FX Daily Strategy: N America, January 21st

Market to focus on Trump executive orders, with particular sensitivity to tariffs

AUD may have the most potential to extend Monday’s rally

CAD upside may be brief if CPI softens

GBP looks likely to remain under pressure

Market to focus on Trump executive orders, with particular sensitivity to tariffs

AUD may have the most potential to extend Monday’s rally

CAD upside may be brief if CPI softens

GBP looks likely to remain under pressure

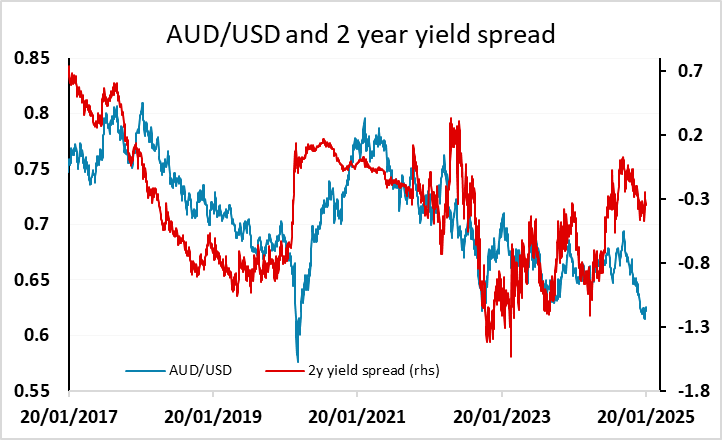

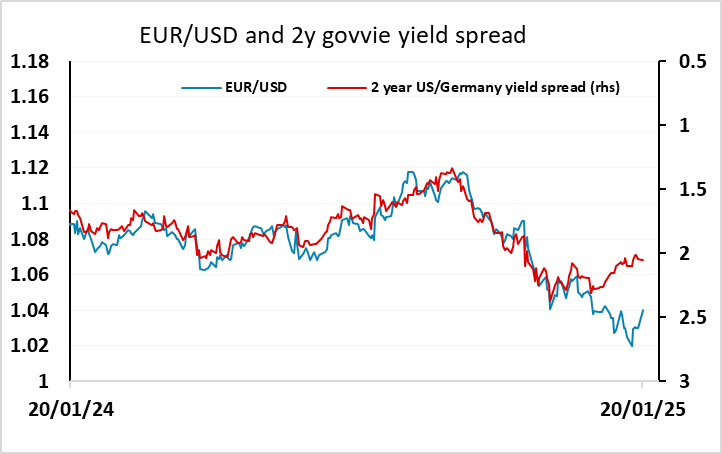

There isn’t any US data of any note on Tuesday, but the market will be very much focused on any executive orders coming out of the White House. The report in the WSJ on Monday saying that Trump would not be introducing tariffs immediately triggered a 1% USD decline across all the riskier currencies, and there looks to be scope for further USD declines if this is confirmed. The USD has outperformed yield spread moves against the EUR in the last month, and against the AUD for much of the last year. The AUD may be the best placed to benefit if the threatened tariff increases don’t materialise, especially if we also see equity markets continue to benefit, but yield spreads also suggest scope for gains in most of the riskier currencies.

