FX Daily Strategy: Europe, January 24th

BoJ and PMIs the main focus on Friday

Scope for JPY gains on more hawkish BoJ rhetoric

EUR likely the most sensitive to PMIs

BoJ and PMIs the main focus on Friday

Scope for JPY gains on more hawkish BoJ rhetoric

EUR likely the most sensitive to PMIs

Friday’s calendar could be the most significant of the week, with the BoJ meeting and the preliminary PMI data for January.

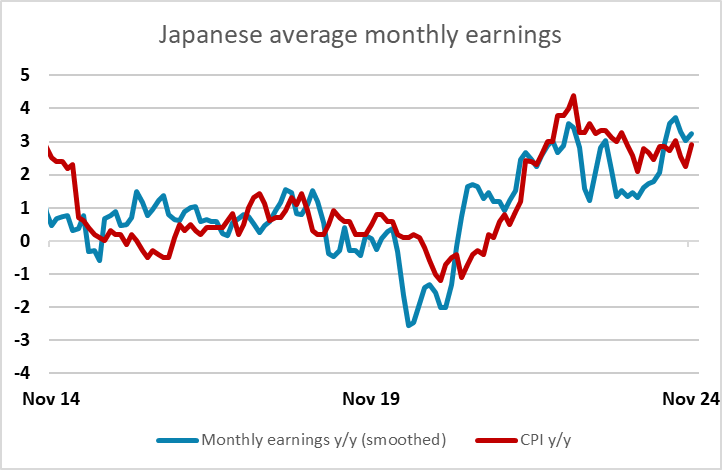

The BoJ meeting has the most potential to move markets, but with a 25bp hike now 95% priced in, the interest will be more in what the BoJ has to say than what they do. Although the BoJ has surprised markets in the past, it seems unlikely that they would have allowed a hike to be fully priced in without some sort of protest. While a 25bp hike is nearly fully priced, there is only one more hike priced in for the year, and one in the subsequent year. This falls short of the BoJ’s declared strategy of bringing rates to at least 1% as seems sensible if inflation holds at 2% as planned. At this stage, markets are sceptical that the BoJ will be able to maintain inflation at the higher level, but with wage growth running at 3% and further wage hikes expected in the spring wage round, the current pricing looks to be on the dovish side.

The BoJ hiked by 25bps to 0.5% in the January meeting by an 8-1 vote. The only dissent, Nakamura, is favoring a hike in February. The BoJ cited the alignment of economics development and wage growth with forecast to support their rationale of the rate hike. They also revised ex fresh food CPI inflation higher for 2024 to 2.7% (0.2% higher) and 2025 to 2.4% (0.5% higher) as import prices will be more expensive due to weak Yen. Market participants are viewing the January hike to be hawkish as forecast open the path for more tightening but we are viewing such with a pint of salt.

