FX Daily Strategy: N America, March 11th

Weak equities keep the JPY on the front foot

Yield spreads already justify further JPY gains…

…but more equity weakness may be needed to break key JPY cross support levels

NOK/SEK rally on Monday may be the beginning of something bigger

Weak equities keep the JPY on the front foot

Yield spreads already justify further JPY gains…

…but more equity weakness may be needed to break key JPY cross support levels

NOK/SEK rally on Monday may be the beginning of something bigger

Tuesday is a very light calendar, although there may be some interest in the US JOLTS data, given the uncertainty about the current state of the US economy and labour market. The US equity market is looking vulnerable, and the problem the market faces is that mediocre growth isn’t good enough. Equity risk premia are very low by historic standards, and price in superior earnings growth, which typically requires superior GDP growth. Anything mediocre means the US equity market is overpriced.

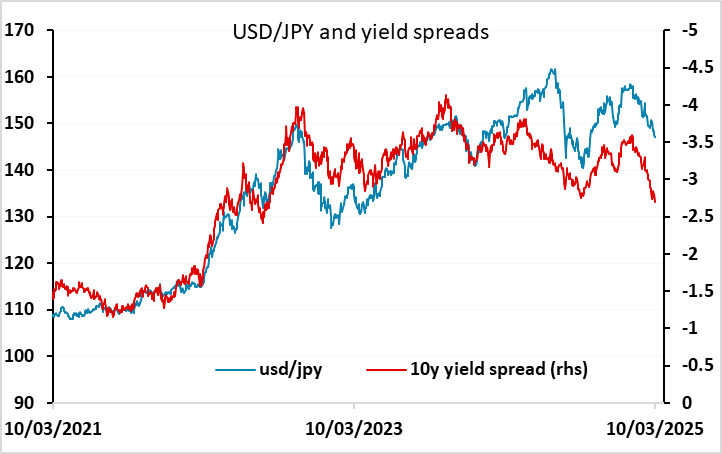

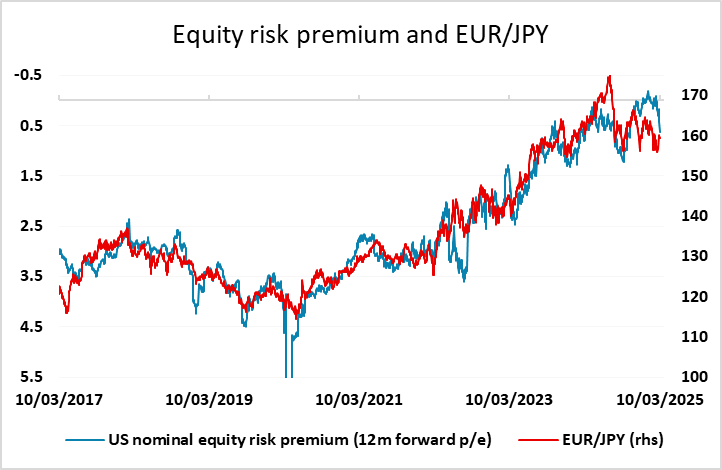

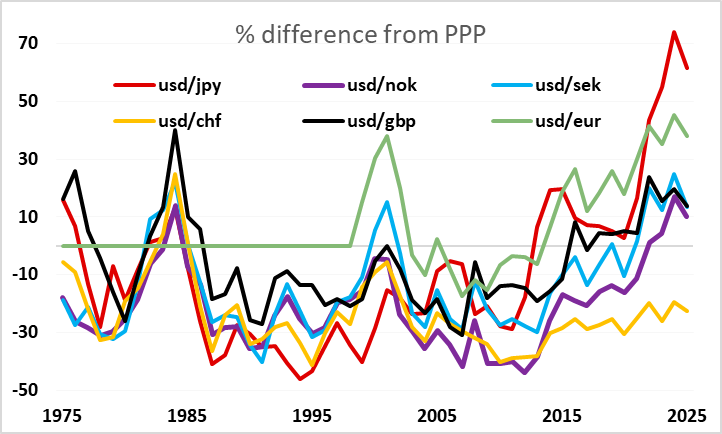

For the FX market, equity market weakness looks likely to mean further JPY strength. Yield spreads have already fallen far enough to suggest there is scope for USD/JPY to fall below 140, but JPY strength typically requires some unwinding of carry positions to get going, and this is much more likely to happen if equity market are falling. For much of the last decade, EUR/JPY and other JPY crosses have been well (inversely) correlated with the nominal US equity risk premium, but this relationship looks to be starting to break down, and the case for holding these positions for carry is already a lot weaker with the sharp narrowing we have seen in yield spreads. Valuewise, the JPY remains extremely cheap by all measures, so any reversion to value trading would see substantial JPY gains.

While we have seen some modest increase in the US equity risk premium in the last few weeks, there could still be a long way to go if it were to revert to anything like normal. As it stands, the risk premium hasn’t yet risen enough to suggest major unwinding of cross yen positions based on the relationship in recent years, but some positive growth numbers are likely to be necessary to prevent an unwind. European growth expectations have been boosted by expectations of increased defence and infrastructure spending, but Europe is starting from a low base and while European equity markets are more reasonably valued than the US, something close to 2% European growth is still needed to justify current valuations. So from here we see little reason for any JPY losses unless there is a reversal of Trumps’ tariff policies that the market is viewing as growth negative.

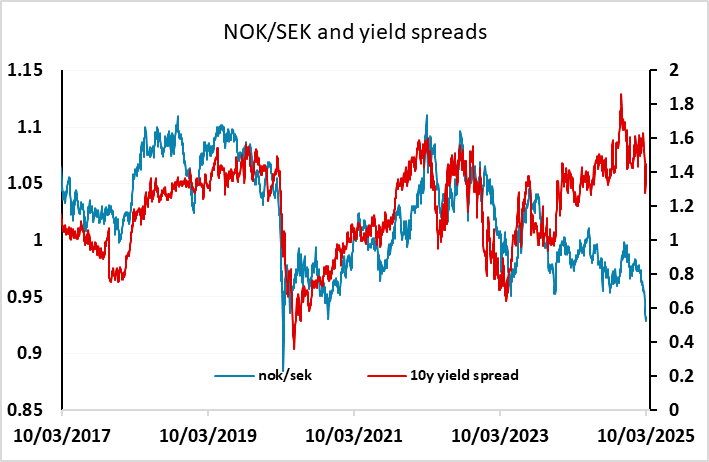

One of the biggest movers on Monday was NOK/SEK, which rose more than 1% after the higher than expected Norwegian CPI data. This still leaves NOK/SEK down around 4% on the year, and close to the 0.90 level that represents the all time low excluding the brief pandemic spike. EUR/NOK is also still close to the all time high at 12.07 (excluding the pandemic spike). The weakness of the NOK over the past year has been something of a mystery, given the attractive yield levels, the solid Norwegian economy and Norway’s huge current account and budget surpluses. Of course, most of the current account surplus is recycled into foreign currency by the government pension fund, and the NOK was historically very expensive, so that recent losses only mean it is close to Purchasing Power Parity against the SEK. But relatively high yields should still allow for a relatively strong currency. 0.90 should be a strong base so most of the medium term NOK/SEK risk here should be on the upside