FX Daily Strategy: N America, January 23rd

No BoJ policy change expected, so knee-jerk reaction may be JPY negative..

…but longer term outlook still JPY positive

EU bank lending survey unlikely to increase easing expectations

GBP looking a little overcooked

No BoJ policy change expected, so knee-jerk reaction may be JPY negative..

…but longer term outlook still JPY positive

EU bank lending survey unlikely to increase easing expectations

GBP looking a little overcooked

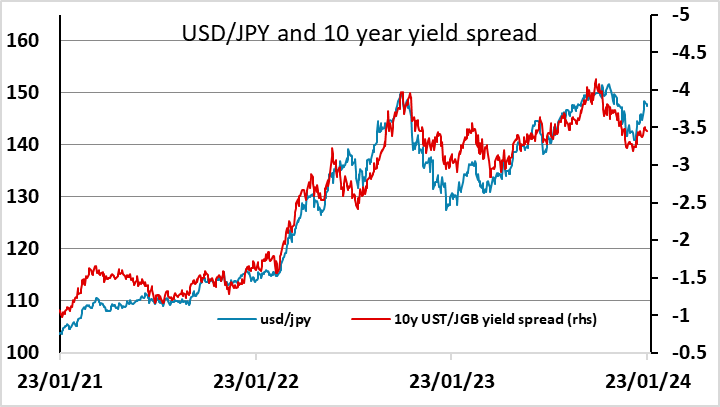

The BoJ meeting was the first item on the calendar in Tuesday. We did not expect any change in policy, with the weak wage and CPI data since the December meeting making it hard to imagine that we are going to see any more hawkish rhetoric. Even so, Ueda has indicated that a tightening of policy is on the agenda in the coming months, so the market will be on watch for any commentary, or any changes to inflation forecasts. This is even more the case since the JPY has been very weak so far this year, so much so that it triggered some jawboning from Japanese finance minister Suzuki on Friday. As expected, the BoJ meeting did not see any fireworks. There is no change to monetary policy and forward guidance with the BoJ patiently waiting for the spring wage negotiation to confirm the momentum in wage growth. Apart from monetary policy, the BoJ has revised fiscal 2024 CPI less fresh food revised lower to 2.4% from 2.8%.

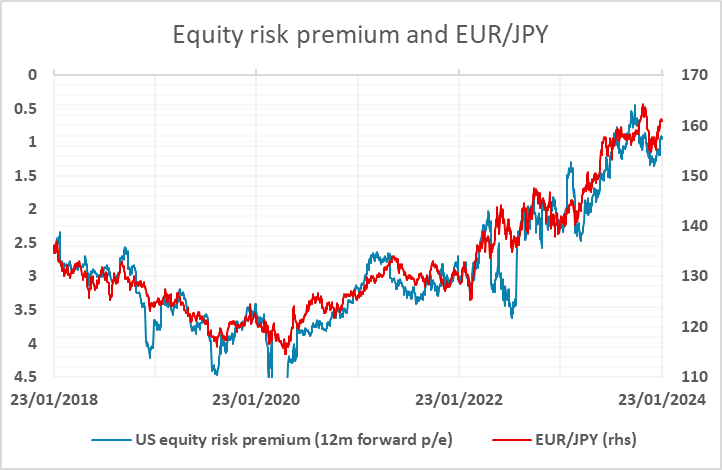

While the JPY was a little softer on the crosses through the Asian session, as the USD fell against the riskier currencies on the back of the better regional equity market performance, it rallied in early Europe and now stands better on the day across the board. At the same time, JPY crosses continue to benefit from low levels of US equity risk premia, helped by new highs in US equity indices in the face of rising yields. EUR/JPY continues to correlate well with this metric – much better than with yield spreads, which are already consistent with a much lower EUR/JPY. But in a subdued growth environment with the US close to full employment, it’s hard to make a case for the current high US equity valuation. Longer term risks should therefore be on the JPY upside, but for the moment we lack a trigger for a JPY recovery.

