FX Daily Strategy: APAC, September 27th

Tokyo CPI unlikely to halt JPY weakness

European data may start to undermine EUR

US PCE prices should be in line with consensus…

…but strong US data may start to favour the USD

Tokyo CPI unlikely to halt JPY weakness

European data may start to undermine EUR

US PCE prices should be in line with consensus…

…but strong US data may start to favour the USD

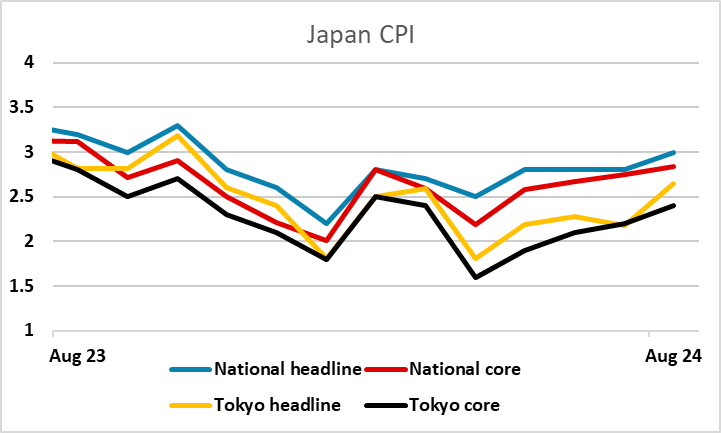

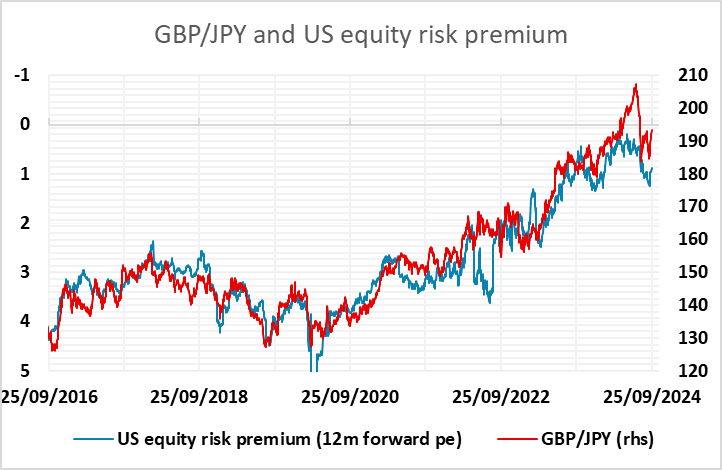

Inflation data dominates on Friday. We start with Tokyo CPI for September – usually a good indication of the outcome for national CPI. The market consensus is for a drop in core CPI to 2.0% from 2.4%, breaking the recent uptrend. At the post-BoJ press conference governor Ueda focused on the October CPI data as important for policy rather than the September data, so the likely drop this month may not be too significant. However, the JPY has been very much on the back foot for the last couple of weeks, ever since the Fed eased, and evidence of weakening inflation will tend to play to this trend. Having said this, the 9 consecutive days of JPY declines against GBP and CHF underline that the move is getting stretched, and we would be wary of a correction, especially since we are coming into the end of the week. But unless we see inflation data come in above consensus, a significant turn is unlikely if general risk appetite remains positive.

