FX Daily Strategy: N America, May 29th

US GDP revision the main data on a sparse calendar

Q1 weakness may be a reminder that there is still some risk of US slowdown

JPY weakness has extended this week and may be overdone

Scope for some catch-up weakness in CHF

US GDP revision the main data on a sparse calendar

Q1 weakness may be a reminder that there is still some risk of US slowdown

JPY weakness has extended this week and may be overdone

Scope for some catch-up weakness in CHF

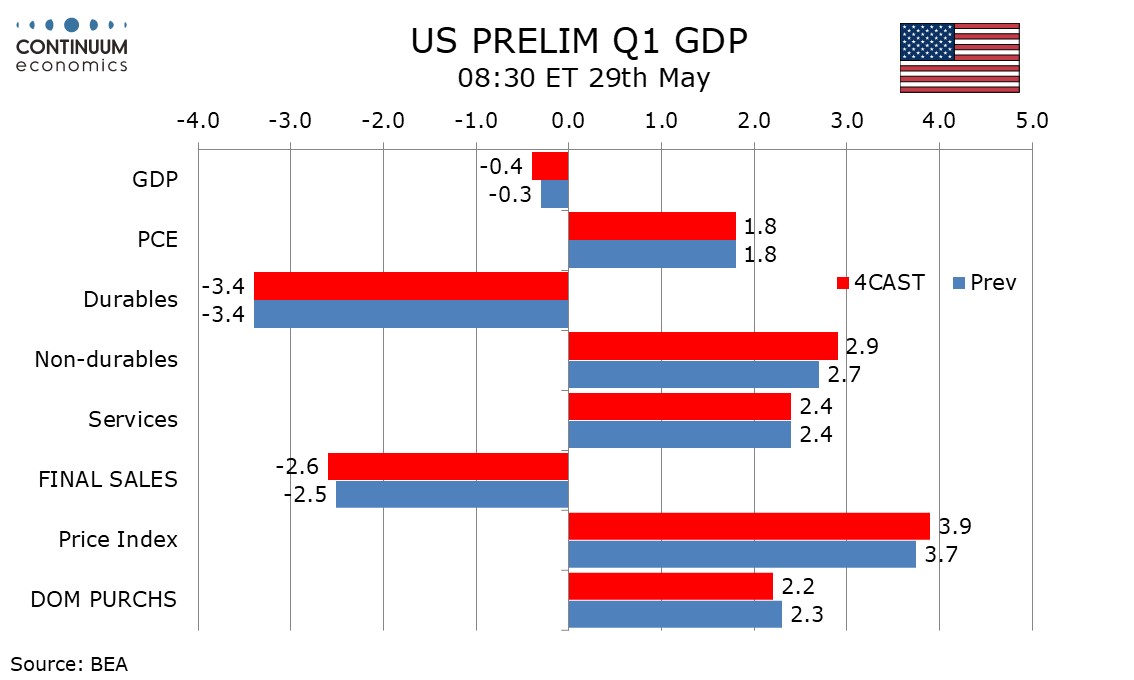

Another fairly quiet calendar on Thursday, with the second estimate of US Q1 GDP probably the data highlight, but unlikely to trigger any market reaction. We expect Q1 GDP to be revised marginally lower to -0.4% from the first (advance) estimate of -0.3%, though we also expect an upward revision to core PCE prices, to 3.7% from 3.5%. While Q1 was weak, the weakness was almost all due to net trade, which looks to have been related to the timing of imports due to the expectation of tariffs. Surging imports took 5.0% off GDP even in the advance report. We expect final sales (GDP less inventories) to be revised down by 0.1% to -2.6% and final sales to domestic buyers (GDP less inventories and net exports) to also be revised down by 0.1%, while remaining positive at 2.2%.

