U.S. September JOLTS report sees Job Openings weaker but October Consumer Confidence rises

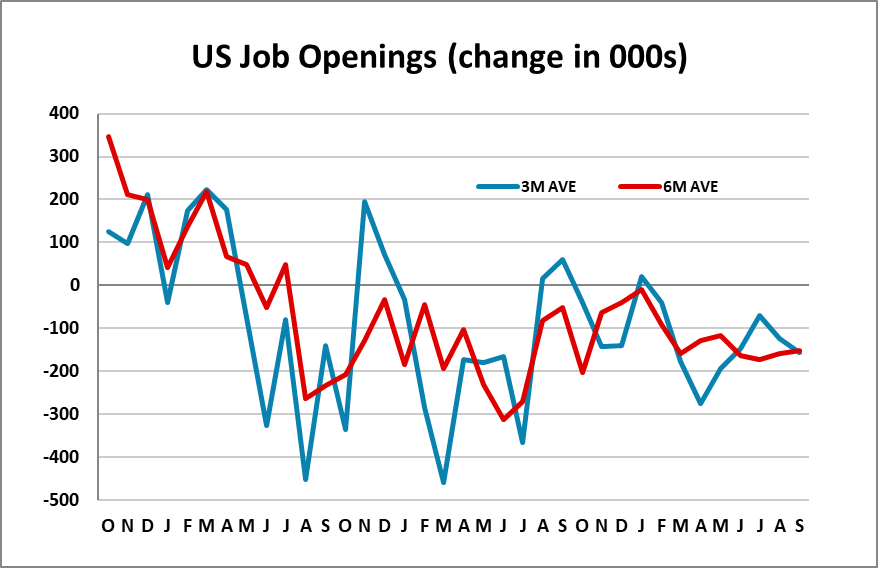

September job openings have fallen by 418k to 7.443m, resuming a slowing trend back into line with pre-pandemic levels. August’s strong rise of 329k has been revised down to 150k. Three and six month averages for openings both stand near -150k. October consumer confidence however, at 108.7 from 99.2, is surprisingly strong.

Other details of the JOLTS report show a 123k increase in hirings and only a 28k increase in separations, leaving fires 362k above separations and that is even stronger than the surprisingly strong 254k rise in September’s non-farm payroll.

However there was a 107k decline in quits meaning involuntary separations rose at a similar pace to hires, and declining quits implies less confidence in the strength of the labor market.

