FX Weekly Strategy: November 24th-28th

Equities likely to drive FX

Some reasons to expect equity market stabilization and a USD dip

GBP risks on the UK Budget mostly on the downside

JPY still vulnerable to equity recovery short term, but upside preferred medium term

Strategy for the week ahead

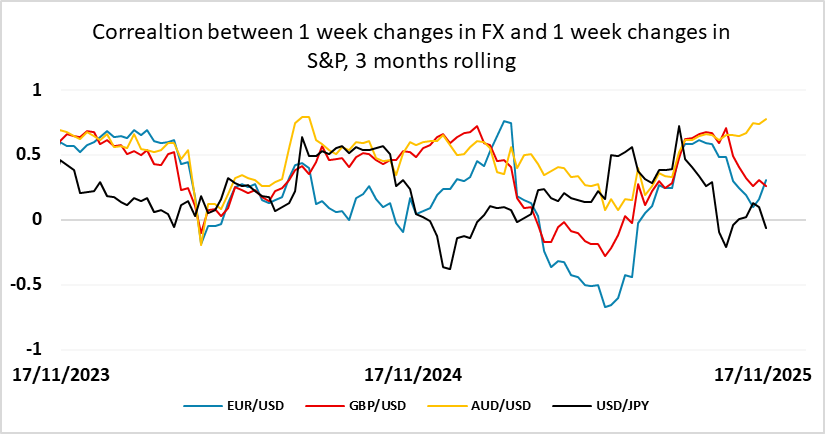

The equity market has been a key driver for most pairs in the last few weeks, and is likely to remain so this week. We have had four consecutive weeks of decline in the S&P 500, and this has weighed on most of the risk sensitive currencies against the USD. The USD continues to show significant negative correlation with equity prices in most pairs, with the AUD continuing to be the most sensitive. The EUR and AUD have both edged lower with equity indices in the last month, but are still stuck in the fairly tight ranges that have held for the last 6 months, albeit towards the lower end of those ranges. The same is essentially true of the CHF and scandis. More equity market losses would likely lead to more USD strength against these currencies, but there is likely to be some support for the S&P500 index around the 6500 level, and the decline in equities has led to the market now pricing in a 60% chance of a Fed easing on December 10, which will also tend to limit equity losses. While the equity market remains expensive, there has been no event to justify a major sell off, and unless we see some clearly negative US data or a clear Fed signal that there won’t be a December rate cut, we may see some consolidation this week which could mean many of these risky currency pairs move back towards the centre of their recent ranges.

