FX Daily Strategy: N America, December 19th

BoJ rate hike is not enough to reverse JPY decline

Forward guidance to be watched, but intervention may be necessary

GBP likely to hold gains as long as retail sales aren’t terrible

AUD may extend recovery on lower US yields

BoJ rate hike is not enough to reverse JPY decline

Forward guidance to be watched, but intervention may be necessary

GBP likely to hold gains as long as retail sales aren’t terrible

AUD may extend recovery on lower US yields

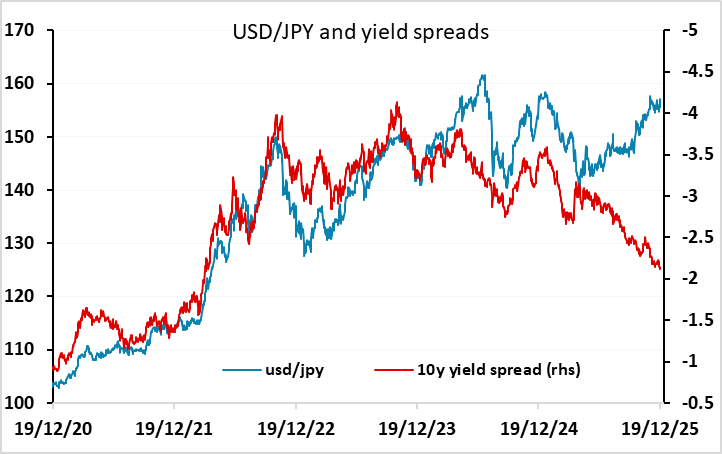

As per forecast, the BoJ has hiked rates by 25bps in the December meeting and bring short term interest rate to 0.75%. The forward guidance is straight forward in reinforcing their stance towards more rate hike if economic/inflation development aligns with their playbook but the timeline remain ambiguous. In contrary to the 7-2 vote to hold in October, the December decision is unanimous.

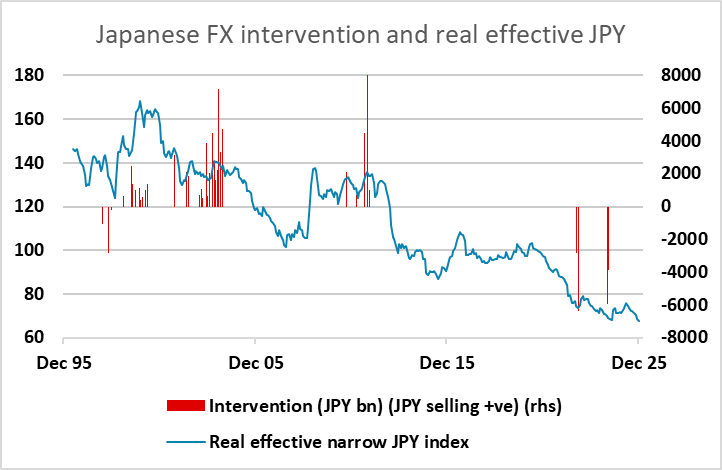

There is a risk that the market treats a rate hike as a “sell on the news” event, with any initial JPY gains seen as a JPY selling opportunity. The trend weakness of the JPY has been resilient to both a sharp narrowing in yield spreads in the JPY’s favour in recent months and corrective pressure in equities, with EUR/JPY hitting another new all time high on Thursday without any obvious rationale. Such trends are hard to oppose and a well anticipated rate hike is unlikely to be sufficient to turn the trend. If the Japanese authorities want to prevent further JPY weakening, they may need to use physical FX intervention in the event of any post-BoJ JPY sell off. If they don’t the market may see it as a green light for further JPY weakness. The JPY is certainly at weak enough levels to justify such action, with the real trade-weighted JPY below the level that triggered intervention last year. History suggests that FX intervention is an effective marker of long term highs and lows in the JPY, and may be the only language that JPY bears understand given the continued decline in recent months despite various JPY positive developments.

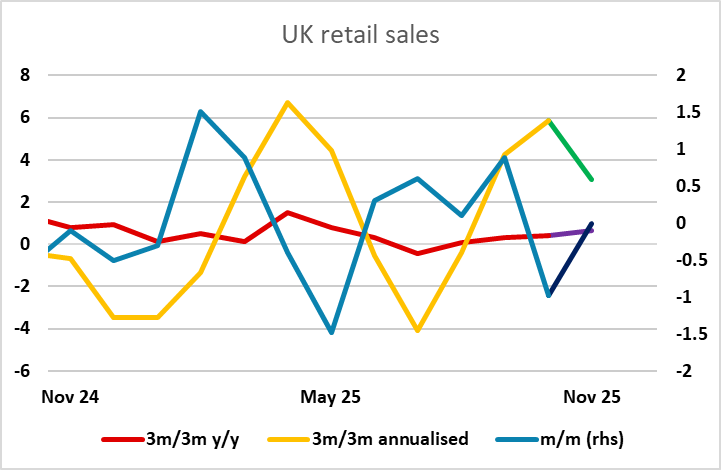

UK retail sales were much as expected in November, with little change on the month and a slightly upward revision to October. The data are a little uncertain, as black Friday is included in this year’s November data but wasn’t in last year’s, making seasonal adjustment challenging. But the data as reported shows a fairly stable trend over the last 3 months and suggests EUR/GBP will continue to trade in the mid 0.87s.

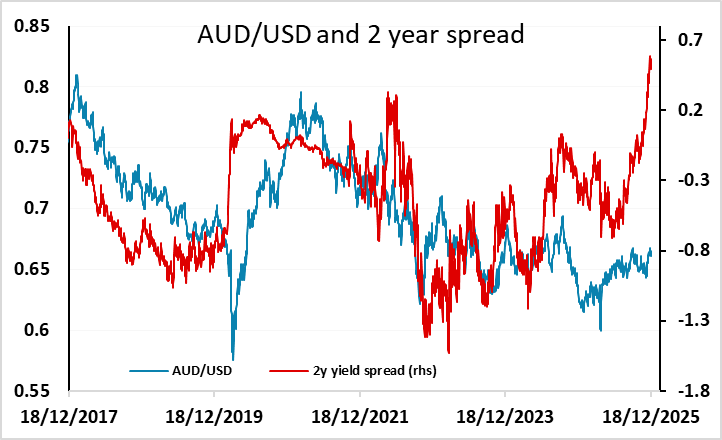

There isn’t much that’s likely to be market moving in the US with just existing home sales and final University of Michigan sentiment data. But the weaker than expected CPI data on Thursday should sustain a more negative USD tone. If it is a sign that the impact of tariffs on prices is fading it may give the Fed more leeway to ease and prove both USD negative and equity supportive. That being the case, the AUD ought to have scope for significant gains, having underperformed in the early part of the week.