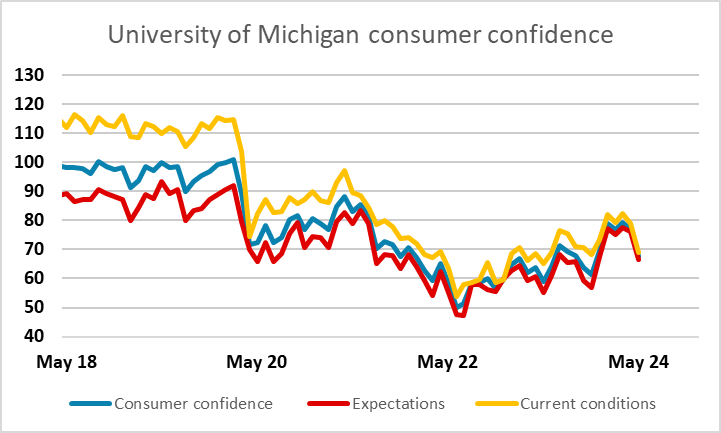

USD flows: USD softer after weak UoM confidence

University of Michigan confidence data shows sharp decline - USD may come under more pressure

Quite a big decline in the University of Michigan consumer confidence index, with both expectations and current conditions significantly lower, while inflation expectations rose. The last few pieces of data have left the clear impression of a slowing US economy while European numbers are suggesting an improvement. This has been seen in the PMI and ISM surveys, as well as the improving European GDP data for Q1.

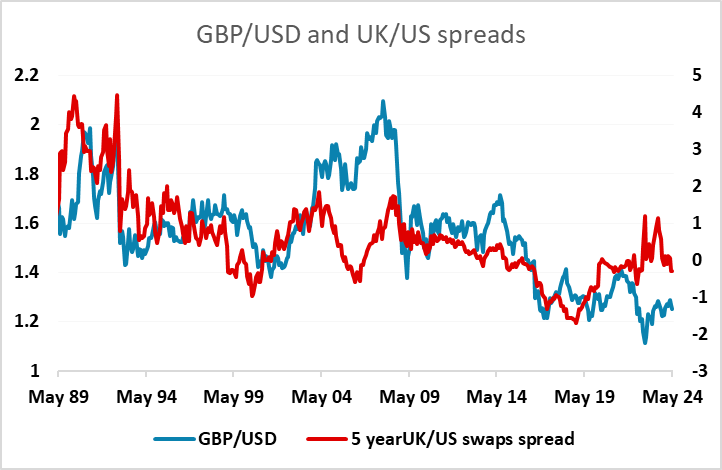

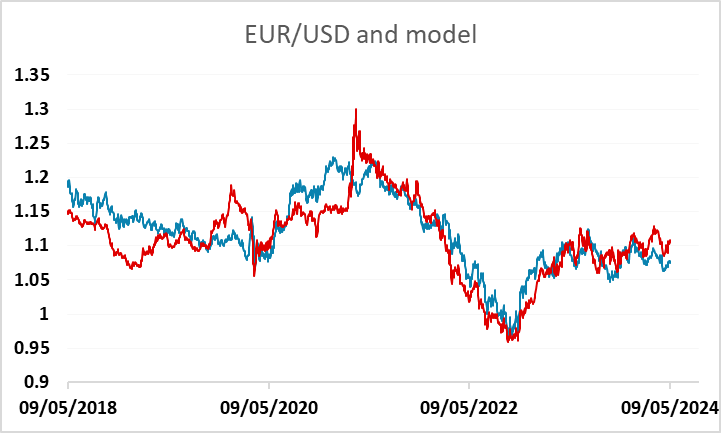

Does this matter for FX? It’s not entirely clear that it does, since for the moment the growth weakening in the US seems to be coming with higher inflation, while the growth improvement in Europe is seemingly being accompanied by weaker inflation, and likely by rate cuts before too long. Inasmuch as EUR/USD is driven by yield spreads, this suggest limited USD downside, but if the change in relative growth leads to outperformance of European equities, it may nevertheless allow some EUR/USD gains. We are a little nervous of the strong UK GDP data this morning, with 0.45% of the 0.6% q/q rise being due to net exports, specifically weak imports, but evidence of recovering UK growth could suggest a more significant GBP recovery. The GBP/USD break from the usual correlation with yield spreads in the last couple of years has been striking, but a return to the normal relationship could mean a substantial GBP/USD recovery.