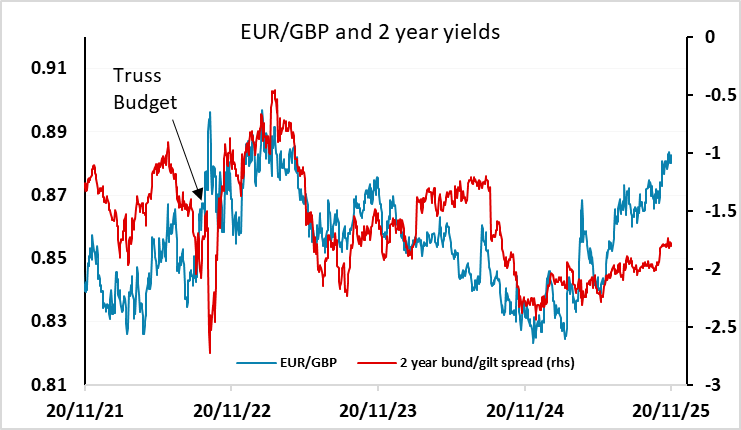

While most pairs have remained in their ranges, GBP/USD has broken to its lowest since April, reflecting rising expectations of BoE easing in December after the November 26 Budget. This will be one of the main focuses this week. GBP’s softness in recent weeks against the EUR is due in part to the government reportedly abandoning plans for a rise in income tax, and instead shoring up the public finances with a variety of smaller measures. This approach was seen as likely to be less effective and indicative of a government more concerned about political optics than fiscal rectitude. The tighter the Budget is fiscally, the more likely the Bank of England is to cut the base rate at the December 18th MPC meeting, so a tight Budget may be seen as mildly GBP negative. However, a rate cut is already more than 80% priced in, so the GBP impact of a tight Budget is unlikely to be large. Indeed, GBP may be more under threat from a Budget that is perceived to fail to address the UK’s underlying fiscal problems. This was the case in the October 2022 Budget from the short-lived administration of PM Truss and Chancellor Kwarteng, when yields rose and GBP fell at the same time in response to hat was perceived to be a recklessly profligate Budget. The risks for GBP consequently look to be mainly to the downside. A Budget that is perceived to be satisfactorily tight may allow a modest GBP rally, but anything too tight or too loose might well undermine the pound.

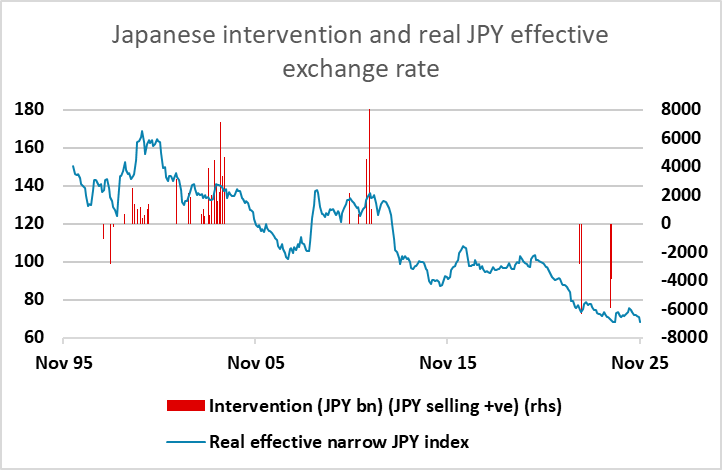

The JPY is the currency that has been least well correlated with movements in equities and US yields in recent weeks, with the market more focused on the policies of the new administration under PM Takaichi. There was some correction higher in the JPY on Friday, helped by aggressive threats of intervention from Finance minister Katayama, but the underlying weak trend is still intact. If equities recover this week, there is likely to be renewed downward pressure on the JPY, and the Japanese authorities are likely to have to put their intervention money where their mouth is to prevent new JPY lows. We are certainly close to levels where intervention could be expected, as the real trade-weighted JPY is at all time lows by our calculations, but some expect the MoF to hold off unless USD/JPY trades above 160.

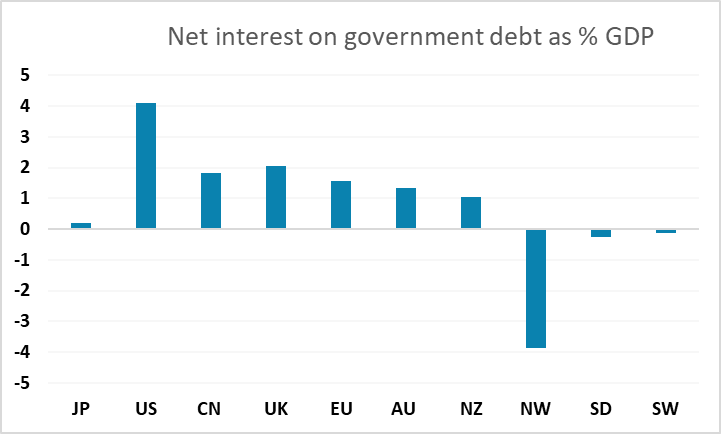

However, the rationale for JPY weakness remains somewhat confused. There is some similarity with the market attitude towards GBP, as the expectation of the expansionary Budget that was passed on Friday led to both higher yields and a sharp JPY decline in recent weeks. However, the logic behind this seems flawed. Japan’s fiscal position is much less problematic than the UK’s, since in spite of a large gross debt level, interest payments on the government debt are tiny by comparison with most of the rest of the developed world. There is therefore little reason to be concerned about sustainability of the public finances. Furthermore, the Japanese government debt is largely domestically owned, so there is little concern about the potential for foreign selling of the debt and the JPY.

