FX Daily Strategy: Europe, March 1st

Eurozone HICP has little market impact

JPY strength can extend a little further…

…but rise in risk premia needed to trigger a larger recovery

UoM inflation expectations the most likely market moving US data

EEurozone HICP has little market impact

JPY strength can extend a little further…

…but rise in risk premia needed to trigger a larger recovery

UoM inflation expectations the most likely market moving US data

Eurozone HICP came in 0.1% above market consensus due to the higher than expected French HICP released yesterday, but there was no market impact with this being expected after yesterday's data. There was more impact from the US data on Thursday, which triggered a general decline in yields in the US and Europe, leading to general strength in the JPY. This was helped by the earlier comments from the BoJ’s Takata indicating that the spring wage round was likely to deliver significant wage rises above the 2023 pace, paving the way for BoJ tightening via a rise in the deposit rate and/or an abandonment of YCC. However, JPY strength has been largely reversed overnight after some comments from Ueda which were seen as slightly rowing back on Takata's comments.

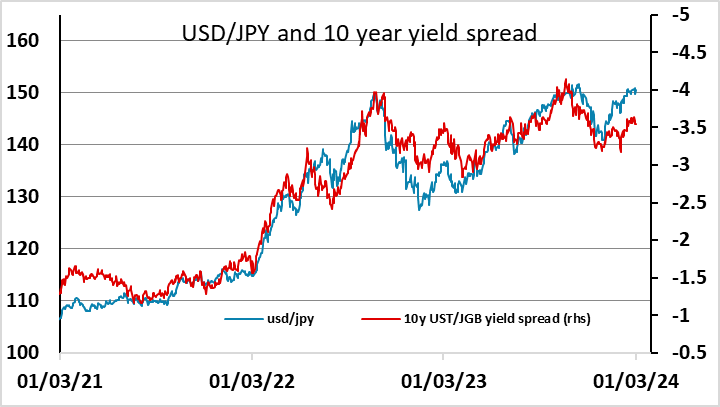

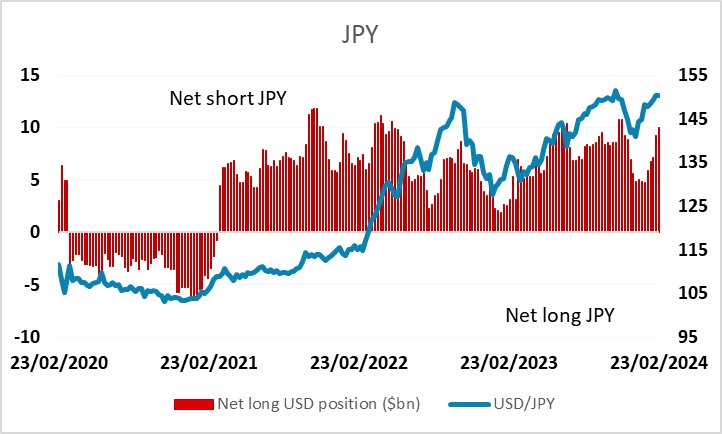

The JPY is likely to remain the focus on Friday, as it looks to have the most potential to move. As it stands, USD/JPY is still trading on the high side relative to the nominal yield spread correlation that has dominated the market in the last few years. Some of the JPY weakness we have seen relative to this spread this year reflects concern about the weakness of Japanese data and worries that the BoJ may consequently delay tightening beyond the spring, while there has also been a steady rise in yields in the US and Europe, mainly on the back of stronger than expected US data. There is some scope for USD/JPY to fall further even without any extension of the decline in US and European yields seen on Thursday, helped by sentiment following the Takata comments and by positioning, with net speculative long USD/JPY positions having been built up in recent weeks according to the CFTC data.

