FX Daily Strategy: Asia, June 21st

US PMIs a focus after May jump

Modest dip expected but unlikely to be enough to trigger much reaction

JPY weakness continues and may bring the BoJ into action

GBP could fall further but big EUR/GBP recovery unlikely ahead of French election

US PMIs a focus after May jump

Modest dip expected but unlikely to be enough to trigger much reaction

JPY weakness continues and may bring the BoJ into action

GBP could fall further but big EUR/GBP recovery unlikely ahead of French election

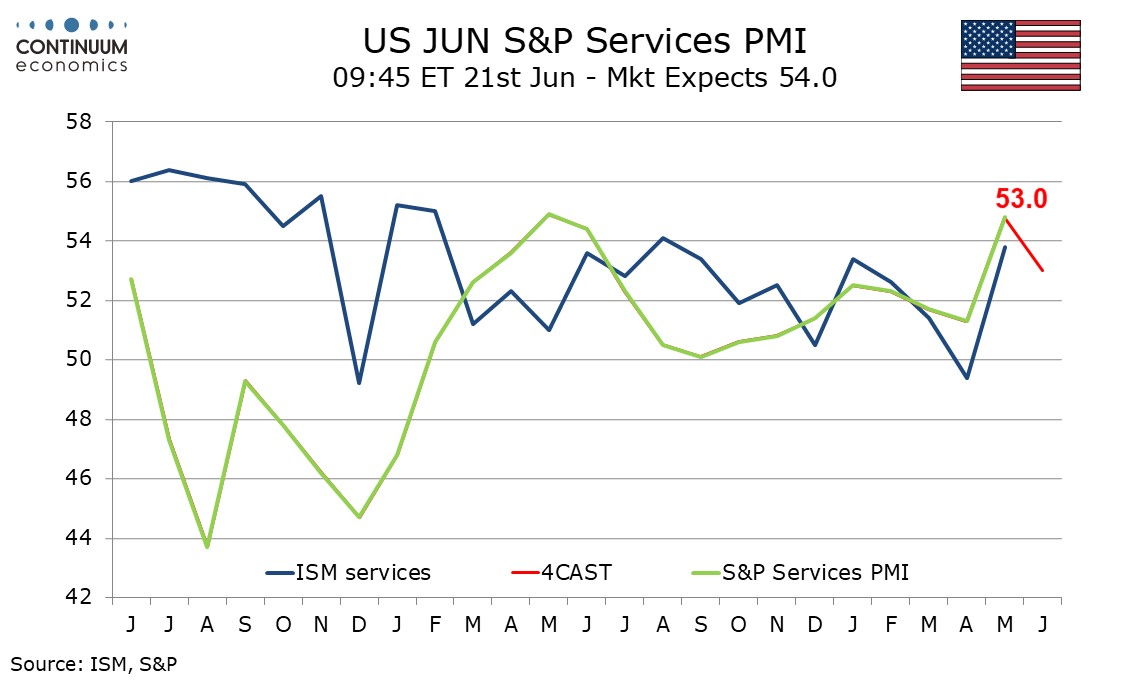

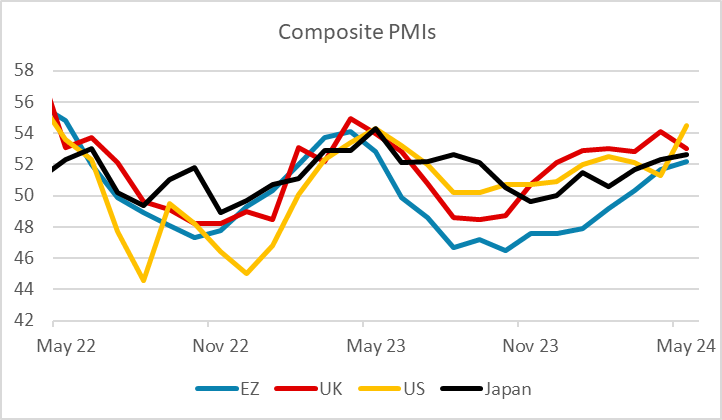

June PMI data will be the primary focus on Friday, after the unexpectedly strong rises seen in May. There is usually more focus on the European PMIs than the US PMIs, but after the sharp rise in the US PMIs in May, this may be less the case in this month’s data. In the US, we expect manufacturing to return to April’s neutral 50.0 level after bouncing to 50.9 in May. This would resume a move off the recent 19-month high of 52.2 seen in February. ISM manufacturing data in April and May has also been edging off a March move above neutral. We expect the services index to correct lower to 53.0 from a 12-month high of 54.8 seen in May. The strength of May’s bounce was difficult to explain, but it was backed by a bounce in the ISM services index and there is no strong reason to expect a sharp reversal in June. An index of 53.0 would still be stronger than the 10 months that preceded May’s bounce. The market consensus looks for a slightly smaller correction lower, so numbers in line with our forecast should mean a slightly negative USD reaction, but our forecast is still indicative of a quite solid performance, so unless the data is a lot weaker than anticipated, any USD correction lower should be modest.