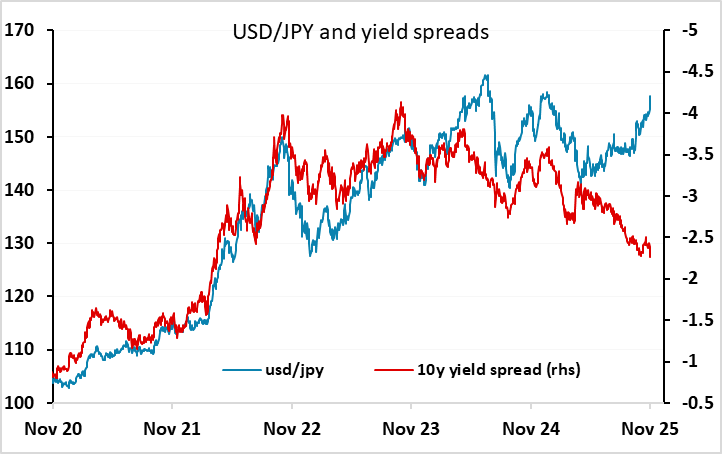

Some argue for a JPY sell off due to concerns about the BoJ following easier monetary policy under orders from the government, but there is little reason to believe this is the case. The BoJ has been reluctant to tighten policy rapidly because despite inflation being above target, they have been projecting a decline to levels below target, in part due to weak wage growth. Current relatively high inflation is due in part to the weakness of the JPY in recent years and the impact on import prices. Recent JPY weakness and the expansionary Budget have led to an increase in market forecasts of a rate hike in December, with slightly more than half the forecasters surveyed by Reuters now expecting a 25bp hike. We don’t see the BoJ running easier policy under the new government. Rather, like all independent central banks, they are likely to run tighter monetary policy in response to easier fiscal policy. Yields are higher along the whole curve in Japan since Takaichi took power, though admittedly mostly at the long end, and this ought to be JPY supportive, but the correlation of the JPY with yield spreads has broken down in the second half of the year (well before the Takaichi election). Nevertheless, we would still expect a major JPY rally medium term in line with the levels suggested by yields spreads. But in the short run, the Japanese authorities may need to turn sentiment with intervention to discourage the JPY bears.