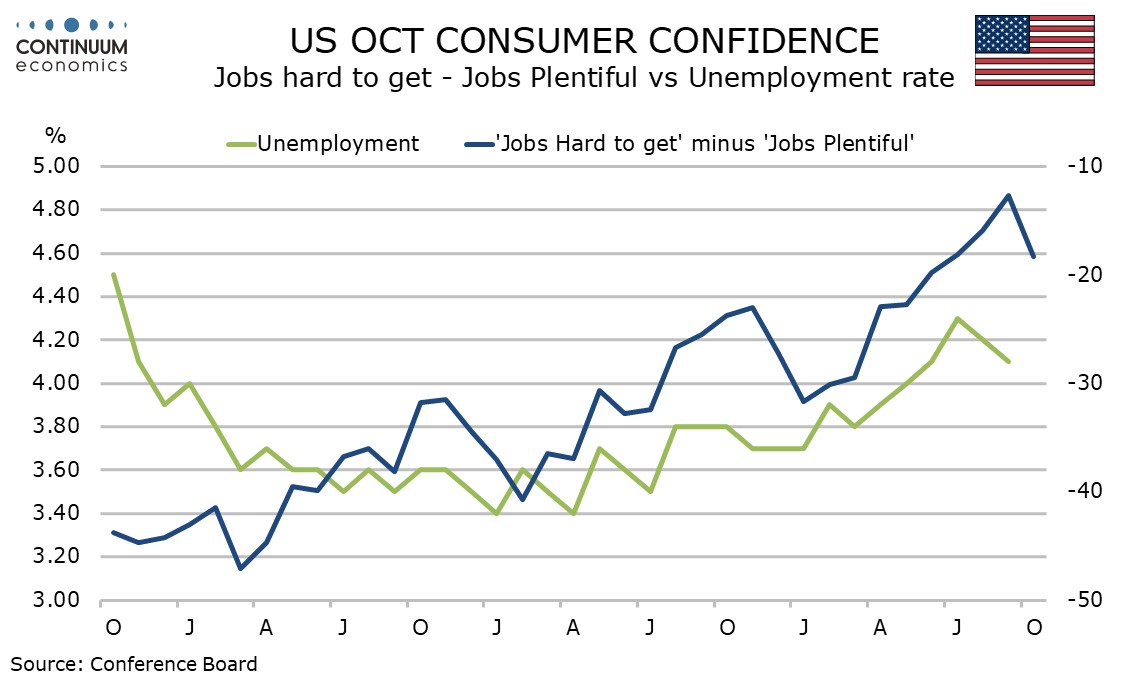

October’s consumer confidence report however suggests consumers are more confident about the strength of the labor market than they were in September, perhaps influenced by the September data. The gap between those seeing jobs as plentiful less those seeing them as hard to get rose to a 4-month high of 18.3% after falling to 12.7% in September, which was the lowest since March 2021.

