FX Daily Strategy: N America, January 30th

GDP data may have more impact than the ECB meeting

European GDP weaker than expected but impact modest

US GDP to come in lower than published consensus after big trade deficit

USD risks consequently on the downside

GDP data may have more impact than the ECB meeting

European GDP weaker than expected but impact modest

US GDP to come in lower than published consensus after big trade deficit

USD risks consequently on the downside

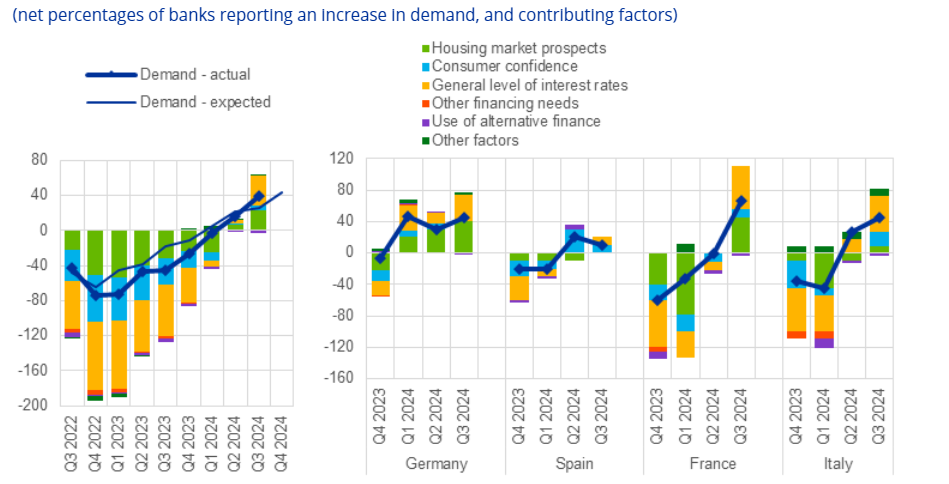

Weaker than expected German GDP at -0.2%, France at -0.1%, and Italy at 0.0% in Q4, have ensured that the Q4 Eurozone GDP was weaker than expected at flat q/q. Even so, while the current data is quite soft, there are some positive signs from stronger bank lending, and the ECB if anything might emphasise these green shoots at today’s meeting. Additionally, the US data later is likely to come in below the published consensus after yesterday’s big trade deficit. EUR/USD should consequently hold near 1.04, but we still see some downside scope for USD/JPY and EUR/JPY.

