FX Daily Strategy: APAC, May 14th

AUD the biggest beneficiary of continued risk positive tone

JPY decline slowing and some stabilisation seen

CHF and EUR look vulnerable

AUD the biggest beneficiary of continued risk positive tone

JPY decline slowing and some stabilisation seen

CHF and EUR look vulnerable

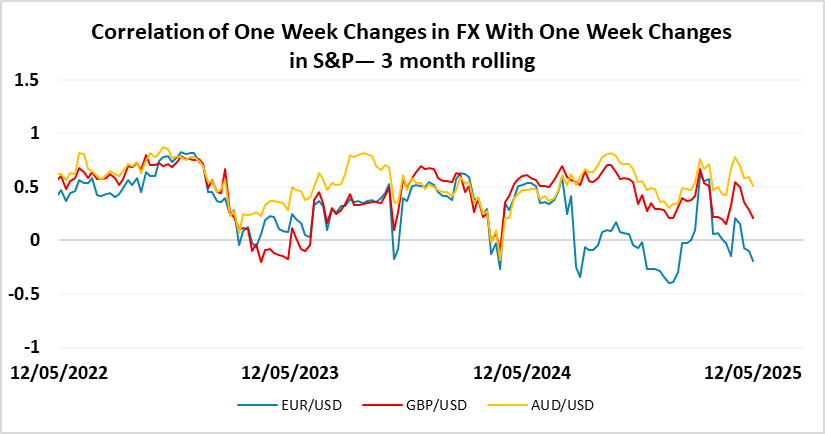

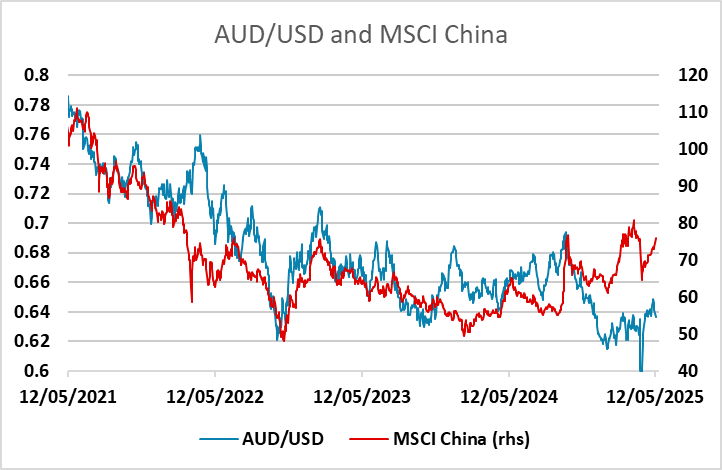

The calendar on Wednesday is quiet, with no significant data in any of the majors. The US CPI data came in on the soft side of consensus, and although there were some signs of tariff effects in the import sensitive components, the lower headline and core rates were supportive for risk sensitive assets with front end yields moving a little lower and equities moving higher. For FX, this is favourable for the equity sensitive currencies, with the AUD probably the biggest beneficiary. The AUD is still the currency with the best correlation to equities, and has also lagged behind the correlation with Chinese equities in recent weeks. As long as the 90 day deal with China is extended, we see upside scope for the AUD over the summer, with yield spreads also pointing higher.

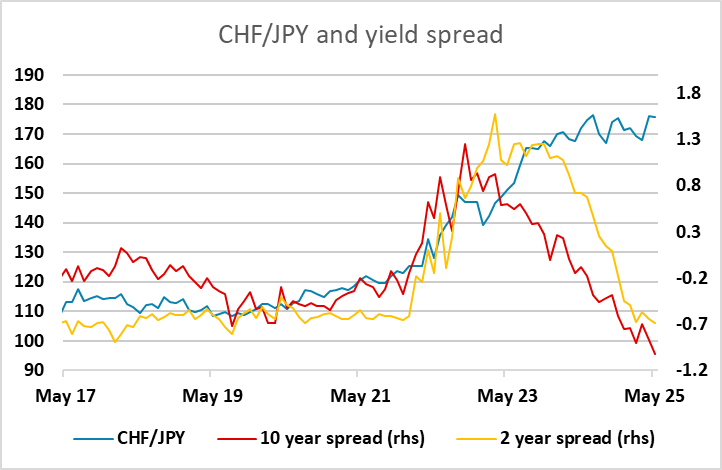

While the JPY is usually undermined by weaker equities, JPY crosses tend to move more with the equity risk premium than with equity indices per se, and this tends to move more due to bond yields than equities. The positive equity market reaction to the CPI data was reliant on a mild decline in front end yields and not much change in back end yields, so the impact on the JPY was modest. For now, USD/JPY looks likely to hold close to 148, which is broadly in line with the level suggested by the short term yield spread correlation. However, we still see upside for the JPY on the crosses over the medium term as equity risk premia still look too low even assuming a mild slowdown in the US. In particular, CHF/JPY continues to look much to high on all measures.

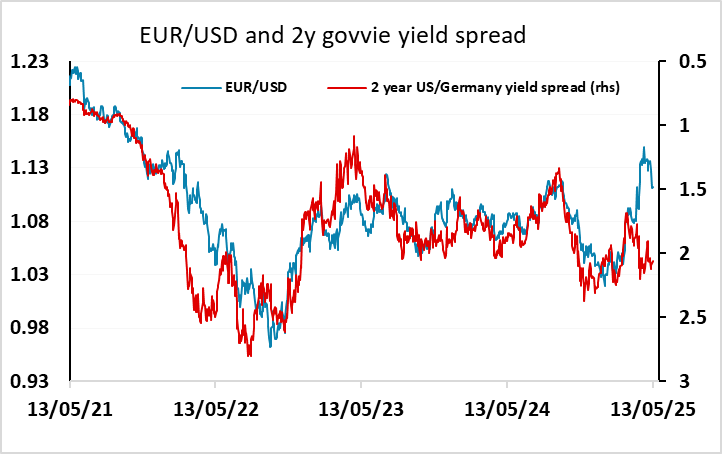

While EUR/USD rose after US CPI data, it still looks a little stretched above 1.11 if the market concerns about tariffs are fading. The break with the yield spread correlation on the tariff announcement reflected some underlying view that the USD might suffer due both to the economic impact of tariffs and a generally weaker US equity market. If these concerns are fading, some further EUR/USD correction is likely, even though we wouldn’t see a move down much below 1.10, and in the longer run we continue to expect the USD to move lower.