NOK flows: NOK edges higher after CPI

Norway CPI mildly stronger than expected, suggesting scope for NOK gains

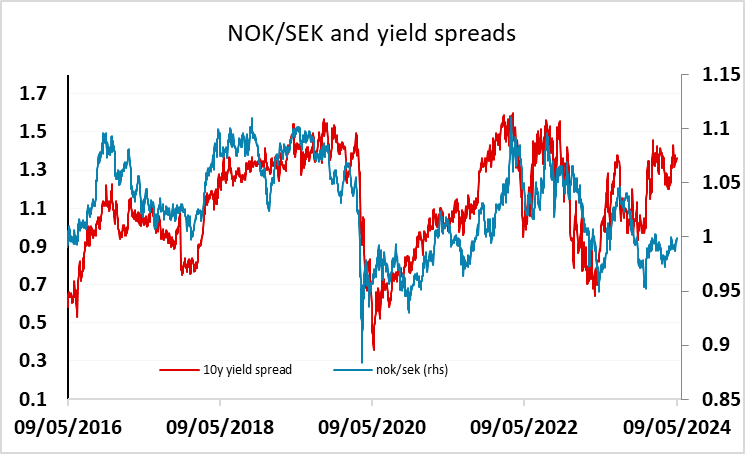

Norway CPI has come in slightly stronger than expected at 4.4% y/y for the core, and the NOK has risen slightly in response, with EUR/NOK down around 2 figures to 11.68. EUR/NOK still looks too high, and NOK/SEK too low, relative yield spreads, and at just around 3% below the all time high just above 12 (excluding the pandemic spike), it is hard to see a rationale for the current NOK weakness.

From a longer term perspective, the NOK has always traded on the strong side relative to PPP, as it typical of currencies of countries with large and persistent current account surpluses, so to that extent even current levels can’t be seen as “cheap”. The NOK weakness may therefore be part of a more general trend for a decline in this historic premium for surplus currencies. If so, there may be scope for the CHF in particular to decline from current high levels. However, with yield spreads still generally the dominant driver of most DM currencies, we still see upside risks for the NOK helped by the relatively hawkish Norges Bank stance.