FX Daily Strategy: APAC, September 24th

IFO a focus but EUR resilient to weaker survey data

GBP strength on surveys looks overdone

AUD and NOK represent the best value in risk positive environment

CHF looks the most attractive funding currency.

IFO a focus but EUR resilient to weaker survey data

GBP strength on surveys looks overdone

AUD and NOK represent the best value in risk positive environment

CHF looks the most attractive funding currency.

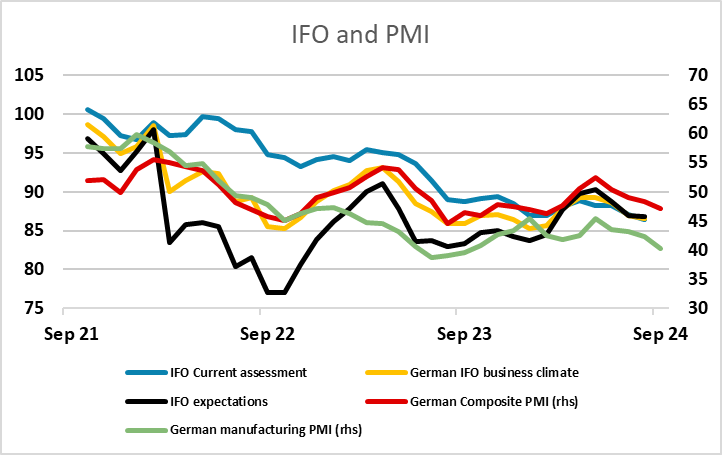

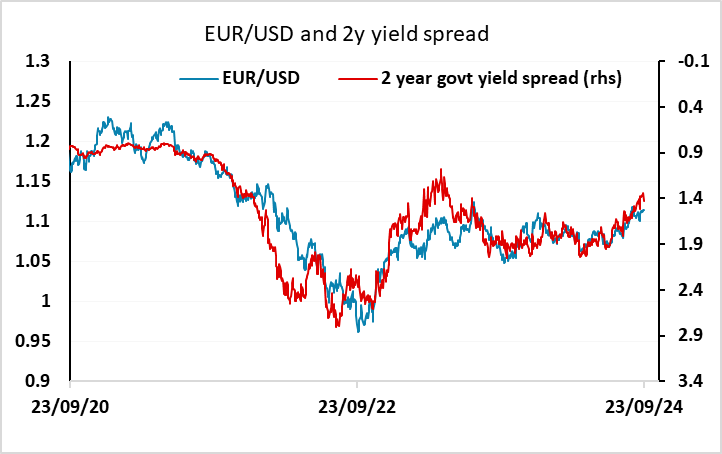

There isn’t a great deal that looks likely to be market moving on Tuesday’s calendar. We have the German IFO survey, but the weakness of the PMI survey on Monday suggests similar weakness will be seen in the IFO survey, with the two tending to be well correlated. The EUR proved quite resilient to the weaker than expected PMI data, only falling modestly against the USD and JPY, with EUR/USD benefiting from EUR yields starting at a level which suggested scope for EUR gains ahead of the data. While the weaker numbers led to lower yields and narrower spreads, spreads didn’t narrow enough to eliminate this upward bias. So as long as risk sentiment remains resilient, the EUR is likely to as well.