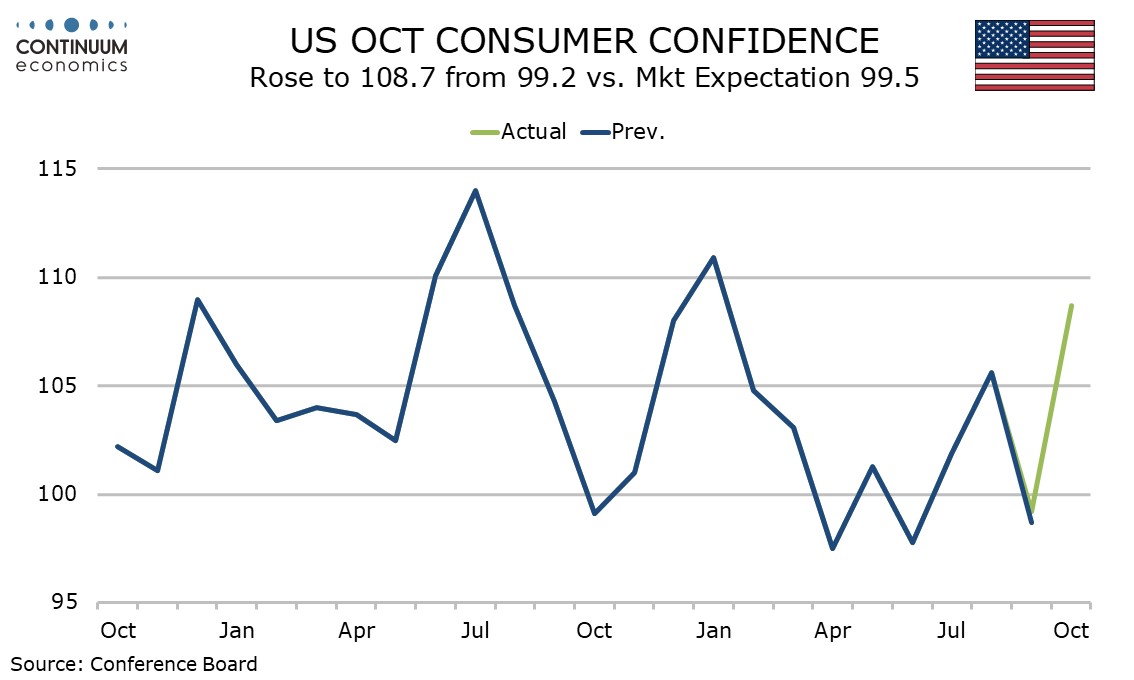

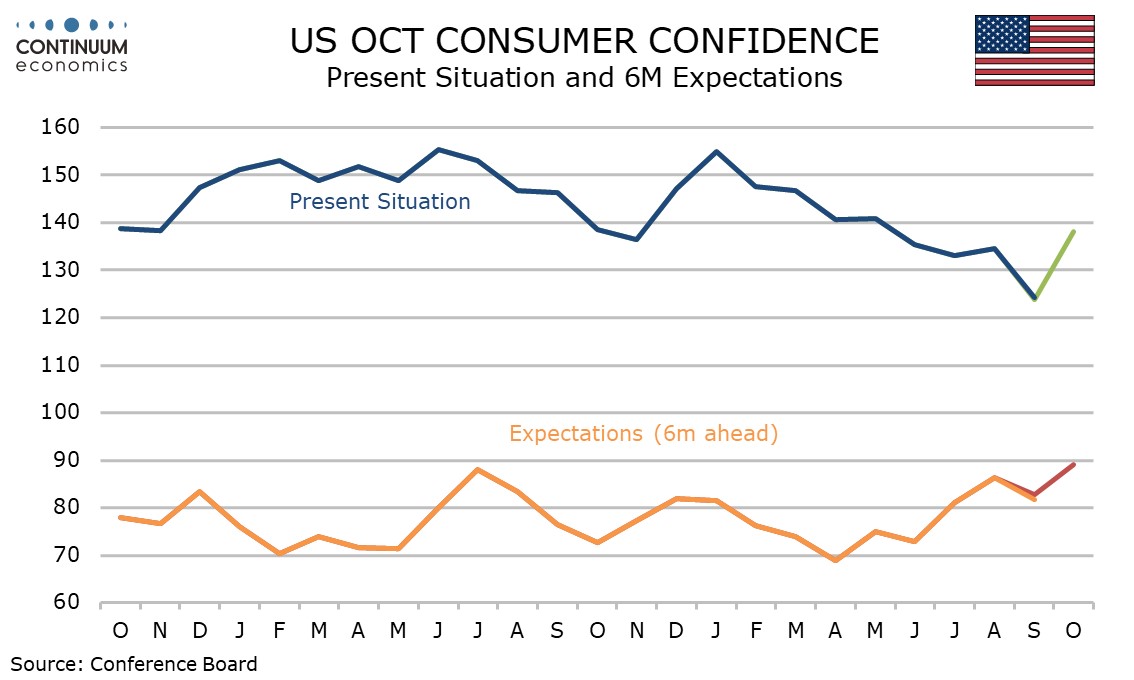

October consumer confidence rose to its highest level since January, from 99.2 in September. Both current conditions, to 138.0 from 123.8, and exceptions, to 89.1 from 82.8, increased significantly, but that current conditions rose by more suggests the view is not due to supporters of both parties feeling optimistic about the election.

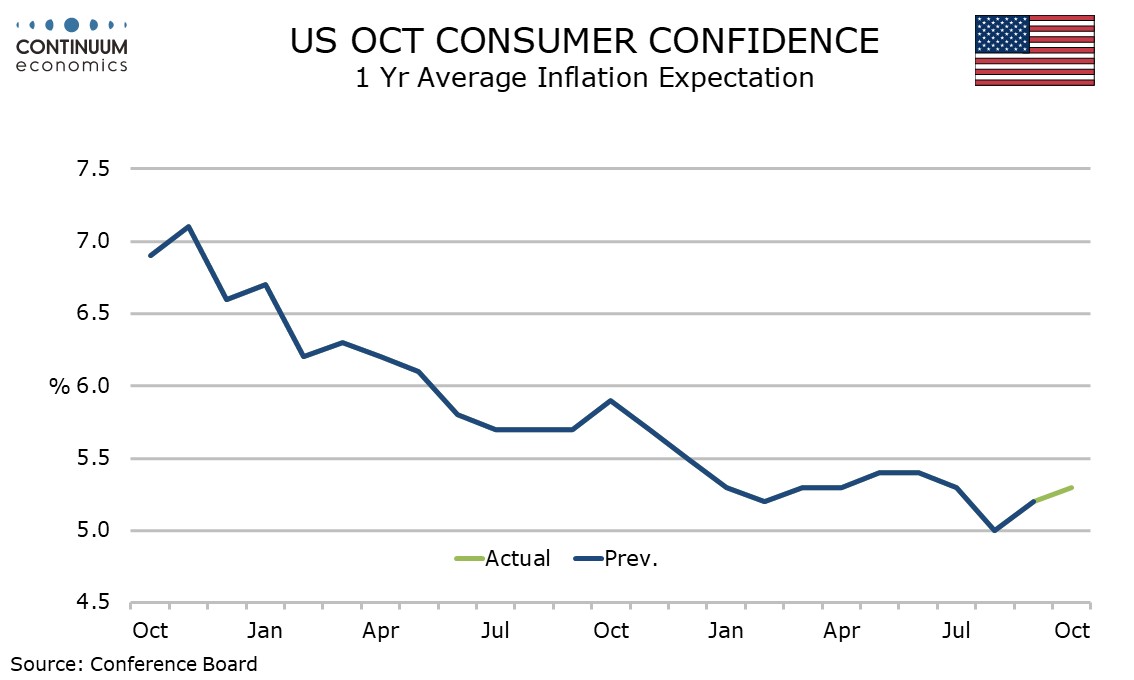

Fed easing is probably playing a part. The median inflation expectation at 5.3% from 5.2%, and 5.0% in July, was slightly higher.