USD, EUR, CHF, JPY flows: More tariffs may impact EUR and CHF

New Trump tariffs may impact EUR and CHF. JPY still weak

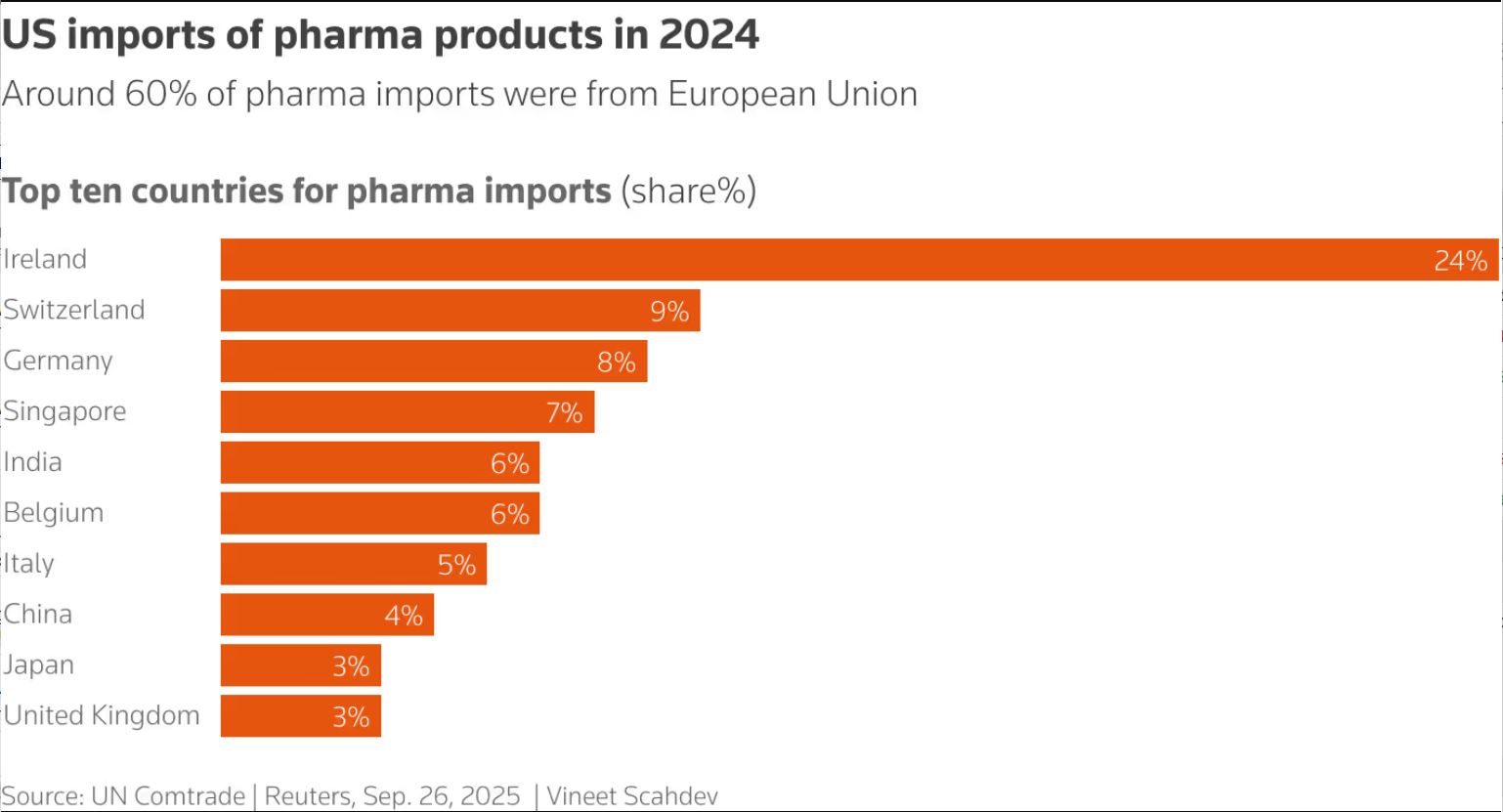

A fairly bare calendar in Europe today suggests something of a drift into the weekend, although there may be some impact from the latest tariff announcement from Trump, which includes a 100% tariff on pharmaceuticals. While trade deals with Japan, the EU, and the UK include provisions that cap tariffs for specific products like pharmaceuticals, the importance of pharma exports for the EU and Switzerland could nevertheless mean the EUR and CHF suffer. But the tariff announcement could also take the edge off USD strength as there are likely to be concerns about price rises undermining real growth, although the impact is likely to be delayed due to stockpiling of products in the first half of the year in anticipation.

