USD, CAD, EUR, JPY flows: USD recovers as JPY corrects lower

USD recovering modestly in moe neutral risk environment. EUR/JPY back in line with the historic risk premium correlation

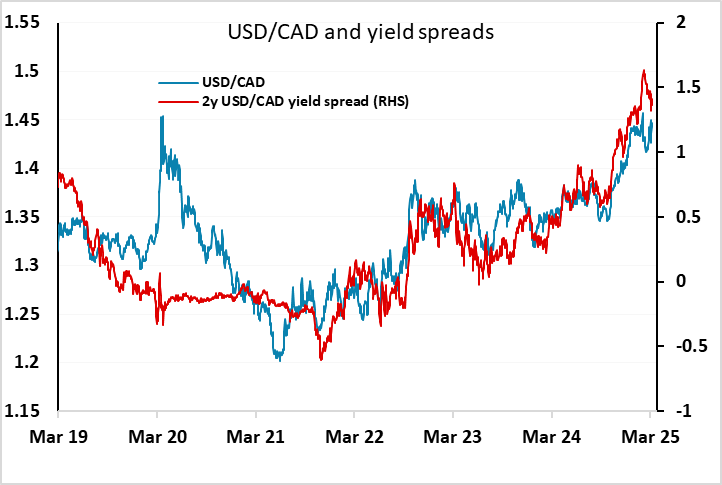

It’s a quiet Wednesday calendar in Europe ahead of the US CPI data later. Overnight we have seen some JPY weakness in a general mild risk recovery which started in the US afternoon, while the USD has also managed some general modest gains in the Asian session. As we note in today’s daily, the risks here look to be towards higher rather than lower US yields with more than three Fed rate cuts priced in for the year, and with the BoC likely to cut rates this afternoon against the background of the US tariff increases on Canada, USD/CAD in particular looks biased to the upside.

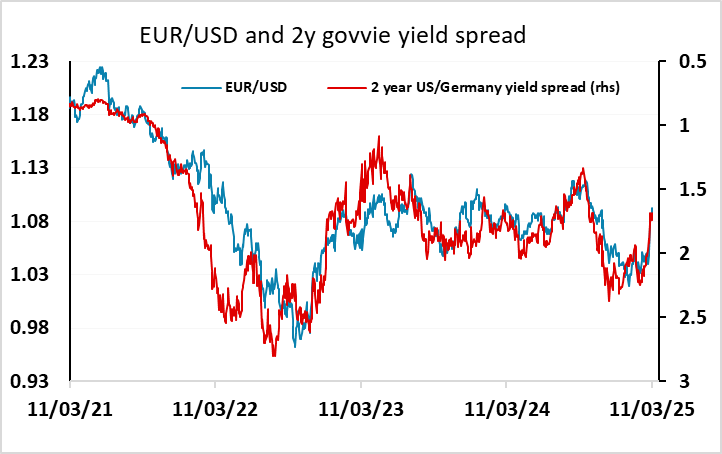

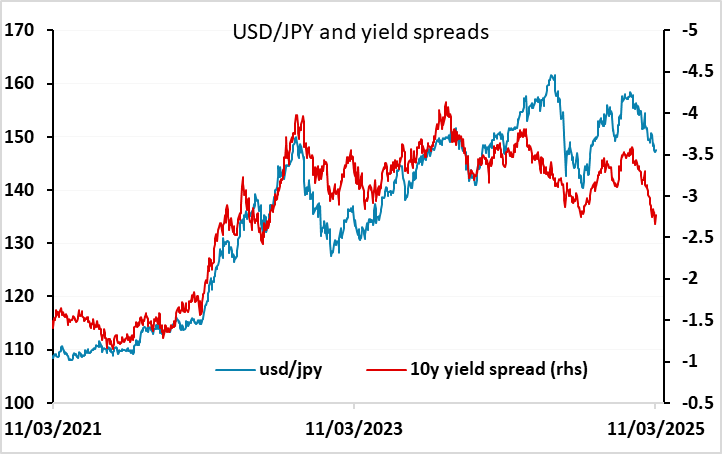

Otherwise, we still see downside risks in USD/JPY with yield spreads pointing substantially lower. For EUR/USD, it will be hard to break above 1.10 without some evidence of real improvement in the Eurozone economy. The market is assuming a better performance on the back of increased defence and infrastructure spending, but there is currently no momentum and until or unless there is the recent EUR/USD gains may stall. Even so, there still doesn’t look to be a lot of downside unless US yields rise from here.

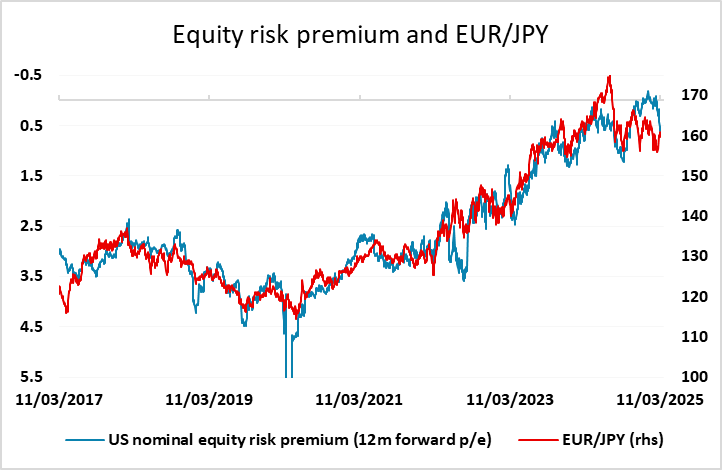

One notable aspect of recent trading is the recovery in EUR/JPY which has come at the same time as equity risk premia in the US gave been rising. This goes against the usual negative correlation, but has brought EUR/JPY back into line with the correlation with risk premia that has persisted for the last 8 years. From here, the JPY looks likely to benefit from any further decline in in risk sentiment.