Data and events for the week ahead

USA

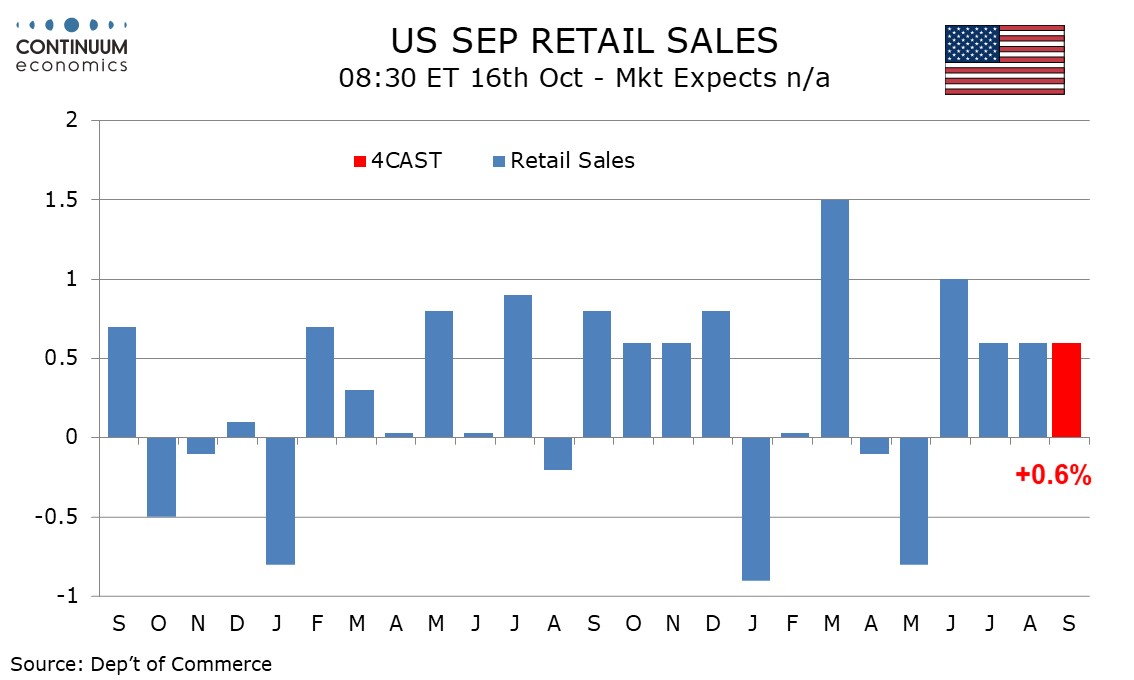

Monday sees little significant data but several Fed speakers. The highlight may be a speech from Williams, though Collins, Barr, Miran, Jefferson and Logan are all scheduled. Tuesday sees some important delayed data. We expect September retail sales to rise by 0.6% overall and ex autos and September PPI to rise by 0.4%, with a 0.3% increase ex food and energy. September house price data from S and P Case-Schiller and FHFA are due, followed by November consumer confidence, October pending home sales and the delayed August business inventories report.

