equity market tone persists, we would not rule out further short term JPY weakness. While this is unlikely to persist, there is heavy long JPY positioning evident in the CFTC futures data, and there will be pressure on these positions to close if we see a break above 146 in USD/JPY and/or 165 in EUR/JPY. The expectation of further trade deals, even if they don’t restore things to the pre-tariff position, could maintain the short term risk positive corrective tone. Longer run, we still see scope for substantial JPY gains, but this is likely to require a turn lower in equities.

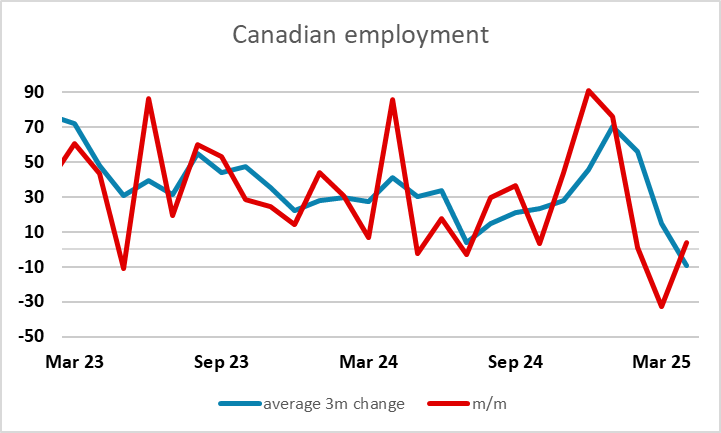

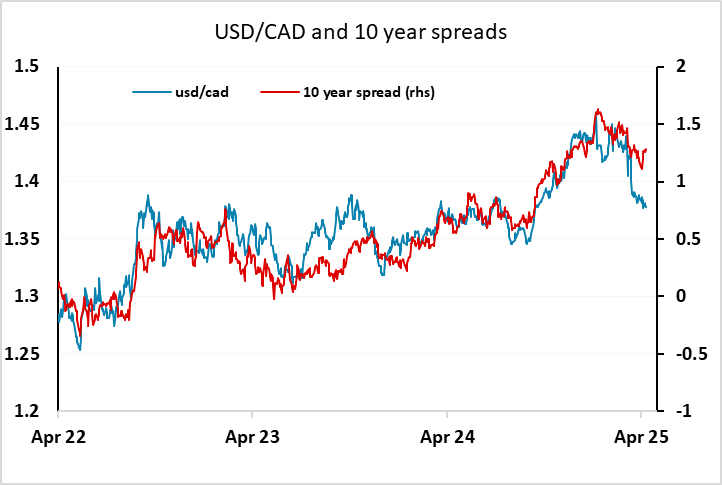

The Canadian employment report is expected to show only a small gain in employment of 4.1k in April, after a 32.1k decline in March, implying a significant deterioration in the underlying trend, with the unemployment rate seen rising to 6.8%. The CAD has performed well in spite of the increasing expectation of economic damage from the US tariff policy, but there are signs of a turn in USD/CAD in the last few days. A weak Canadian employment report could well trigger a bigger CAD correction towards 1.40.

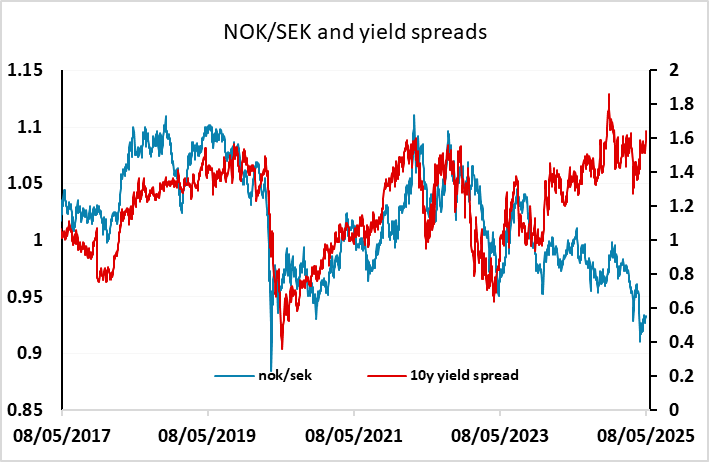

Norway CPI was on the soft side of expectations, with the core measure falling to 3.0% y/y against a consensus of 3.2%, even though the headline was in line at 2.5%. EUR/NOK had edged up ahead of the data but is back at the levels seen at Thursday’s close near 11.72. We continue to see upside potential for the NOK, even though the slightly softer data marginally increases the chances of a rate cut at the June meeting. Rate cuts should not be damaging for the NOK as yield spreads remain substantially in its favour and the currency remains good value, especially against the SEK.