FX Daily Strategy: N America, Oct 22nd

UK CPI expected to peak in September

EUR/GBP risks on the upside

JPY weakness may require explicit opposition from the new government to reverse it

CAD has scope to extend gains as BoC October rate cut not assured

UK CPI expected to peak in September

EUR/GBP risks on the upside

JPY weakness may require explicit opposition from the new government to reverse it

CAD has scope to extend gains as BoC October rate cut not assured

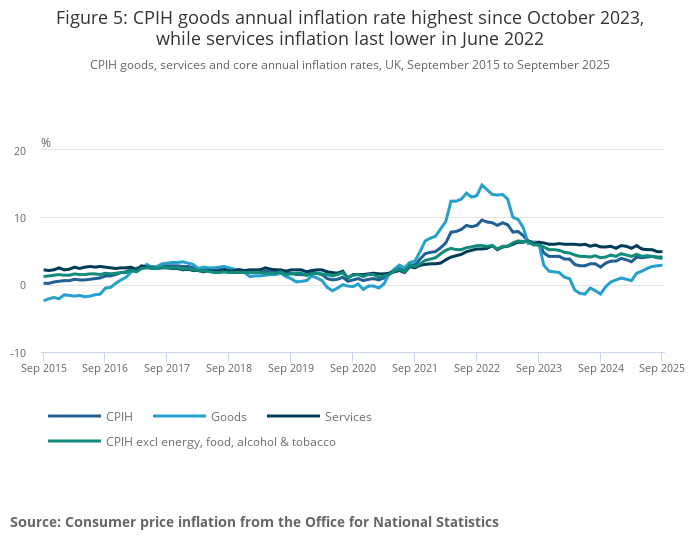

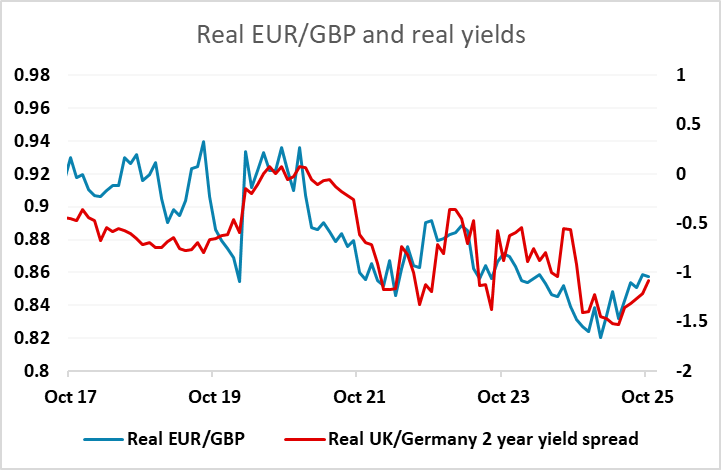

UK September CPI has come in weaker than expected at 3.8% y/y, with the core down to 3.5% y/y, both 0.2% below the market consensus. EUR/GBP has risen 30 pips in response, as markets price in the possibility of an earlier cut in UK rates than was previously expected. However, while this data and the labour market data last week have been on the soft side of expectations, they are still unlikely to be weak enough to convince the hawks at the BoE that a November rate cut is justified. A cut is currently priced as around a 35% chance, up from 15% before the data, but a cut is now seen as a 75% chance by year end.

Nevertheless, UK yields haven’t fallen quite enough to suggest that EUR/GBP will break above the year’s high of 0.8763. The BoE will likely want to see the Budget at the end of November before deciding to cut again, but if this is as contractionary as expected, a December cut looks very likely, and EUR/GBP should be trading on an 0.88 handle by year end.

Otherwise, the weakness of the JPY remained a major feature of the market after Takaichi was appointed PM on Tuesday. She indicated that she hoped the BoJ would continue to pursue a 2% inflation target, driven by wage gains rather than commodity prices, which might be seen as a call for them to avoid tightening. An October hike remains only an outside chance, but further JPY weakness might pressure the BoJ to pull the trigger. However, it is unclear whether even tighter BoJ policy would prevent JPY weakness as the JPY has been weakening in the last few months despite yield spreads moving very much in its favour. There may also need to be a signal from the new administration that they don’t seek a weaker JPY to halt the downtrend.

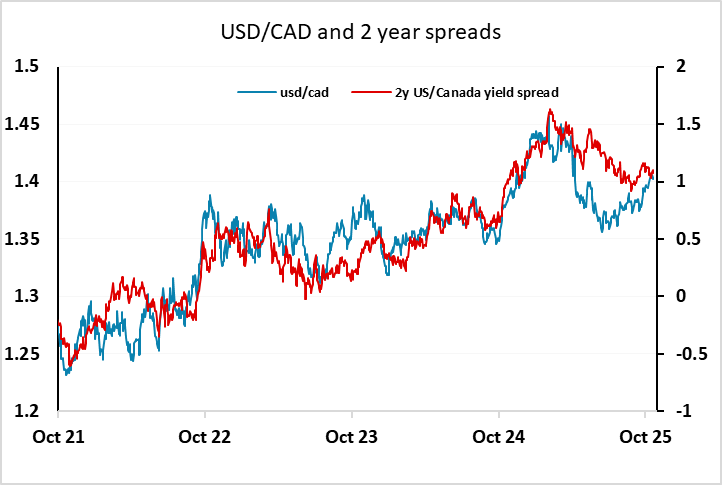

The CAD managed a modest gain on Tuesday on the back of slightly stronger than expected September CPI data. However, there has been no significant decline in expectations of a BoC rate cut at the October 29 meeting in response, and this is still priced as around an 85% chance. We think it will be a close call, and slightly favour no change, which would suggests scope for USD/CAD to extend the decline below 1.40.