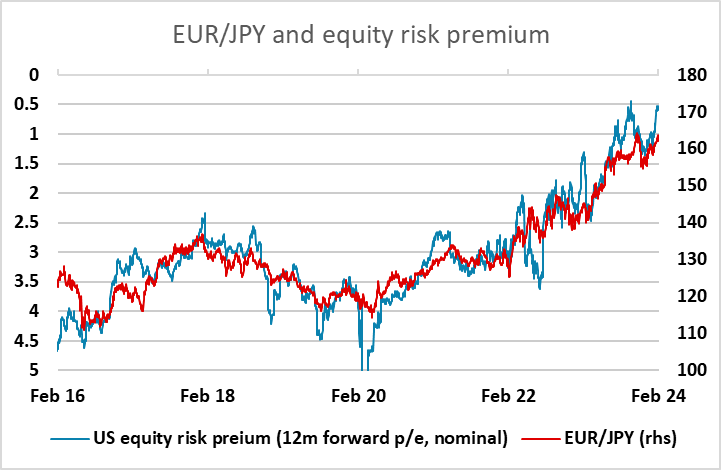

CFTC net long speculative positioning

However, the US data on Thursday didn’t really justify any significant change in view on the US. The PCE price data was in line with expectations, and at 0.4% m/m above the level that the Fed will be comfortable with. The market reaction may have related more to the rise in the initial claims numbers, but this was a modest rise and followed a bigger decline in the previous week. Other numbers were mixed, with strong personal income data and weak Chicago PMI and pending home sales, but there was nothing that provided justification for a significant further decline in US yields. While we still see potential for a big JPY recovery over the year, it is likely to require a turn in risk sentiment to trigger a more substantial JPY move. For now, the low level of US equity risk premia continue to indicate a positive market risk tone, and remains highly correlated with JPY weakness on the crosses.

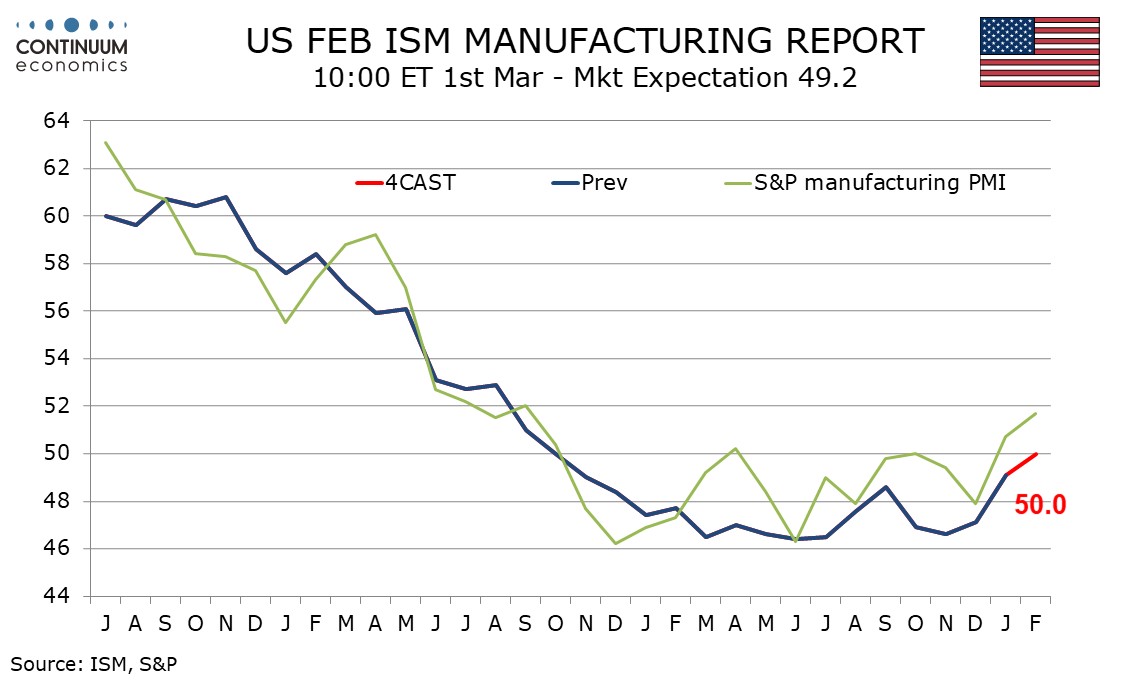

Otherwise, Friday sees US manufacturing ISM and the University of Michigan survey. While these represent the best chance of market moving data, we doubt there will be a major reaction to either. The ISM survey is usually well forecast by the PMI survey, and the University of Michigan survey will primarily be interesting for any news on inflation expectations. If this shows a significant move, it might move the USD.