FX Daily Strategy: N America, May 20th

AUD dips on RBA rate cut, but holds support

CAD continues to hold firm relative to yield moves

General USD underperformance similar to first Trump presidency

AUD dips on RBA rate cut, but holds support

CAD continues to hold firm relative to yield moves

General USD underperformance similar to first Trump presidency

Tuesday is another quiet US calendar, with the highlights elsewhere being the RBA meeting and the Canadian CPI data.

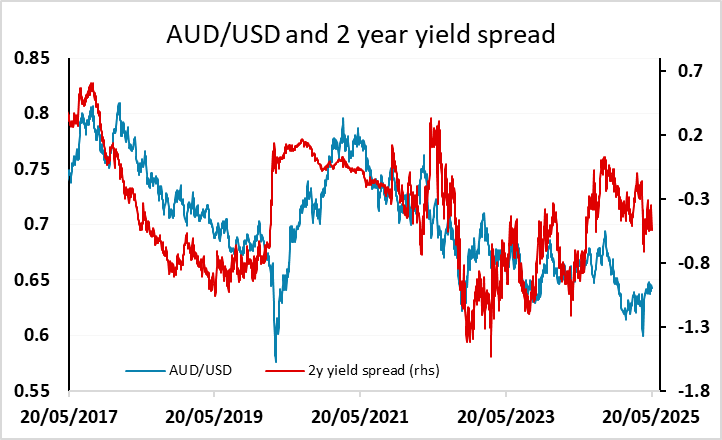

AUD fell back overnight after what was seen as a dovish rate cut from the RBA. They cut 25bps as expected, but admitted a 50bp cut was discussed, though not seen as a serious proposition, and the market has moved from projecting a further 50bps of easing this year to a further 65bps. The AUD fell back around 0.5% after the announcement, but hasn’t really threatened the key support area around 0.6400. The AUD already has substantial support from yield spreads, having underperformed the usual correlation over the last year, so should still hold the support area near 0.6400 as long as general risk sentiment holds up.

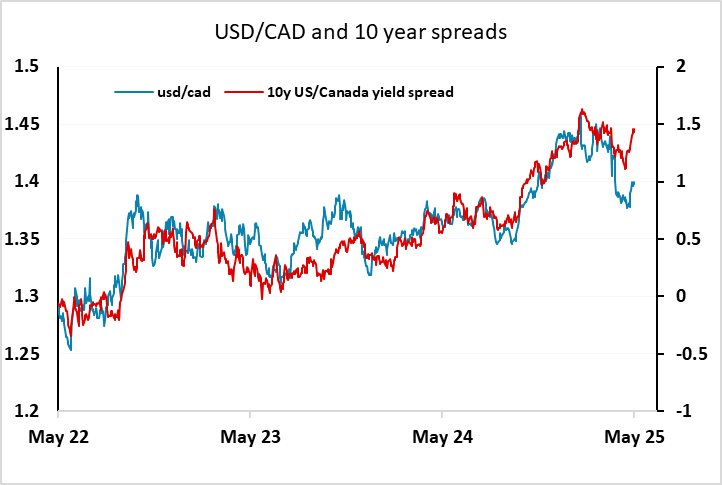

We expect April Canadian CPI to fall to 1.6% yr/yr from 2.3% with the fall entirely due to the April 1 removal of a carbon tax which the Bank of Canada estimates will reduce inflation by 0.7%, largely in gasoline. We expect the Bank of Canada’s core rates to be unchanged from March. Our forecasts are in line with the market consensus, although the consensus does see some modest risk of slightly firmer core rates in the common and trimmed CPI. The CAD has somewhat outperformed its normal relationship with yield spreads since the tariff announcement, in line with the generally weaker USD tone, so wouldn’t expect a significant reaction to the CPI data. As long as the USD continues to trade generally weak relative to yield spread movements, USD/CAD should continue to hold below 1.40.

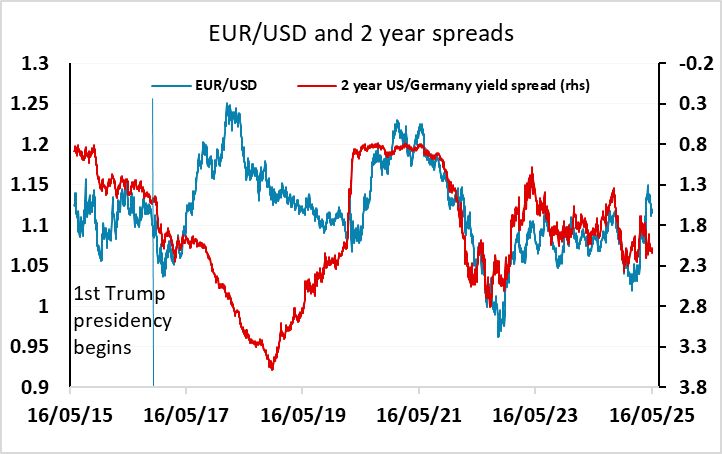

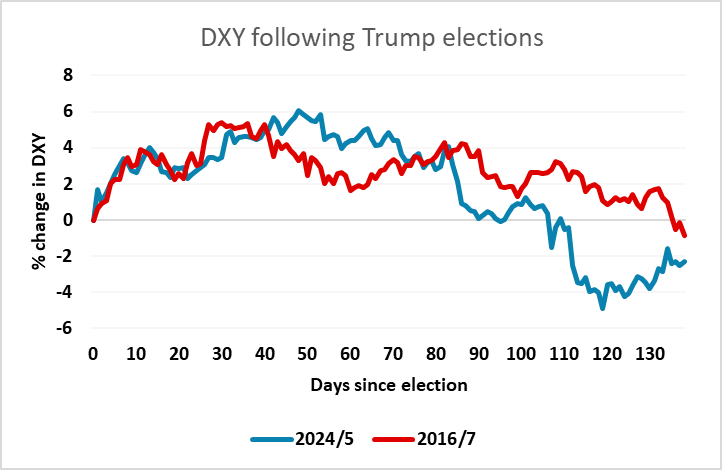

The USD decline in response to the Moody’s downgrade was perhaps a little larger than might have been expected, given that it wasn’t a major surprise as it just brings the Moody’s rating in line with S&P and Fitch, who has already acted. But it is another example of USD underperformance relative to the yield spreads relationship that has dominated in recent years, suggesting some fundamental loss of confidence or some introduction of a risk premium. It’s similar to the way the USD behaved in the first Trump presidency, when it significantly underperformed yield spreads in 2017 after an initial rally. Then, the USD weakness lasted into 2018, and the first presidency was much milder in terms of policy action, so at this stage it seems USD underperformance may well continue, even if the usual drivers move in its favour.