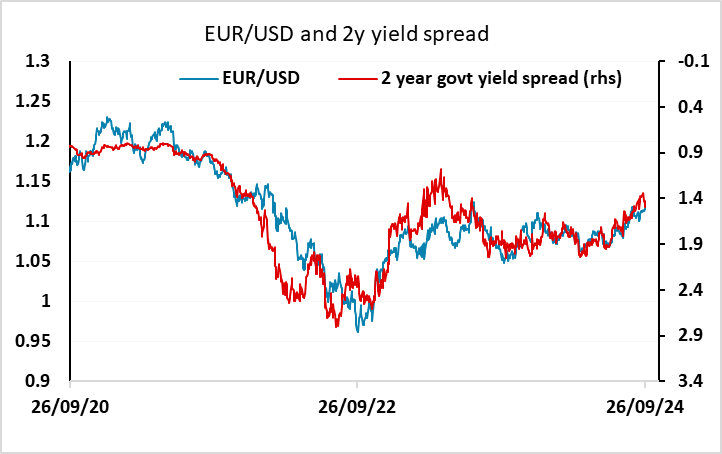

Following the Japanese data, we have preliminary French and Spanish inflation numbers for September. These are also expected to produce significant declines in y/y inflation, with both expected to see headline inflation rates sink below 2% y/y. As it stands, the market is pricing a 72% chance of an ECB rate cut in October, with front end yields dipping a little lower on Wednesday on speculation of an October move. Such hopes may dissipate if the French and Spanish numbers fail to show the expected dip. However, the decline in Eurozone yields this week, and the rise in US yields, has already brought spreads down to levels that no longer suggest scope for EUR/USD gains. We also have the European Commission survey, which may garner more attention after the weaker PMIs earlier in the week. The business climate index has been on a steady downtrend all year, and any further decline would likely increase expectations of an October ECB ease. Stronger CPI data may now be necessary to prevent EUR/USD dipping back to test 1.11.

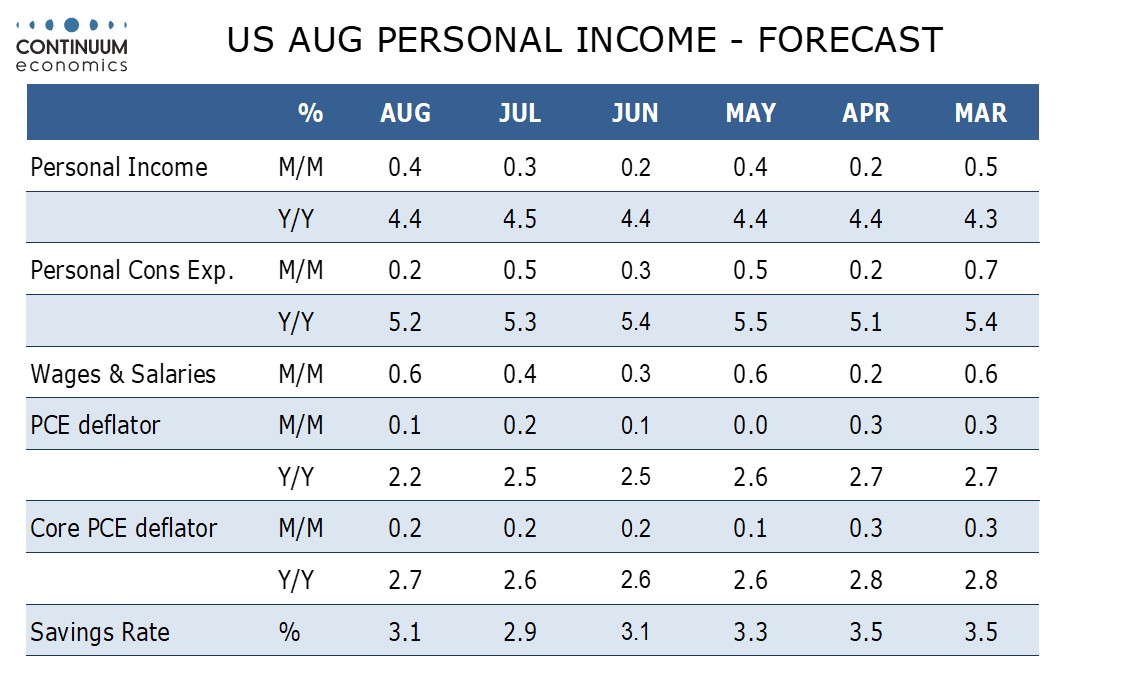

In the US, there is the core PCE price index for August – the Fed’s targeted measure and consequently important, although CPI does tend to provide a strong lead so there is unlikely to be a major surprise. We expect August core PCE prices to rise by 0.2%, a little softer than the 0.3% core CPI which rose by 0.28% before rounding. We also expect personal income with a 0.4% rise to unusually outpace a 0.2% increase in personal spending. Our forecast is in line with consensus, so shouldn’t have a significant impact.