FX Daily Strategy: Europe, January 19th

GBP strength may founder as retail sales drop

CAD weakness may still extend a little further

USD can see some correction to the week’s strength against the EUR and JPY

NOK/SEK looks ripe for a move back above parity

GBP strength may founder as retail sales drop

CAD weakness may still extend a little further

USD can see some correction to the week’s strength against the EUR and JPY

NOK/SEK looks ripe for a move back above parity

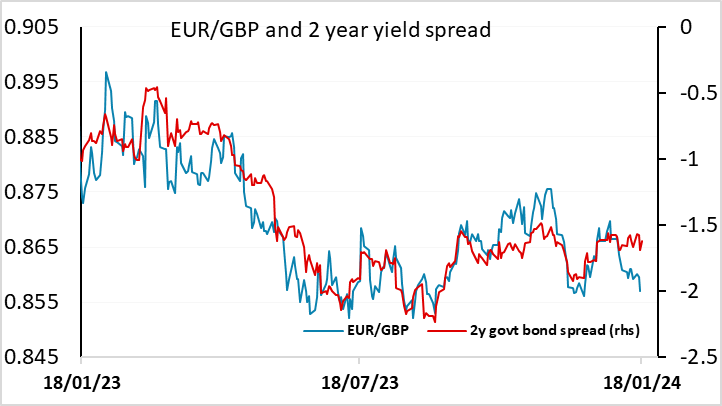

Friday sees essentially second tier data in retail sales from the UK and Canada, and the University of Michigan survey in the US, so we wouldn’t anticipate major data reactions. The UK retail sales data has been known to have a significant impact, but the December data is likely to show a weather related decline after the 1.3% jump in November, against the background of a fairly flat underlying picture, so it’s hard to see it having a significant effect. However, GBP has been strong this week after the slightly higher than expected CPI data, which reduced market expectations of UK easing, so another stronger than expected number could extend the gains. Even so, we favour some corrective GBP weakness as the CPI data was still below the BoE expectations in the November MPR and the the underlying trend in UK CPI remains soft, while the average earnings data earlier in the week showed more evidence of slowing in recent months. The strength of GBP consequently looks unjustified, especially since EUR/GBP continues to trade below the level suggested by the yield spread correlation, even after the rise in UK yields this week, and we would expect EUR/GBP to find support above 0.8550.

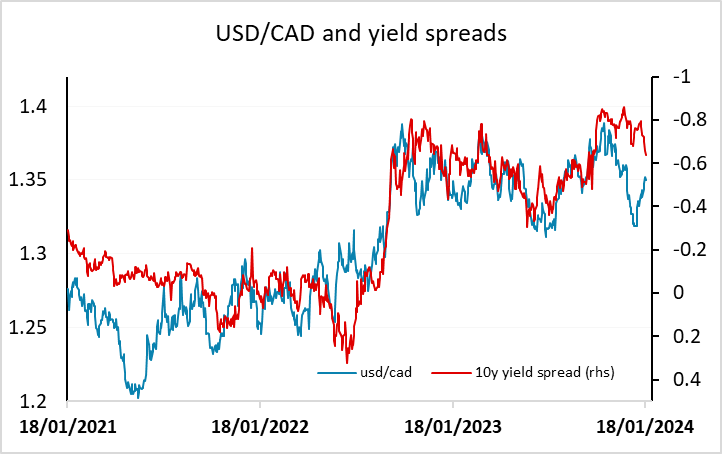

The Canadian retail sales data tends to be even less of a focus, as it is even more out of date, covering November. It does come with some projections for December, but we doubt there will be much impact. The CAD has slipped lower against the USD this week in spite of stronger than expected CPI data, as although this did lead to some rise in CAD yields, the CAD decline at the end of last year was out of line with yield spreads. The USD/CAD rise in the last week has brought t closer to what looks like fair value relative to yield spreads, but the upside is still favoured.