In Europe, we see a small drop back in the composite having risen to a one-year high of 52.2 in May, from 51.7 in April. Overall, this indicated the apparent strongest increase in EZ economic activity since May 2023. Equally important will be whether there are more signs of easier inflationary pressures. But as with the US, numbers in line with our forecast are unlikely to significantly undermine risk sentiment.

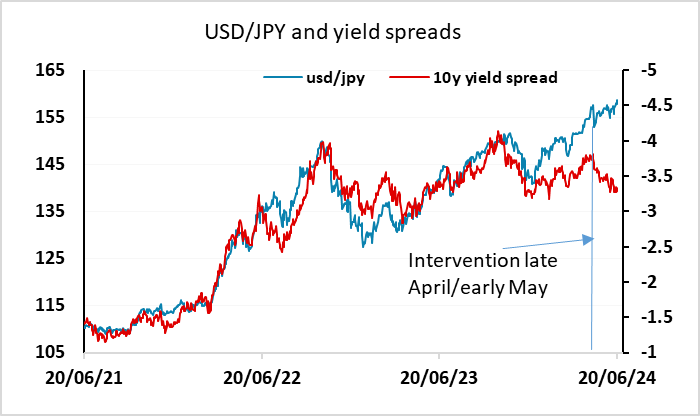

Risk sentiment stayed positive through Thursday with yields higher and European equity markets stronger, catching up with some of the recent strength in the US. In the FX market, this led to more weakness in the JPY, which hit its lowest against the USD since the first BoJ intervention on April 29. The Japanese CPI data out early on Friday may have some impact on the JPY, but it tends to be close to expectations because the Tokyo CPI data already released is generally a good guide. Still, CPI is expected to rise to 2.6% y/y, and the weakness of the JPY on Thursday must bring the prospect of BoJ intervention back into the equation. Thursday saw somewhat weaker US data across claims, the Philly Fed survey and the current account, but US yields rose anyway, which looked anomalous. Yield spreads already support JPY strength, so we might see a sharp response if the BoJ decided to intervene. But it still looks like the underlying equity market confidence needs to be shaken if the JPY downtrend is to reverse.

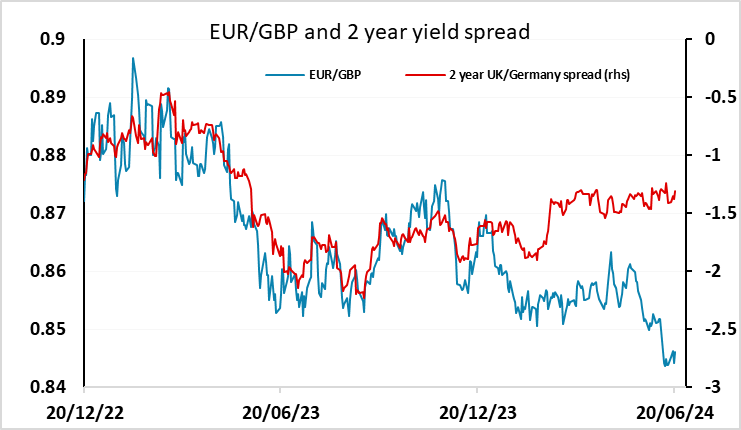

Friday also sees UK retail sales data, which is expected to record a sharp bounce in May after the unexpected 2.3% decline in April, but wet weather may hold back the recovery to some extent. There is still scope for GBP to fall back in response to the more dovish BoE tone heard from the MPC on Thursday. This boosted market expectations of an April rate cut to near a 50% chance, but there may be more to come, especially if retail sales are weak. But much of the decline in EUR/GBP in the last couple of weeks has been about the French election uncertainty, so a major recovery looks unlikely this side of the French elections on June 30/July 7.