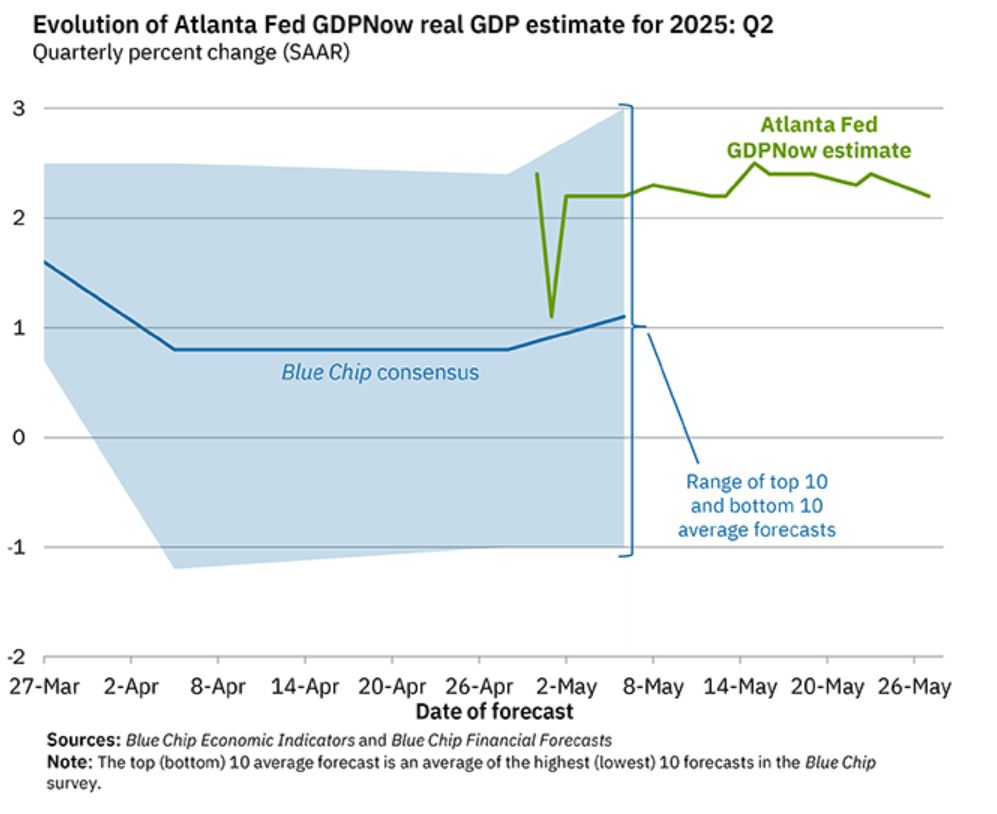

Having said this, it is still something of a mystery as to where the Q1 imports went, since if they weren’t consumed or invested, they should have shown up in inventories. While investment and inventories did rise in Q1, they didn’t rise enough to offset the surge in imports. It may therefore be the case that there was some real Q1 weakness, and that investment and/or inventories would have been negative without the import surge, although there may also have been some impact from weather. Alternatively, the data may simply not be fully accurate, and may have missed some inventory build. Revisions might be expected to be more accurate, so to that extent this release has a risk of upward revisions, but our forecast suggests there is something real about Q1 weakness. Since the advance release, the US markets have rallied and fears of recession have subsided, but the data may serve as a reminder that Q2 needs to be significantly strong – stronger than the normal trend – to offset Q1 weakness and suggests that the economy isn’t slowing. As it stands, the data doesn’t suggest that is the case – the latest Atlanta Fed GDPNow forecast is 2.2%. So there is a risk that the data triggers a correction to the more risk positive tone seen in recent weeks and so far this week.

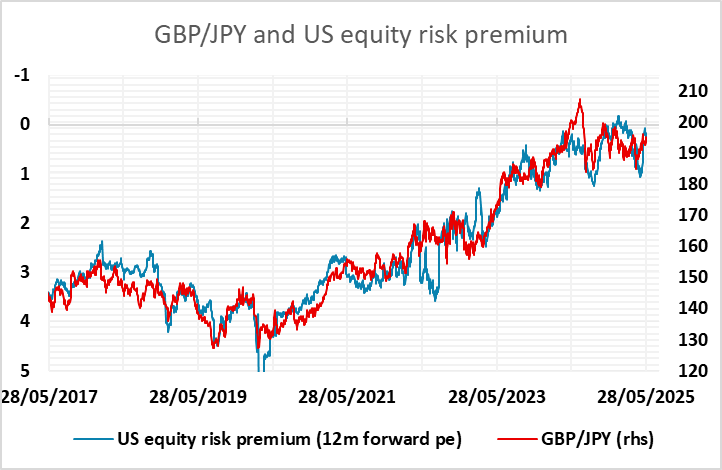

Wednesday saw the JPY come under general pressure with the USD the best performer, even though equities were a little weaker against the background of higher US yields. The rise in US yields means US equity risk premia remained low despite the equity decline, and this suggests the JPY can remain under pressure on the crosses unless there is some more negative take on US data and the US economy. Broadly speaking, however, we remain very much in ranges, with EUR/USD 1.11-1.15 and USD/JPY 140-148 big picture, but 1.12-1.14 and 142-146 the more practical ranges. These currently look hard to break without some more significant news.

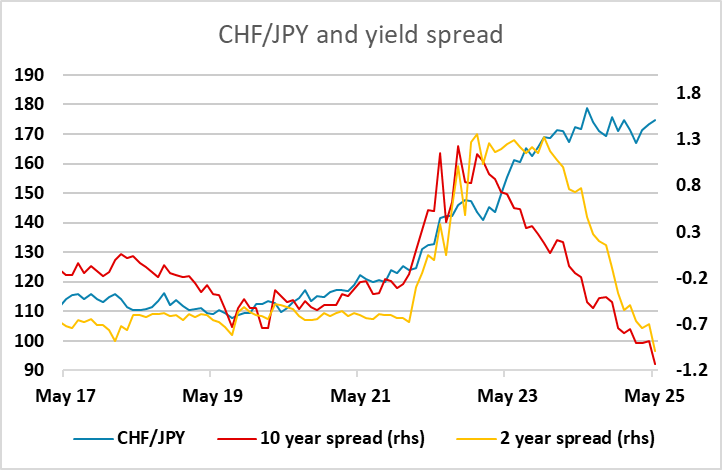

There may still be scope for some movement in other pairs, with the CHF looking due some weakness to catch up with the JPY decline. CHF/JPY remains the most obvious value play among the G10 currencies, and it is approaching the top of its recent range. With risk sentiment broadly positive, there should be scope for EUR/CHF to move back above 0.94.