FX Daily Strategy: APAC, August 19th

Canadian CPI unlikely to have a significant impact

Recent USD/CAD recovery approaching its limits

US housing starts trend to remain soft

JPY weakness to continue until risk premia rise

Canadian CPI unlikely to have a significant impact

Recent USD/CAD recovery approaching its limits

US housing starts trend to remain soft

JPY weakness to continue until risk premia rise

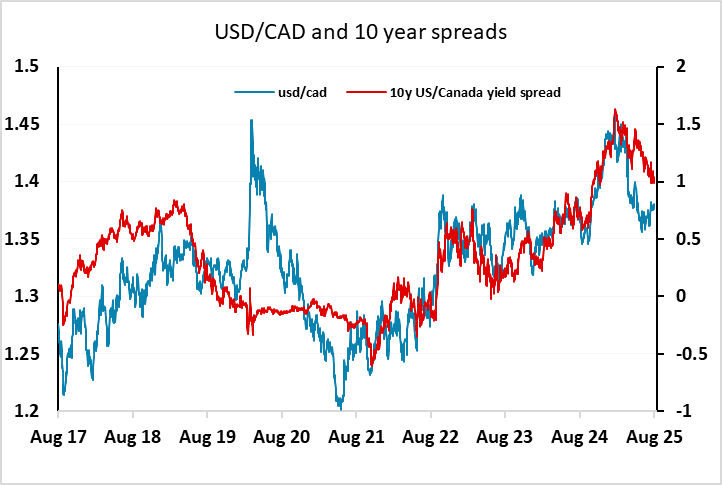

While we do see the release of US housing starts, Canadian CPI is the most notable G10 data on Tuesday, and we doubt it will have much market impact, as both we and the market consensus look for the BoC core measures to be unchanged in July from June on a y/y basis. USD/CAD has been edging up in recent sessions, and is close to reconnecting with its historic relationship with yield spreads. Similar to EUR/USD, USD/CAD broke away from this relationship when Trump announced the initial version of reciprocal tariffs in April. While EUR/USD remains some way away from the level normally associated with current yield spreads, USD/CAD is only a figure or two away from what might be considered fair value based on spreads.

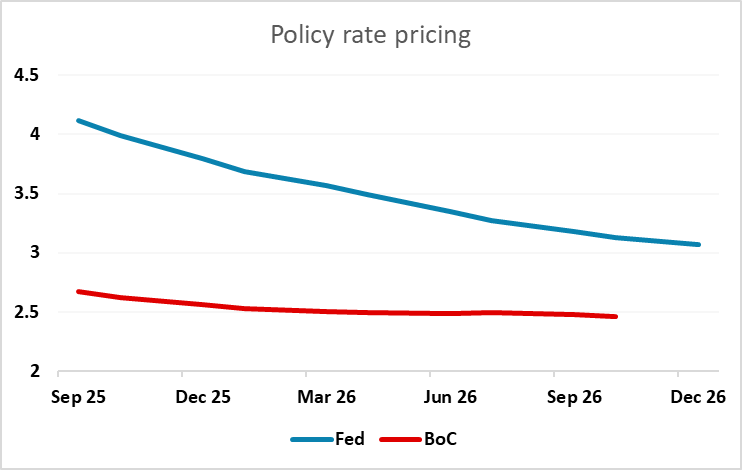

Currently, the market is pricing the Fed to ease around 100bps more than the BoC by the end of 2026, starting with a Fed cut in September, while the BoC is not fully priced to cut by 25bps again until March 2026, by which time the Fed is priced to have cut 75bps. If this is correct, it is likely that the 10 year yield spread will also contract significantly, suggesting scope for USD/CAD to move lower. So from here, while it is possible that we see a further short term move up towards 1.40, it is likely that we will see significant sellers on USD/CAD rallies from here. But today’s CPI data seems less likely to trigger a reaction than a more general USD move, possibly triggered by the Trump/Zelensky/Europe talks, although these also seem unlikely to deliver anything substantive.