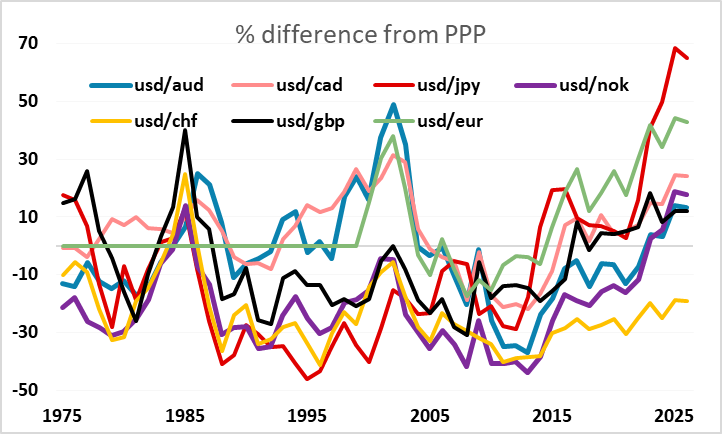

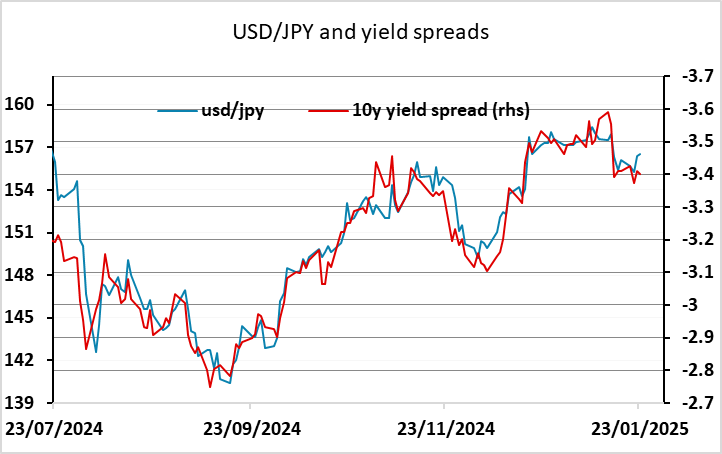

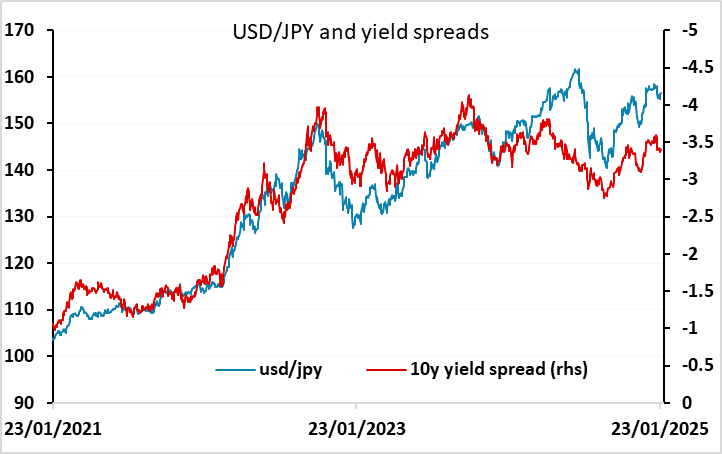

The interest will therefore be on what sort of guidance Ueda provides about future policy. We see some risks on the hawkish side which ought to be JPY positive. However, the JPY has moved very much with the 10 year US/Japan yield spread in recent times, so policy on JGBs and the longer end of the curve will also be important. We very much favour the JPY upside medium term, primarily for valuation reasons, as the JPY remains close the weakest level relative to PPP against the USD that it has ever been, and the weakest on this measure that any G10 currency has ever been. But even on a nominal spread basis the JPY has shifted to a weaker path in the last 6 months and has potential to revert to the behaviour of the previous few years which would suggest scope to move below 150.

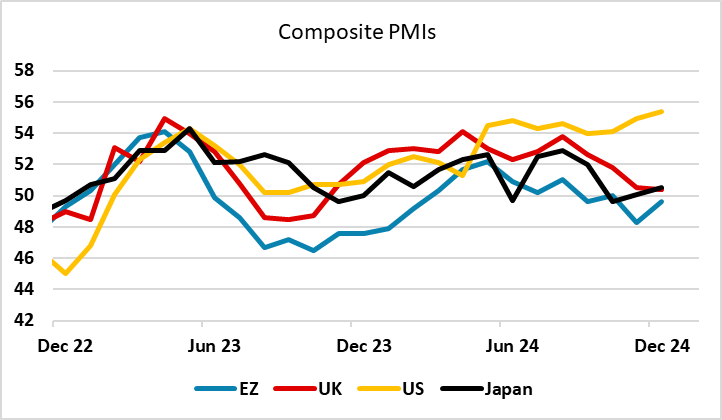

The PMI data will also be a focus, particularly in Europe, where recent data have suggested that the European economies are teetering on the brink of recession. The Eurozone data is seen as one of the best contemporaneous measures of GDP, and any weakness could lead to expectations of an easier ECB policy stance. EUR front end yields have edged up in recent weeks, with less than 100bps of easing now priced for the next couple of years, in part because of rising yields in the US, in part because of some sticky inflation data. But if we see evidence of weakness, this could lead to some more aggressive easing being priced in and a weaker EUR. While yield spreads still appear to be supportive for EUR/USD, any weakness in Eurozone data would hit the EUR both via yields and via a negative impact on equities. Conversely, an extension of the December recovery could give the EUR a boost.

There is also interest in the UK and US PMI data, but less so. The UK data in particular is a poor guide to UK growth, while the US data has never quite surpassed the ISM survey in significance. The market may nevertheless take more notice of the UK data than it should, given a high degree of uncertainty about UK growth and BoE policy. We continue to see GBP risks on the downside.