FX Daily Strategy: N America, Oct 23rd

EUR edges up after better French data

AUD edges higher after solid confidence data

JPY gets little encouragement from new finance minister Katayama

GBP looking more vulnerable after weaker UK CPI

EUR edges up after better French data

AUD edges higher after solid confidence data

JPY gets little encouragement from new finance minister Katayama

GBP looking more vulnerable after weaker UK CPI

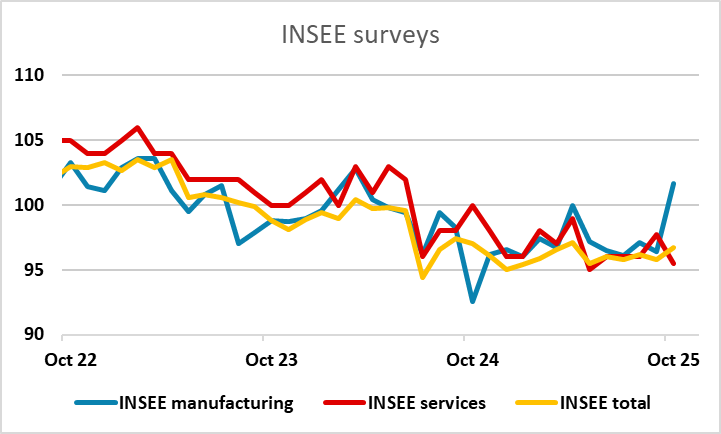

The French INSEE survey has shown a strong improvement in manufacturing in October, although the general business situation remains relatively weak. There has been a slight EUR recovery in reaction to the data, and the better manufacturing tone should be seen as mildly supportive given the recent wobbles due to concerns about the French fiscal and political situation. However, the data looks a little out of line with other surveys, and with services and the total business situation still in the doldrums, an extended reaction should not be expected.

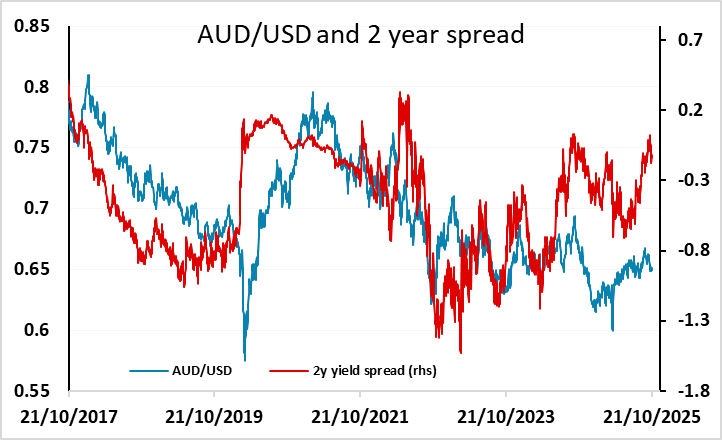

For the AUD, the quarterly business confidence numbers provided some support to the AUD which has slipped a little since Trump’s announcement of tariffs on China. The evidence from the domestic economy has still generally been supportive, and AUD/USD has surfaced back above 0.65. However, some resolution to the China tariff question is likely to be necessary if the AUD is to move back towards the top of the year’s range.

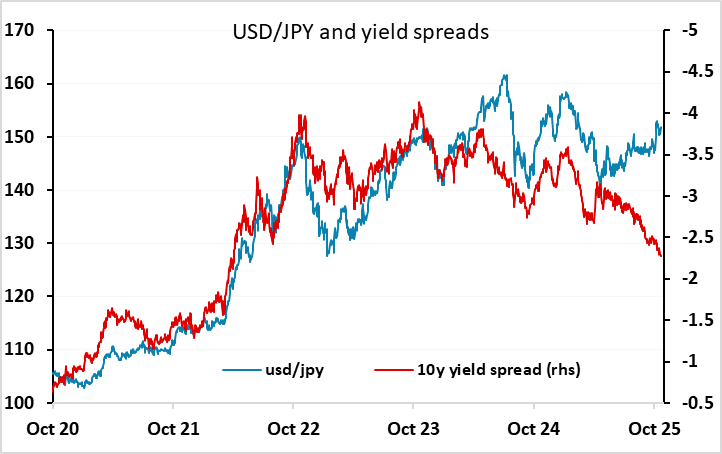

USD/JPY didn’t do a great deal on Wednesday, despite comments from new finance minister Katayama. She avoided making any comment about FX rates, and this is significant since the previous finance minister Kato had protested the recent weakness of the JPY. This suggests there is no immediate threat of intervention, any may embolden the JPY bears. She also said that monetary and fiscal policy needed to be co-ordinated and that Japan hadn’t fully exited deflation, which sounds like a preference for monetary policy to be left on hold near term. While she said the specifics of monetary policy were up to the BoJ, an October rate hike might be seen as unwelcome. Of course, that doesn’t mean it can’t happen, but the BoJ may prefer to wait for the specifics of her supplementary budget before acting again. All in all, her comments look slightly JPY negative, inasmuch as policies to strengthen the JPY look unlikely to be implemented. But JPY weakness already looks very overdone given current yield spreads and risk premia, so we still don’t favour JPY downside.

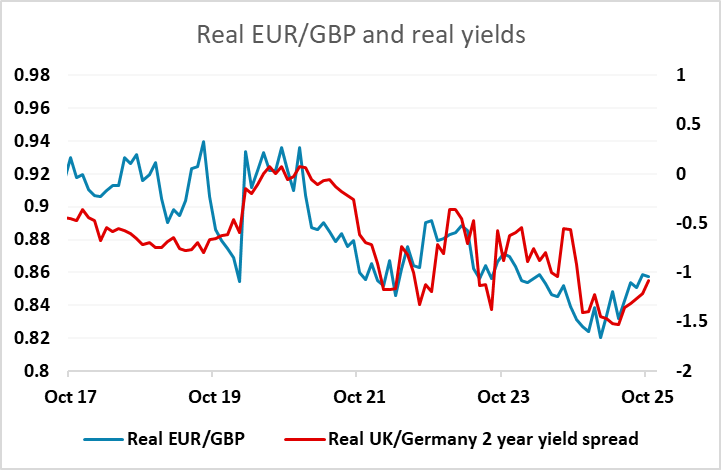

Although we saw GBP decline after the UK CPI data on Wednesday, the decline was largely reversed by the end of European trading on Wednesday, even though the chances of a BoE rate cut in November were seen to have risen significantly, with the market now pricing it as 40% chance from 15% ahead of the data. We still see the next cut as more likely to come in December after the MPC have seen Chancellor Reeves’ budget, but the resilience of GBP looks a little complacent. The inflationary problems in the UK do look to be diminishing, and there is little good rationale for real UK rates to be above Eurozone rates in the longer run. So the medium term risks or EUR/GBP are on the upside, and we would expect some upward pressure to be maintained as we head towards the November MPC meeting.