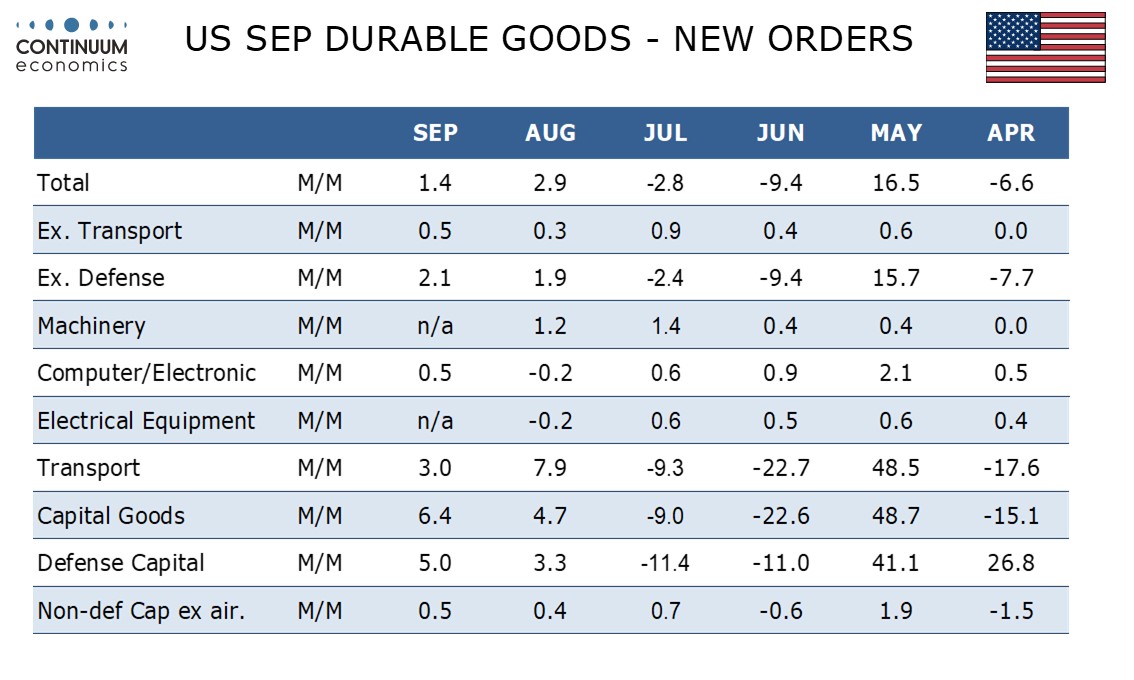

On Wednesday we expect a 1.4% rise in the delayed September durable goods orders headline, with a 0.5% increase ex transport. Weekly initial claims will also be released on Wednesday due to Thursday’s Thanksgiving holiday. The Fed’s Beige Book on Wednesday may merit more attention than usual given the continuing absence of timely official data. Thursday and Friday are likely to be quiet.

Canada

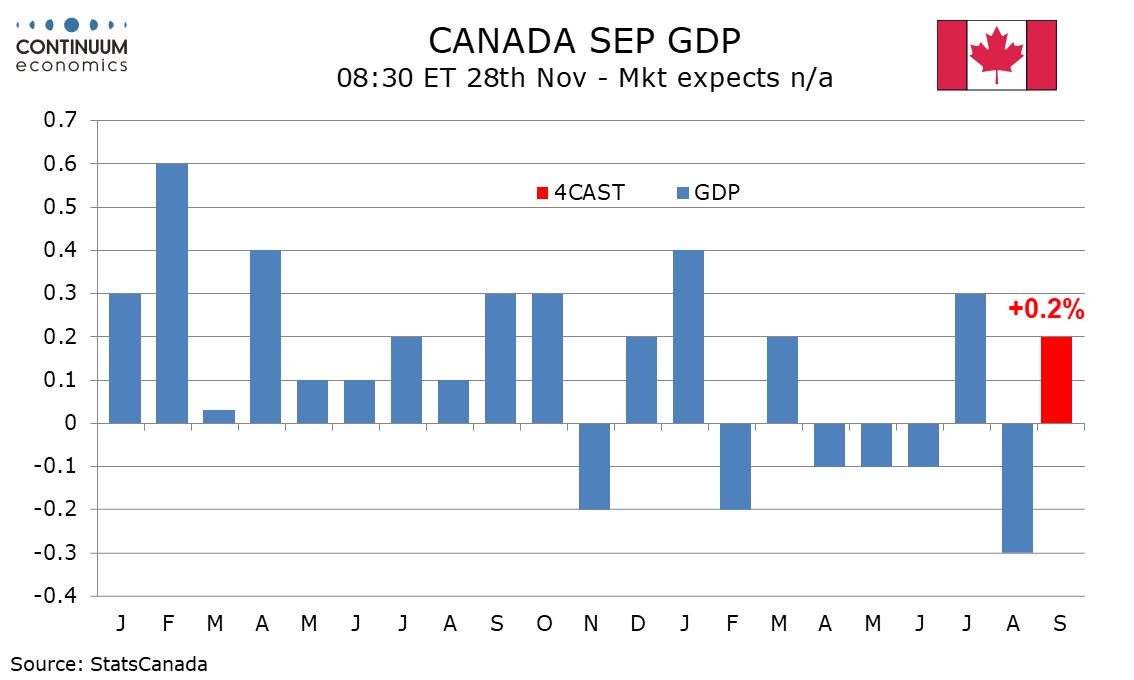

Canada’s data highlight is Q3 GDP on Friday, where we expect a 0.6% annualized increase, though absence of September trade data due to inputs from the US being absent complicates the picture. We expect a 0.2% monthly increase for September. The Q3 current account is due on Thursday.