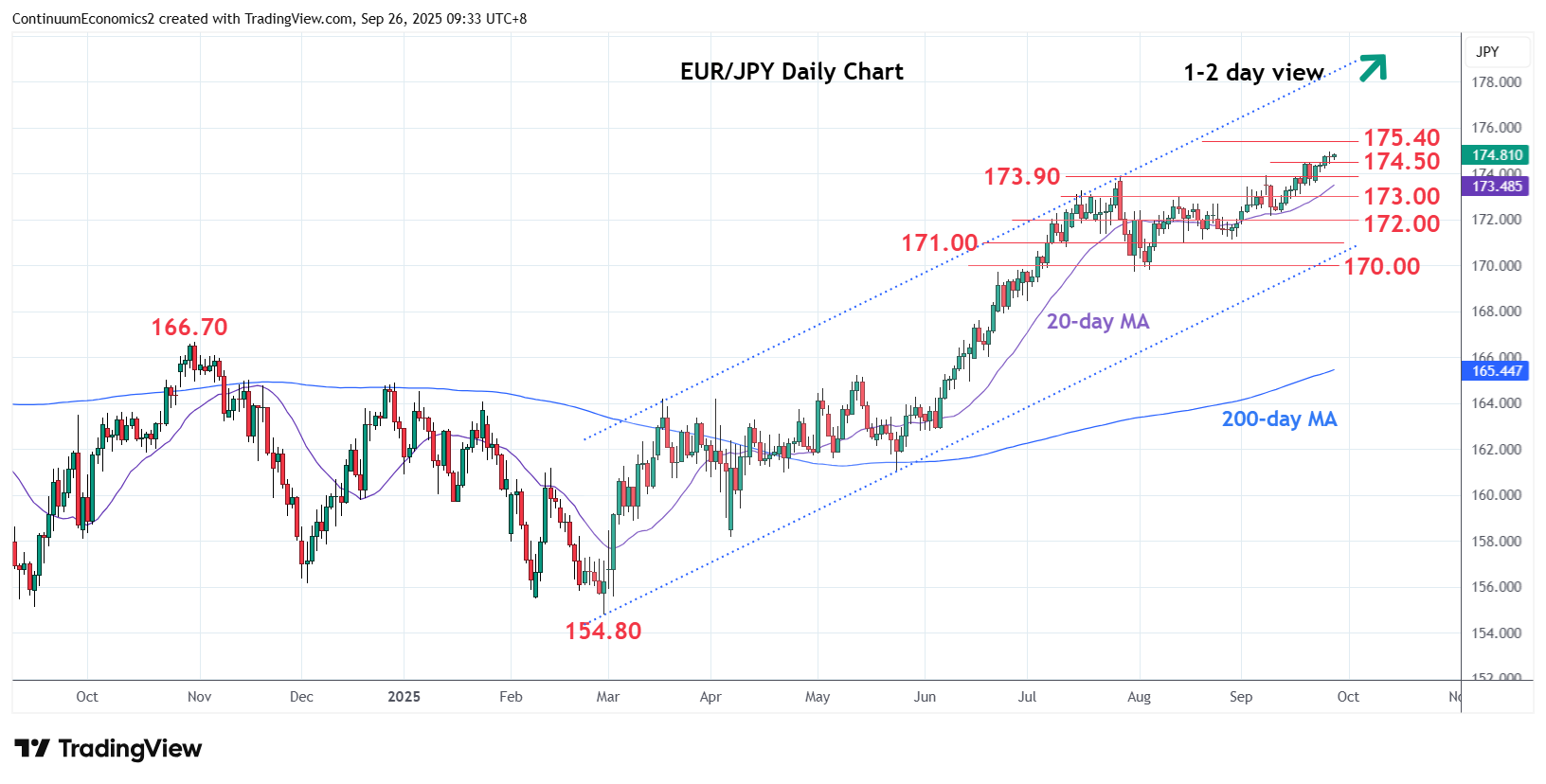

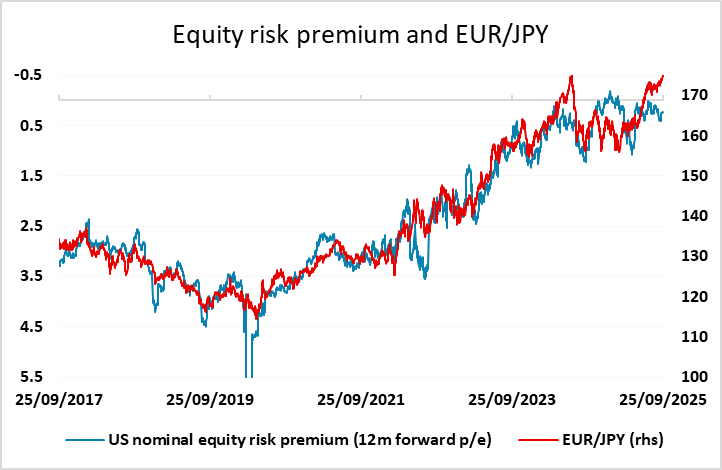

Overnight, weaker than expected Japanese Tokyo CPI data didn’t have much impact on markets, but may slightly reduce the chance of an October rate hike from the BoJ. The JPY remains weak, with EUR/JPY continuing to creep up on the all time high of 175.42 and CHF/JPY making yet another all time high overnight, but the USD remains generally firm after the unexpected upward revision to Q2 GDP seen yesterday.