GBP flows: GBP recovers on stronger GDP

UK GDP rises a better than expected 0.6% in Q1, but breakdown looks suspicious. Nevertheless, GBP likely to hold firm short term

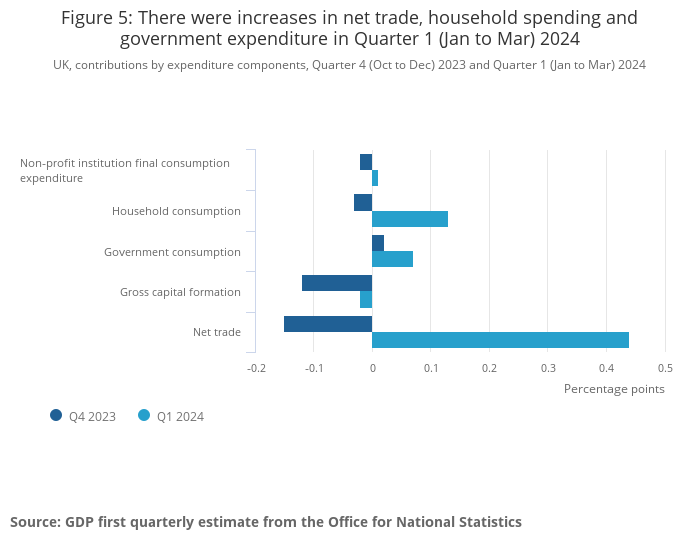

GBP has strengthened in early trade, reversing yesterday’s decline after the Bank of England MPC meeting and Monetary Policy Report, driven by stronger than expected Q1 GDP. GDP rose 0.6% q/q, the strongest quarterly rise since Q1 2022, with industrial production and services output both rising strongly, but construction falling again. From the expenditure side, most of the gain was due to strength in net exports, owing to a 2.3% decline in imports. This makes the rise look a little suspicious, as such volatility in net trade is often temporary. However, the output measure is normally the more reliable in the short term, so it may be that he expenditure breakdown changes in the revised data.

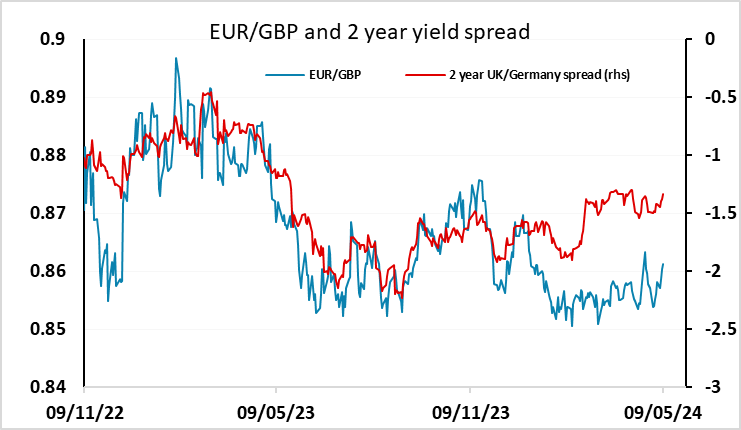

For GBP, the focus is still more on the inflation picture which has been less related to growth performance than supply factors in recent years. There is still a prospect of a June rate cut if the April CPI data behaves and there is evidence that wage growth is continuing to ease. So while in the short run today’s data is likely to see some extension of GBP gains with EUR/GBP stretching below 0.86, we still see upside risks medium term.