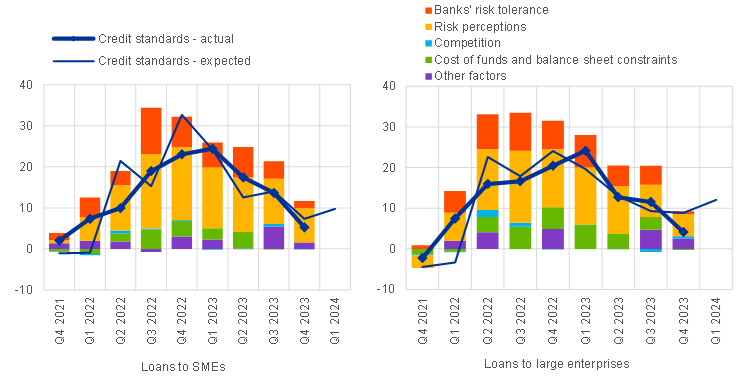

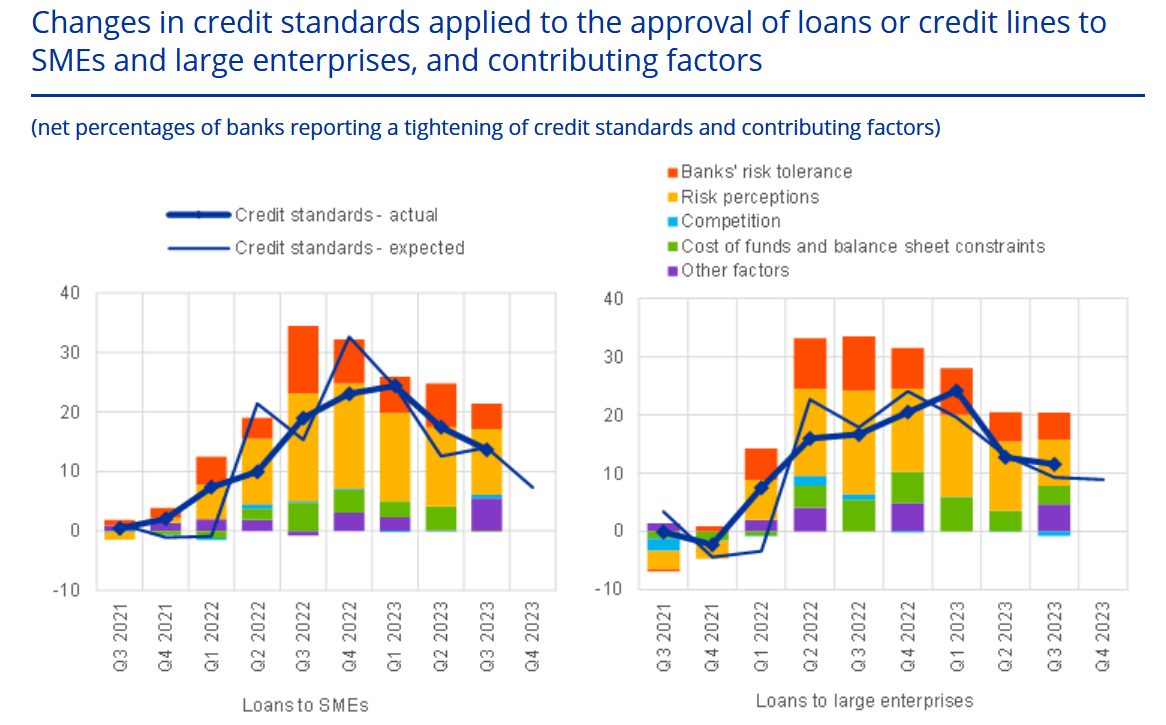

Changes in credit standards applied to the approval of loans or credit lines to SMEs and large enterprises, and contributing factors

(net percentages of banks reporting a tightening of credit standards and contributing factors)

The ECB Q4 bank lending survey showed a continuation of recent trends, with further tightening of credit standards and further declines in demand for loans, but the tightening and declines were happening at a steadily reduced rate. While it is important to realise that the effect of the tightening is cumulative, as is the decline in demand, there will be some comfort taken from the expectation that on current trends the tightening of standards and the decline in demand will be coming close to an end on Q1 2024.

