FX Daily Strategy: N America, January 9th

Quietish day likely as US markets semi-closed due to day of mourning

JPY supported by Japanese wage data

EUR/USD still under pressure but limits of Trump trade may be approaching

GBP weakness can extend further, one way or another

Quietish day likely as US markets semi-closed due to day of mourning

JPY supported by Japanese wage data

EUR/USD still under pressure but limits of Trump trade may be approaching

GBP weakness can extend further, one way or another

Thursday promises to be relatively quiet, with US federal agencies on holiday due to the national day of mourning and the stock market also closed, although many other markets will continue to trade. In any case, there is no US data released, and with the US employment report on Friday the markets would in any case be waiting for the upcoming data.

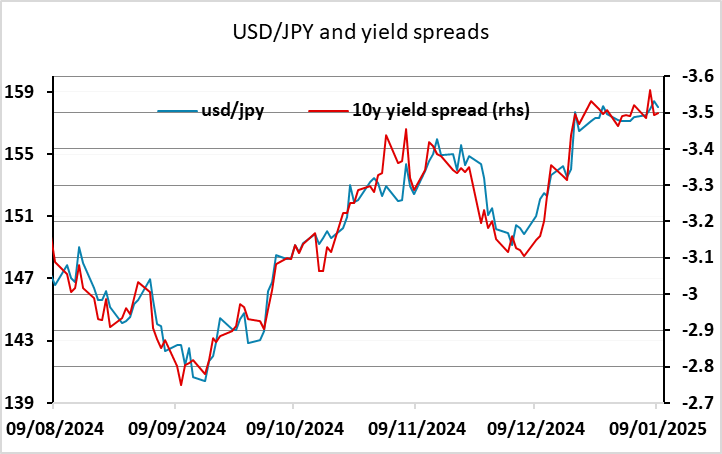

The November Japan Labor Cash Earning came in strong at 3% y/y, beating estimates and improved from 2.2% in October. It will be supportive for the JPY if BoJ follow through with their tightening. There is a reluctance to tighten further if wage growth isn’t keeping up with price inflation, so that consumption remains depressed. Wage growth has picked up since the wage round last spring, and is expected to pick up again this spring. As it stands the market is pricing in 12bps of tightening at the January 24 meeting, which can be seen as a 50% chance of a 25bp hike or a larger chance of a smaller hike. The recent comments from the BoJ haven’t really encouraged expectations of tightening before the spring, but the wage data looks strong enough to at least justify a modest hike in rates. However, the lack of commitment from BoJ will see JPY gains capped. Still, it is a good data point for Japanese as it suggests the gradual change in price/wage setting persists.

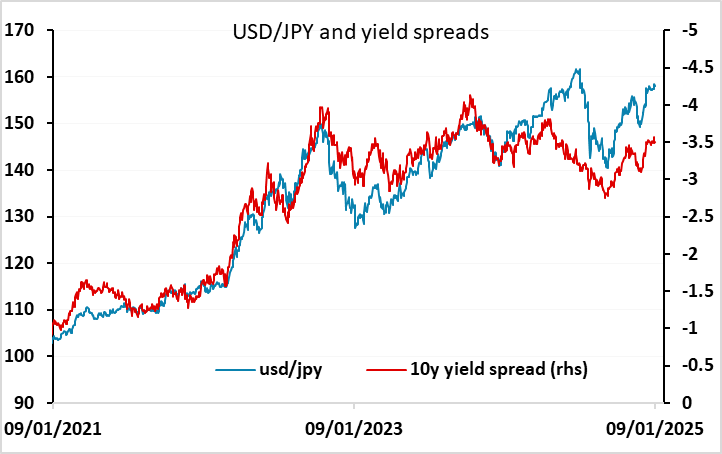

USD/JPY remains at extremely high levels historically, and there has been some verbal intervention from Japanese officials, so the upside for USD/JPY may be restricted in the short term by the intervention threat. But USD/JPY has been tracking the 10 year UST/JGB yield spread closely since August, so intervention would likely only delay a reaction to a move in yield spreads. Having said this, USD/JPY remains considerably higher than would be expected based on both longer term yield spread correlations and on any fundamental measure involving real exchange rates. So while here may be short term risks towards 160 on weak data, we continue to believe USD/JPY will move significantly lower in the medium to long term. But this may well require a less positive tone to the US and global equity markets.

For the USD more broadly, the underlying positive tone that has persisted since the US election continues, and has been helped by this week’s strong US JOLTS and low jobless claims data, the slightly softer than expected ADP employment data notwithstanding. In Europe, Wednesday’s weak German factory orders and retail sales data helped maintain downward pressure on the EUR, even though the underlying trend in these numbers remains mildly positive. The German production data on Thursday may provide more information, with a modest recovery seen in November after a weak October. But the main trends look likely to be dominated by US events. The path of the USD since the election remains similar to that seen after Trump’s election in 2016. Then, after the initial gain of a little more than 5%, the USD fell back, and remained weak for the subsequent 2 years. There is currently little reason to expect a USD turn, other than the high valuation of both the USD and US equities, with the current US data still very solid. But it may be that the good news for the USD is now fully priced in, with yield spreads already suggesting the EUR has scope for recovery. So we would be a little wary of current USD strength. A stronger than expected employment report looks necessary if USD gains are to extend.

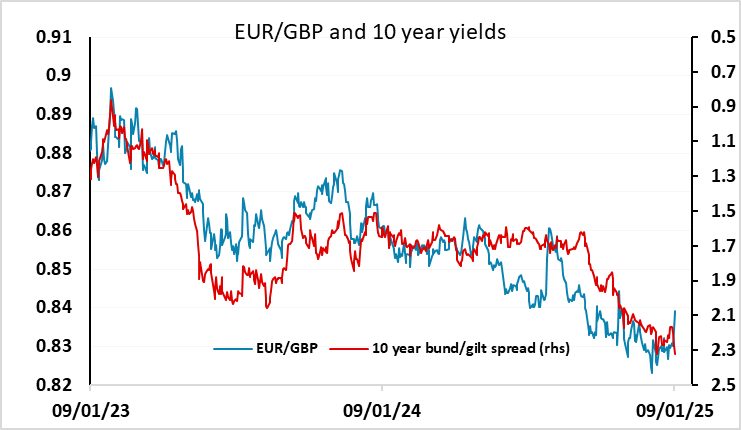

Finally, GBP deserves a mention. UK yields have been rising this week without a strong current rationale, but GBP fell back on Wednesday despite higher yields, suggesting foreign selling of UK bonds is underway. This may reflect a concern at the UK fiscal picture given the lack of UK growth momentum. Even so, GBP remains reasonably strong on a real trade-weighted basis, with EUR/GBP still close to its lowest seen since the 2016 Brexit vote. There is therefore plenty of potential for GBP to weaken further, either because the BoE eases more than expected, or because the lack of BoE easing undermines confidence in UK growth prospects.