FX Daily Strategy: APAC, Oct 14

UK earnings data a focus for GBP

GBP risks on the downside given the lack of BoE easing priced in

NFIB survey unlikely to disturb firm USD tone

AUD still supported as long as risk sentiment holds up

UK earnings data a focus for GBP

GBP risks on the downside given the lack of BoE easing priced in

NFIB survey unlikely to disturb firm USD tone

AUD still supported as long as risk sentiment holds up

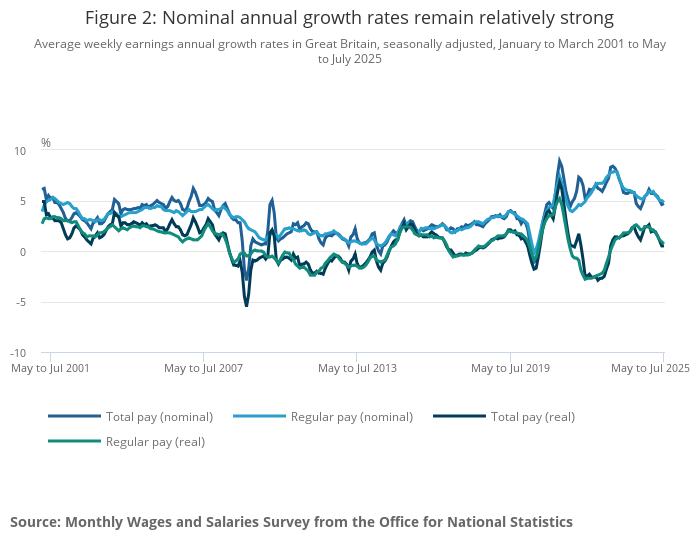

UK labour market data looks like the most interesting data release on Tuesday, as it remains a key focus for the BoE. There is increasingly more focus on the HMRC data on payrolled employment and earnings, in part because this is more up to date, in part because the data is seen to be more complete. Both the ONS and the HMRC data have shown weakening in employment trends in recent months, although this is clearer in the HMRC data. However, the earnings data has shown a clearer decline in the ONS data. The market still tends to react more directly to the ONS data, particularly on average earnings. The HMRC data showed a pick-up in earnings in August, but the latest REC survey reported starting pay for permanent workers rose negligibly in September, with the rate of growth the weakest seen since the current run of pay inflation began just over four-and-a-half years ago. We see risks of some further but modest drops in the official earnings data, at least in this release.

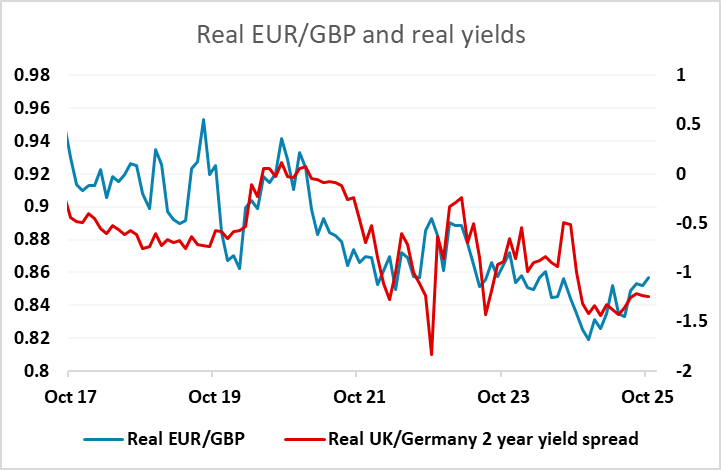

For GBP, we still see risks as being mainly on the downside because of the only very modest BoE easing priced into the UK curve for the next year. The next rate cut is not fully priced in until April next year, while the Fed is expected to cut three times by then, taking US rates well below UK rates. This seems an unlikely scenario with the UK economy likely to struggle to generate any growth in the coming quarters, especially with a fiscal tightening expected in the November budget. EUR/GBP does tend to move with UK/EUR real yield spreads, and these are likely to converge over the long run, suggesting upside risks. Weak earnings data could restore hoes of a UK rate cut this year, while stronger earnings growth is unlikely to have any impact on UK rate expectations.

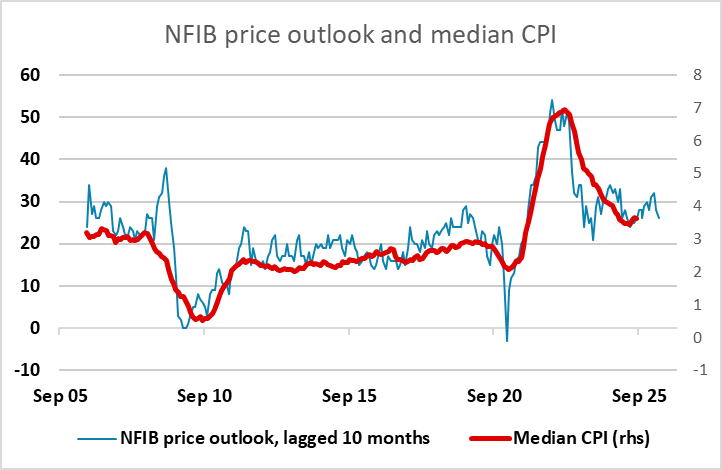

The US does release the NFIB small business optimism survey on Tuesday, which takes on slightly greater importance given the lack of official data. This has recovered since April, having dipped on the Trump reciprocal tariff announcement, following a strong rally on the election result, similar to 2016. It’s unlikely we will see a lot of change in the optimism index this time around, but there will also be interest in the price index, which has some leading indicator properties relative to CPI inflation. However, the main focus for the USD will be on the China tariff issue, although Trump may well now stay quiet on this until nearer the November deadline for the introduction. The USD retains an underlying firm tone, but we still see it as being vulnerable against the JPY as the USD/JPY rally on the LDP election looks flimsily based.

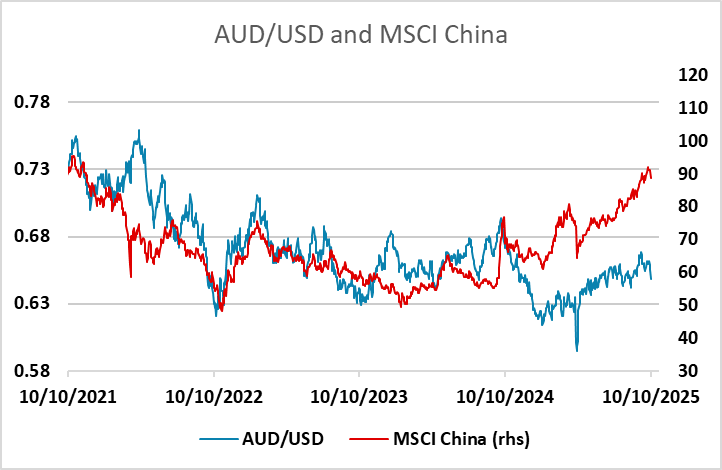

The RBA minutes and the NAB business confidence indictor could have some impact on the AUD, which is still holding the shallow uptrend seen since the April dip despite some recent softness against the USD. We would still expect the AUD to perform solidly unless we see a more general decline in risk sentiment, although it is vulnerable to any deterioration in sentiment towards China.