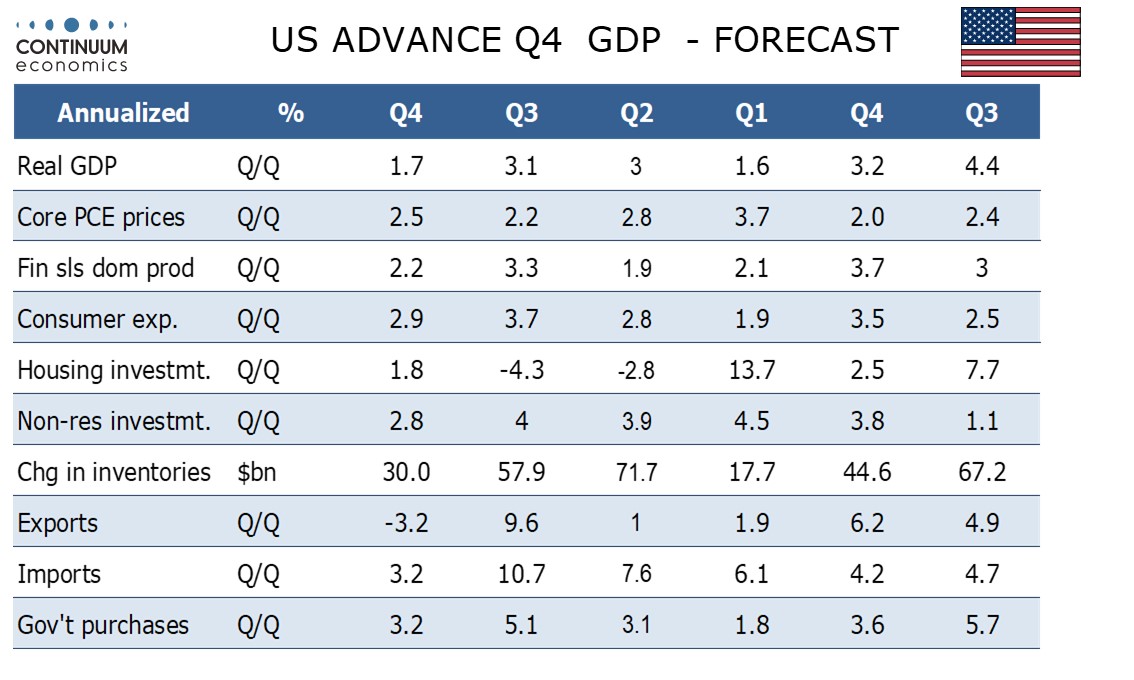

Potentially more significant could be the US GDP data. After surprisingly weak December advance goods trade and retail and wholesale inventory data on Wednesday we have revised our forecast for Q4 GDP down significantly, now expecting a 1.7% annualized rise rather than our previous estimate of 2.6%. The gain may have been stronger without strikes and hurricanes in early October. Q1 data is also likely to see some adverse weather effects early in the quarter. We expect core PCE prices to see a modest acceleration to 2.5% from Q3’s 2.2%, assuming a 0.2% rise in December. Overall PCE prices will be slightly slower at 2.3% but the overall GDP price index slightly firmer at 2.6%, lifted by subdued export prices marginally outperforming import prices.

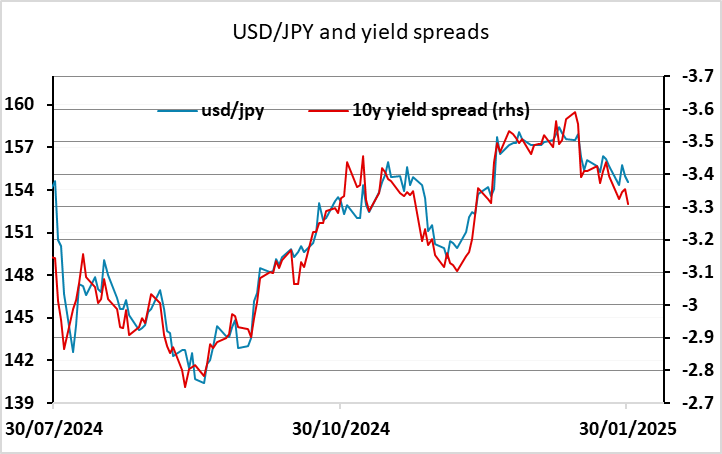

The published market consensus is for a rise of 2.7% q/q, but most forecasters will be revising down their numbers after the trade and inventories data, so the true consensus is somewhat lower. The Atlanta Fed GDPNow indicator, which is a nowcast of the GDP numbers and is generally well followed, was revised down to 2.3% from 3.2% in response to the data. However, neither the USD nor US yields declined in response to the data, so there is some downside risks if the numbers are weaker than the published consensus as we expect. The fact that a rising trade deficit is partly responsible should also be seen as USD negative, although inasmuch as it encourages Trump to go ahead with tariff increases it could work the other way. Even so, we see USD downside risks on the data, particularly against the JPY as lower yields should have the clearest impact on US/Japan yield spreads.

Household Loan Demand Reflecting Better Interest Outlook?

The ECB meeting is less likely to have a significant impact, as a 25bp cut is fully priced in. Admittedly, the door will be left open for further cuts but hints may be made that amid less-soft survey data, possibly including better bank lending signs, the discount rate is approaching a terminal if not a neutral outcome. It is clearly the case that the ECB is discussing what constitutes a neutral rate, but this is occurring more covertly rather than within the confines of the Council meetings. Regardless, we still think that the economy will undershoot ECB thinking and inflation will continue to soften. All of which implies around four 25 bp cuts in H1 this year, with an ensuing around-neutral 2% policy rate. This is broadly what is priced into the market, with the policy rate priced to be 2.03% at the December meeting. Unless the ECB show a clear protest to market thinking, expect the reaction to be mild.