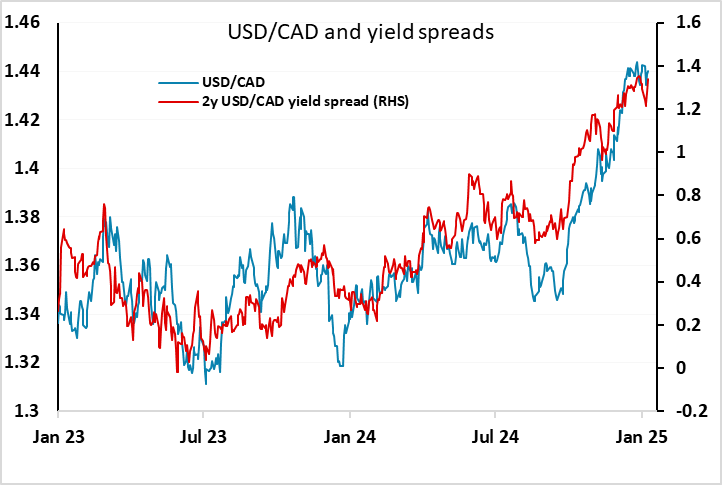

While the CAD and MXN may benefit the most from any announcement effect, as China, Canada and Mexico were the primary targets of Trump’s initial tariff threats, USD/CAD has actually stuck fairly close to the levels implied by yield spreads, so unless we see some yield spread narrowing, upside for the CAD still looks comparatively limited. The CAD also probably won’t be helped by the Canadian CPI data. We expect Canadian CPI to slip to 1.7% yr/yr from 1.9%, the fall largely due to a temporary supsension of the Goods and Services Tax that will run from Mid-December through Mid-February. Bank of Canada Governor Tiff Macklem has stated that the tax suspension is expected to move inflation down to a low of around 1.5% in January.

UK labour market data was broadly as expected. The ONS data showed average earnings growth rose to 5.6% y/y in the 3 months to November, from 5.2% in October, but the rise was in line with expectations and due to base effects rather than particular strength in November. The more up to data HMRC data on payrolled earning showed a decline in December to 5.6% y/y from 6.4% in November. Employment data was also as expected, showing a 35k rise in the 3 months to November, but the HMRC data are showing a weaker trend, with a December showing a 47k decline from November following a 32k decline in November.

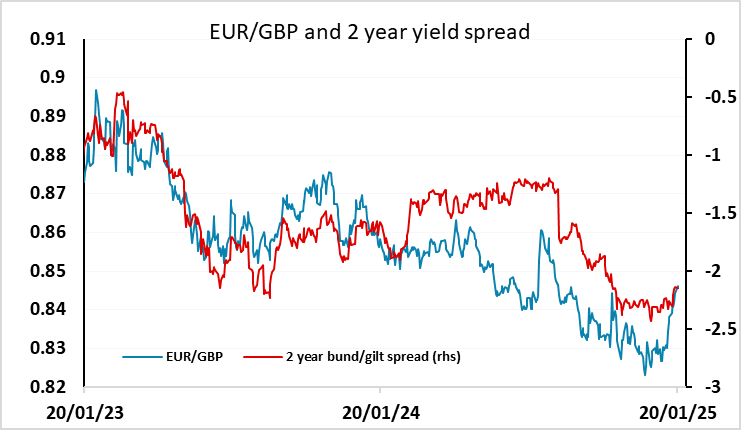

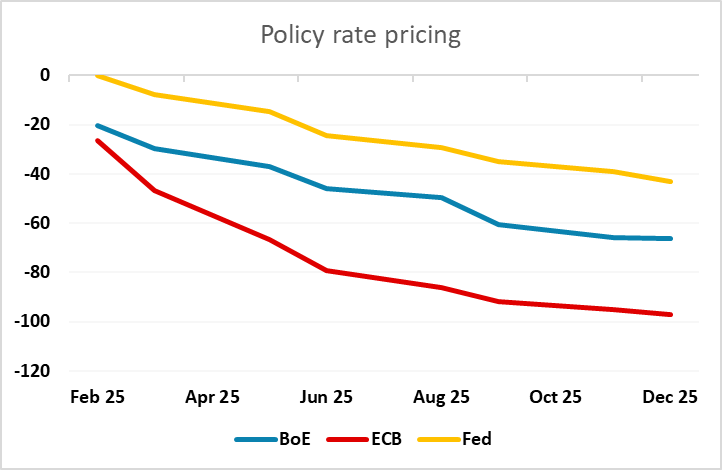

The data is unlikely to have much impact on market expectations for the February BoE decision, and GBP is not much changed in response to the data. A 25bp rate cut is currently priced as an 80% chance. There is still scope for the current pricing of the path of rate cuts over the year to change, as this only shows 66bps of cuts against the 97bps for the ECB (who are starting at a lower level). But this will likely have to wait for the MPC statement and Monetary Policy Report at the February meeting, which seems likely to suggests a steeper pace of rate cuts. In the meantime, EUR/GBP should hold in the mid-to-high 0.84s, but we still see upside risks over the medium term.