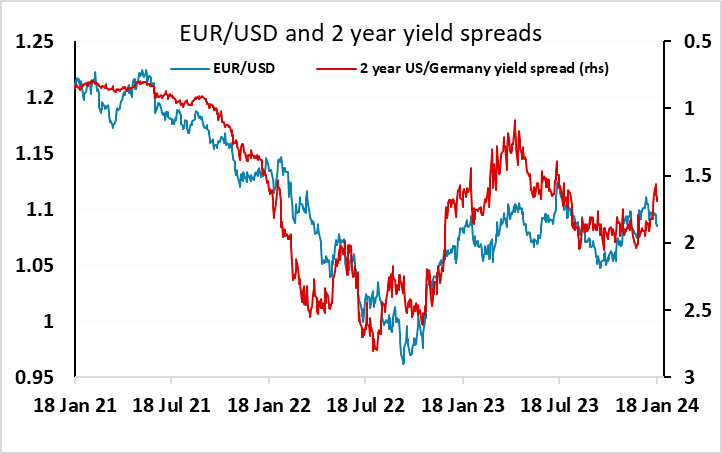

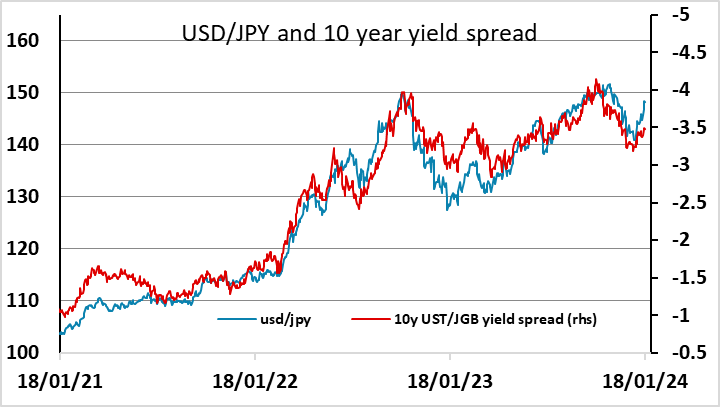

Elsewhere, USD strength has continued largely unabated through the week, supported by a succession of stronger US numbers, with the low claims data on Thursday the latest example. Nevertheless, unlike USD/CAD, the USD strength against the EUR and JPY doesn’t look to be well supported by the rise in US yields. EUR yields have followed US yields most of the way up, so the spread move has been modest despite the decline in EUR/USD, while the USD/JPY move looks excessive relative to the move in spreads. We may see some corrective USD losses at the end of the week to move it back more in line with the spread moves. This suggests that the EUR and JPY also ought to have scope for gains against the CAD.

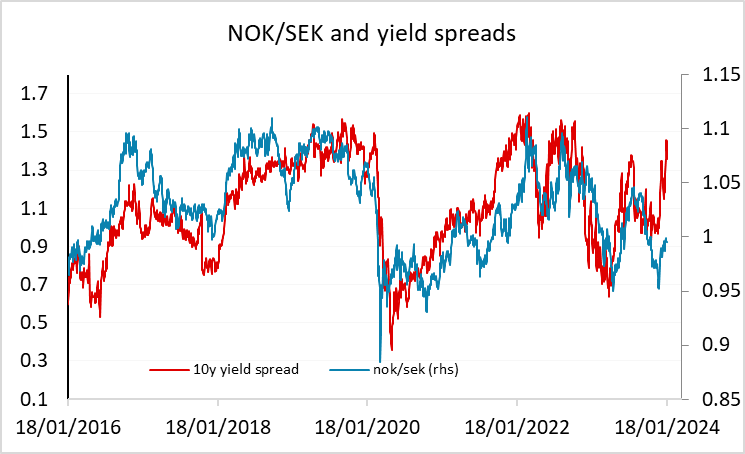

Both the NOK an SEK have performed poorly in the last week, with both losing more than 1% against the EUR. To some extent the SEK move has been supported by a yield spread move in the EUR’s favour, but this is not true of the NOK, and the NOK/SEK move is strikingly out of line with the usual yield spread correlation. At the beginning of the year it pays to be wary of old correlations, as the market can take a new focus, but the NOK/SEK yield spread correlation has been stable for some years, and with the oil price steady to firmer this week it’s hard to find a good rationale for NOK weakness. There is scope for a NOK/SEK move back above parity near term.