JPY, EUR, USD flows: JPY still weak as equities stay firm

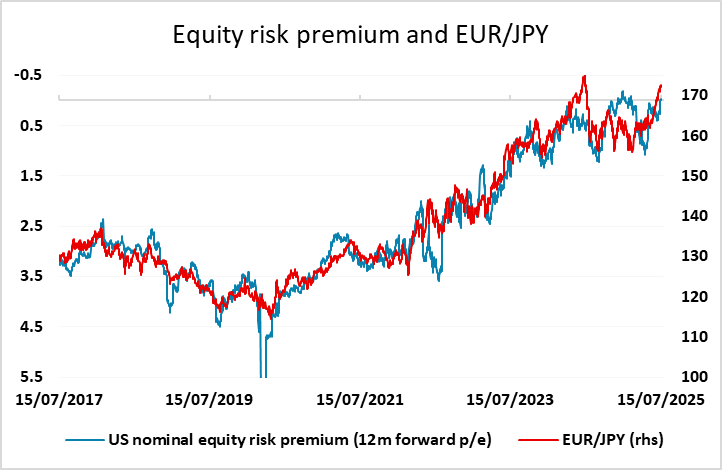

JPY weak despite higher JGB yields. New high in S&P500 futures

There’s not a great deal on the calendar ahead of the US CPI data later, although the German ZEW survey will attract some attention. The ZEW expectations index has gained strongly in the last couple of months, perhaps because of declining concerns about tariffs, but this month’s survey won’t include any reaction to Trump’s latest tariff initiative, so is of limited significance. US CPI will therefore be the main focus, but risk sentiment is likely to remain positive unless CPI comes in stronger than expected.

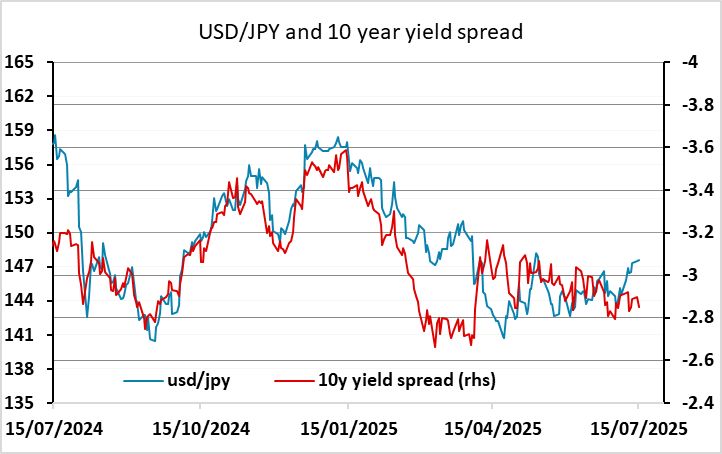

Overnight we have seen a new all time high in S&P500 futures. This came before the Chinese GDP data, which showed a larger than expected 1.1% gain in Q2, and appears to be related to positive news on Nvidia. Chinese equity indices fell back after the data, which was mixed in that investment was weaker than expected and retail sales also disappointed in June. The JPY remains under pressure despite a rise in JGB yields related to the upcoming Upper House elections which are seen as potentially triggering more fiscal spending. While JPY weakness looks excessive, no reversal is likely unless equities turn lower.