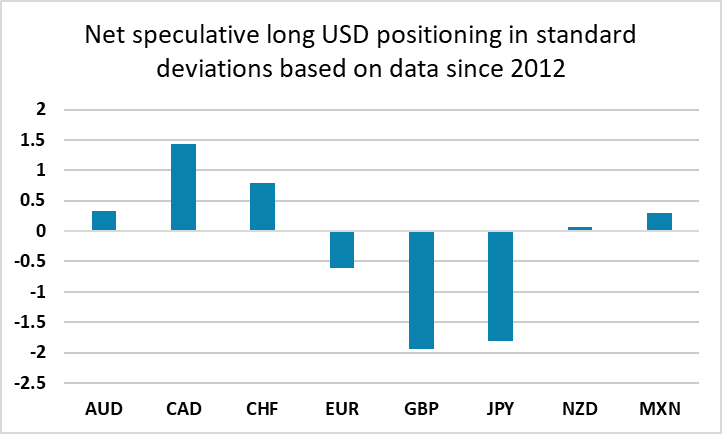

GBP performed best of the majors in response to the data. Even though the UK data was also weaker than expected, it was less weak than the Eurozone data and was at much higher levels. EUR/GBP fell to new 2 year lows as a result. But we have several reservations about this reaction. First, the UK PMI does not have a very strong correlation with UK growth. In particular, the manufacturing PMI has recently had no correlation with UK manufacturing output. Indeed, if anything the correlation has been negative, with the UK manufacturing PMI climbing strongly for the last year while manufacturing output and has fallen both in growth and level terms. Second, even if UK growth is outperforming this year, the UK has still been the worst performing of the G10 economies since the pandemic (counting the Eurozone as one region). Third, GBP is already at high levels, with EUR/GBP approaching pre Brexit referendum lows in real terms, and the recent rise has come without much support from moves in yields. Finally, net speculative positioning remains longer GBP relative to history than any of the other majors according to the latest CFTC data. We consequently wouldn’t expect the EUR/GBP decline to extend below 0.83.

Source: CFTC, CE

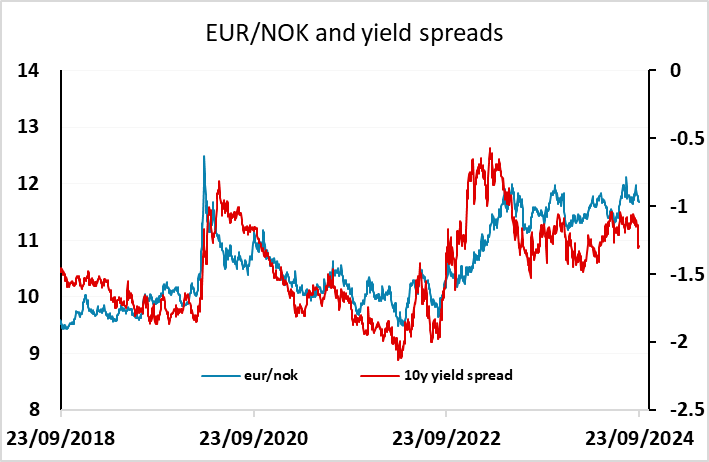

However, the strength of GBP does illustrate a general risk positive tone in the FX market that has been in place since the Fed rate cut. AUD/USD traded to new highs for the year on Monday, helped by the positive tone in equities, and the other risk positive currencies also performed well. After the hiccup in the summer it looks as if the market is intent on renewing risk positive carry trades. If this is the case, the AUD and NOK represent the best value, with the NOK having underperformed all year while the AUD has been held back by concerns about China.

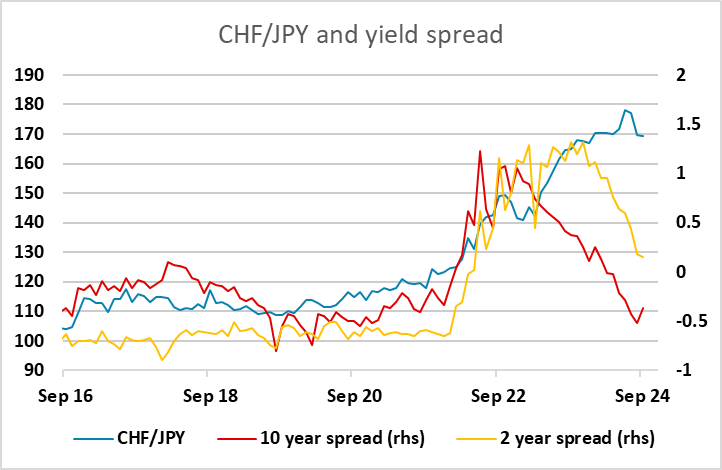

On the other side of the equation, the CHF still looks like the most attractive funding currency, with valuation remaining very high, particularly relative to the JPY. While EUR/JPY recovered almost all its initial dip on Monday, EUR/CHF held close to the day’s lows below 0.9450 at the end of the European session after trading above 0.95 after the Eurozone PMI. As we have noted before, it’s very hard to make the case for the current level of CHF/JPY given the 50% rise in the last 5 years and the yield spread move back to close to zero.