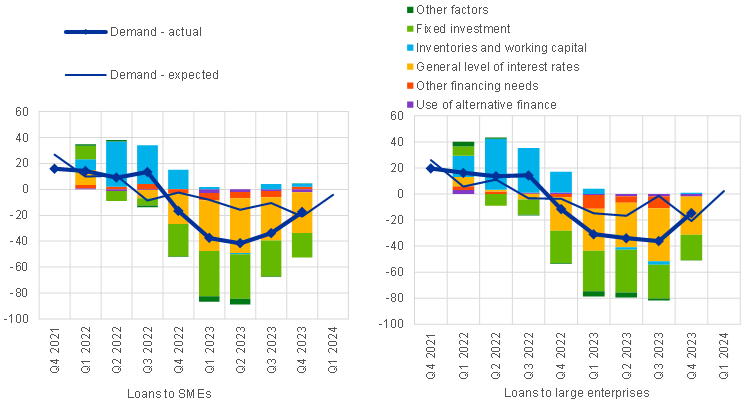

Changes in demand for loans or credit lines to SMEs and large enterprises, and contributing factors

(net percentages of banks reporting an increase in demand, and contributing factors)

Even so, negative headlines about further tightening in credit standards and further declines in loan demand, and the fact that the tightening was larger than expected, have pushed EUR/USD a little lower, although there has been no significant decline in Eurozone yields in response. We doubt today’s survey will change any minds at the ECB, where the inclination is still to look at the first cut coming in the summer and not as early as April, which is currently 70% priced for a cut by the market. This suggests some mild upside risks for front end EUR yields, and consequently for the EUR, although the EUR direction is currently being more affected by the equity market tone, and this will continue to be an important factor.

Changes in demand for loans or credit lines to SMEs and large enterprises, and contributing factors

(net percentages of banks reporting an increase in demand, and contributing factors)

EU Q3 bank lending survey

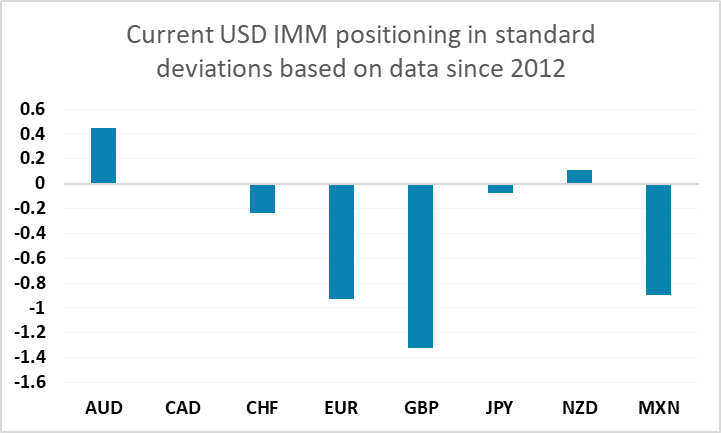

However, from an FX perspective the focus is likely to be very much on equity markets, after the S&P500 made a new all time high once again on Monday, dragging European markets with it, and Chinese equities rallied overnight, pulling the USD generally lower. While we have seen some weaker equity indices through teh European morning, momentum in US equities is clearly positive, and technical analysts are calling for further gains. This not only puts downward pressure on the JPY, but also tends to support the riskier currencies against the USD. Of these, GBP may now be one of the more extended, with the CFTC data showing rising long positioning, and last week’s retail sales data serving as a warning that reports of the UK’s recovery may be overly optimistic.