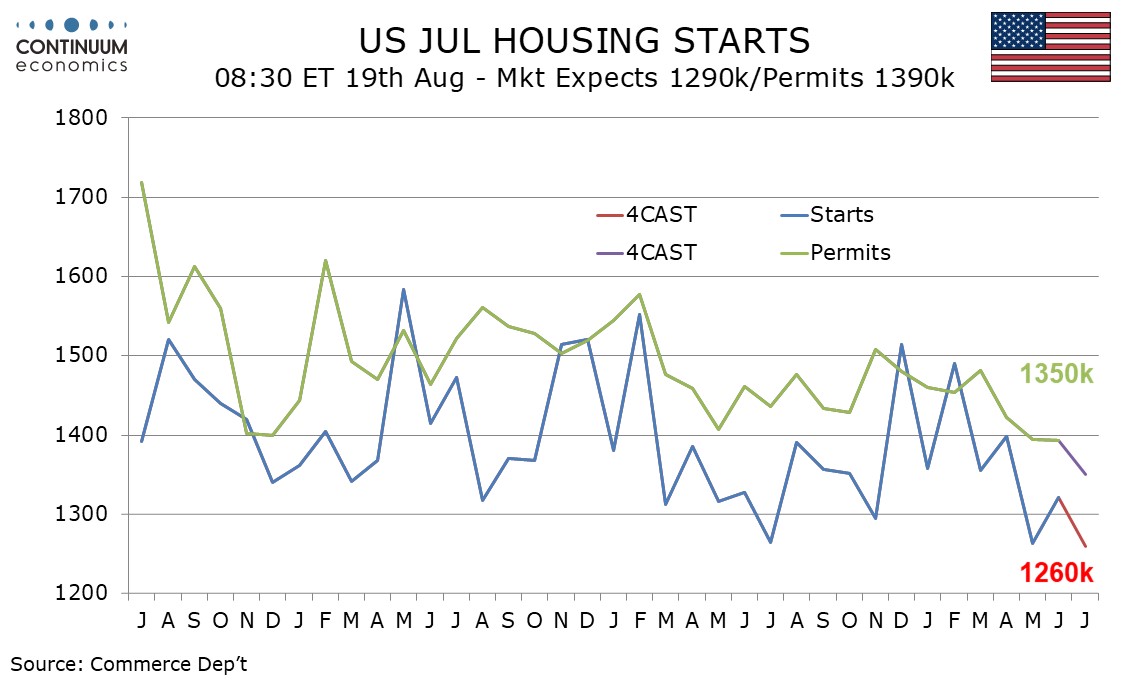

As for US housing starts, we expect July housing starts to fall by 4.6% to 1260k, reversing a similar rise in June which corrected a 9.7% decline in May. We expect permits to confirm a slipping trend with a fourth straight decline, by 3.1% to 1350k. A soft trend is likely to persist unless Fed easing commences, but seems unlikely to be severe enough to undermine confidence in the US economy or the USD.

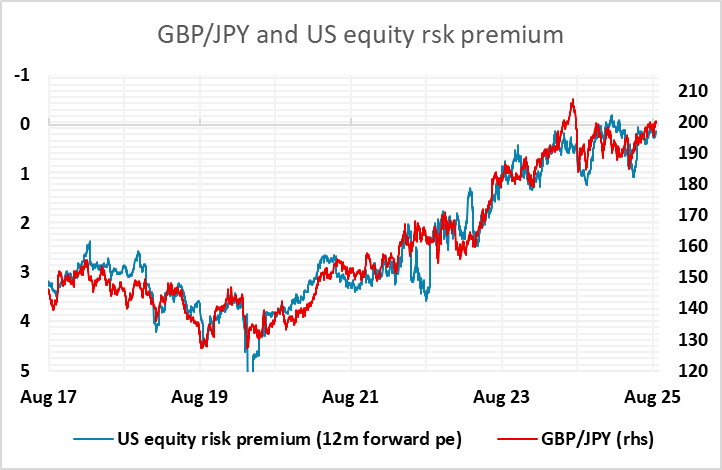

The USD was generally firmer on Monday, helped by slightly firmer US yields and some geopolitical uncertainty around the Ukraine talks. The JPY continues to trade well below the level suggested by yield spreads, with the low level of equity risk premia continuing to weigh on the JPY, notably on the crosses. GBP/JPY once again traded above 200 on Monday, threatening the one year high from last week, and targeting the retracement level at 201.50. It still looks likely to require a turn in risk sentiment, most likely triggered by weak US labor market data, to trigger a significant JPY recovery.