UK

The week ahead has little interesting data wise but with further signs of an underlying weakening in house prices as may be evident in Nationwide house price data due later in the week. But this makes the Budget Statement (Wed) all the more the focus. If not the most keenly awaited Budget for some years, Chancellor Reeve’s updates is certainly the one that has attracted the most speculation and from all sides. What is clear is that amid several factors, a marked fiscal tightening is in store. This though now seems as if it will be less sizeable than markets and even the Chancellor was hinting even a week or two ago – it will be interesting to see what new assumptions are made about the size and impact of immigration legislation! The rationale behind this fiscal reassessment (which seemingly allows the government to avoid breaking its electoral tax promises) will be as important as the form and timing of the budget consolidation measures themselves. What the estimated economic impact will be is also keenly awaited, not least as a harsher fiscal picture for the next 2-3 years should make the BoE less divided over the size and speed of Bank Rate cuts.

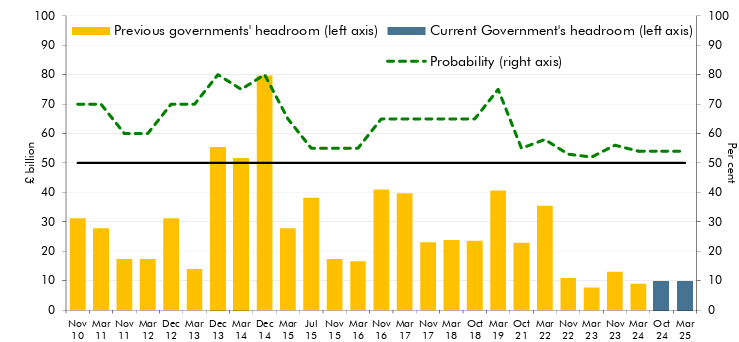

Current Fiscal Headroom Historically Tiny

Source: OBR (March 2025), Probability of hitting the fiscal target & successive headroom forecasts

Eurozone

Several important updates are due this week. On the monetary side, while official credit growth data showed adjusted credit growth stable at 2.8% y/y, this masked a clear softening on a three-moth basis, in both households but particularly non-financial company credit and it will be interesting whether the October money and credit data (Thu) continues this weaker trend. The ECB biannual Financial Stability Review is also scheduled for Wednesday; back in May the ECB noted that despite drawdowns, equity valuations remained high while credit spreads still appear out of sync with underlying credit risk.

Otherwise, there is more survey data from the ECB on consumer expectation and the German IFO update (Mon) and then from the European Commission (Thu). And the week ends with preliminary German HICP on Friday, where we see a 0.1 ppt drop back in these November numbers to 2.2% partly driven by lower services inflation.

Rest of Western Europe

There are key events in Sweden, most notably actual GDP numbers (Fri), likely to confirm a decent Q3 pick-up this preceded by the Economic Tendency Survey (Thu), the latter likely to remain below par, however. Otherwise, in Switzerland, Friday sees what may still be soft KOF figures for November and confirmation of a circa-0.5% q/q fall in Q3 GDP. Friday sees Norway release more labor market data but with more interest on Wednesday’s GDP updates this followed the same day by a keynote speech from the Norges Bank Governor.

Japan

Rather empty calendar next week with the only releases on Friday. It is a key release though as we see Tokyo CPI, retail sales and unemployment rate all on the same day. Tokyo CPI will likely hover around 3% with headline chopping lower and ex fresh food & energy more stubborn. It will be a dovish surprise if we see both item dips below 2.5%. The other data point will carry less weight unless it is a multi-deviation miss.

Australia

Only monthly CPI on Wednesday will be market moving. The last monthly CPI is strong above 3% and we expect such to continue, but not aggressively above 3% as it was more base effect from last year’s energy rebate than resurging inflation.

NZ

The RBNZ Interest rate decision is on Wednesday and the market is anticipating another 25bps cut. We do not hold a different view as while inflationary pressure is at the top band of target range, the RBNZ has indicated in the October meeting that they will cut despite of such. The area to watch is in their forward guidance where if they see more cuts are to come at what magnitude.