FX Daily Strategy: N America, January 24th

JPY gains on BoJ rate hike and hawkish tone

Trump says he would rather not raise tariffs on China

EUR up on stronger PMIs and Trump comments

JPY gains on BoJ rate hike and hawkish tone

Trump says he would rather not raise tariffs on China

EUR up on stronger PMIs and Trump comments

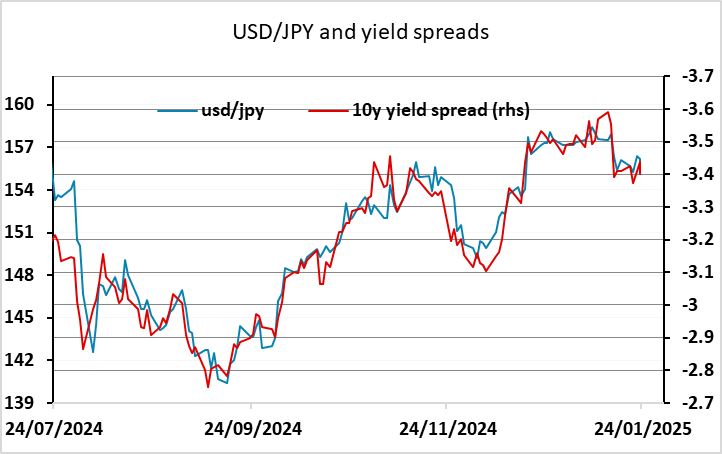

The BoJ hiked 25bps as expected but the market has also taken the statement as hawkish, with USD/JPY around half a figure lower since the announcement, having initially fallen a big figure. However, the JPY is not much changed on the crosses as the USD is generally weaker overnight, having lost ground to the risky currencies early in the Asian session on Trump comments saying he would rather not impose tariffs on China following a conversation with Chinse premier Xi. The USD is therefore generally up to 0.5% lower. However, the reaction to the Trump comments may be overdone, as he could easily reverse his position tomorrow. It seems unlikely he will reverse his tariff strategy on the basis of one conversation.

For the rest of the day the market will be alert to further Trump comments on tariffs as well as the PMI data starting at 0815 GMT in Europe. After the BoJ decision we would tend to favour the JPY with scope for a move back to 155, while USD losses elsewhere are less reliable given the potential for Trump to change his tone.

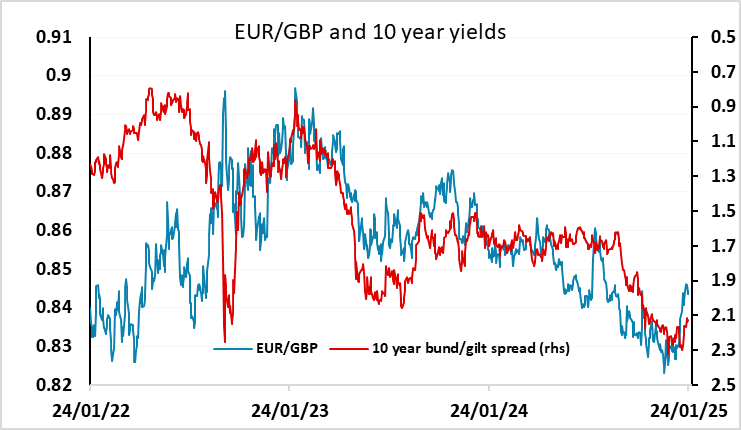

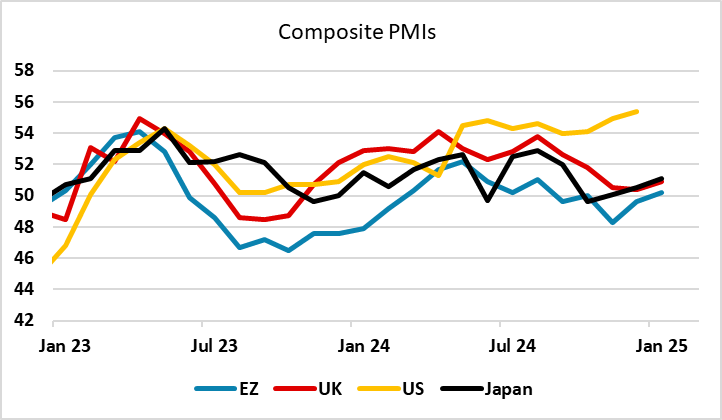

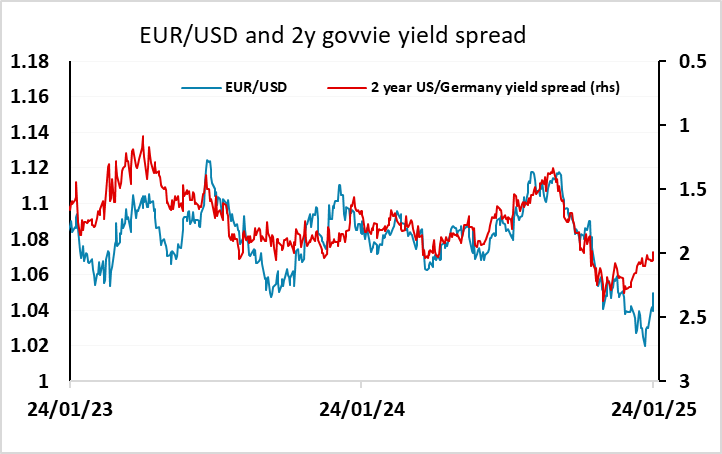

Eurozone PMIs were stronger than expected in January, with German services and manufacturing both stronger and French manufacturing bouncing strongly. UK PMIs show similar strength to the Eurozone PMIs, but we are more wary of the UK data as the correlation with GDP data has been much weaker. The Eurozone data has boosted the EUR to its highest since September against the USD and CHF, coming on the back of Trump's more conciliatory comments on China tariffs overnight, and GBP has broadly kep pace.

The stronger PMI data has helped a general risk positive tone that has meant European yields have edged a bit higher while equities are also continuing to make gains. While there is value in European equities if we see positive growth momentum developing, we would still be wary of the risk positive market tone inasmuch as it is based on a more positive view of Trump tariff policies, as we are likely to see plenty of volatility in Trump’s statements in the coming weeks. We also remain concerned that US equity valuation remains extremely high, limiting upside for global equities. But for now the USD looks likely to remain under pressure against the riskier currencies, at least until or unless Trump makes a statement favouring tariffs.