FX Daily Strategy: APAC, December 17th

UK CPI a downside risk for GBP

Softer equities to weigh on riskier currencies

JPY to benefit in more risk negative conditions

AUD still represents value

UK CPI a downside risk for GBP

Softer equities to weigh on riskier currencies

JPY to benefit in more risk negative conditions

AUD still represents value

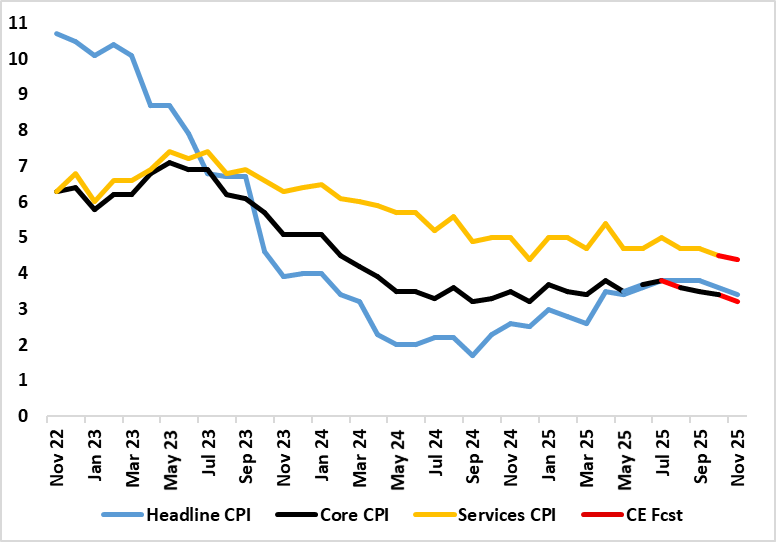

Headline and Core to Fall Further

Source: ONS, Continuum Economics

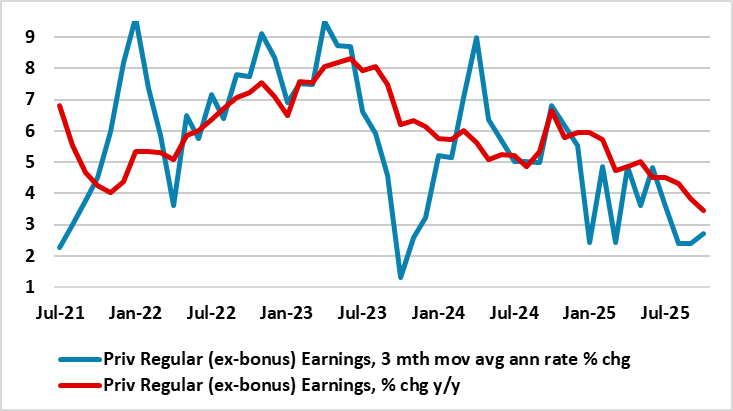

Wednesday sees UK CPI data, following on from the labour market data on Tuesday, which we saw as weak although the market responded as if the data was on the strong side. The official ONS data was mixed, in that there was weakness in private sector wages but the headline numbers were slightly stronger than expected. However, the more up to date HMRC November data on payrolled employment was even weaker, showing wage growth at its weakest since the pandemic. GBP did reverse some initial gains against the EUR and we see scope for more losses.

Private Sector Pay Growth - Falling Fast

Source: ONS, CE

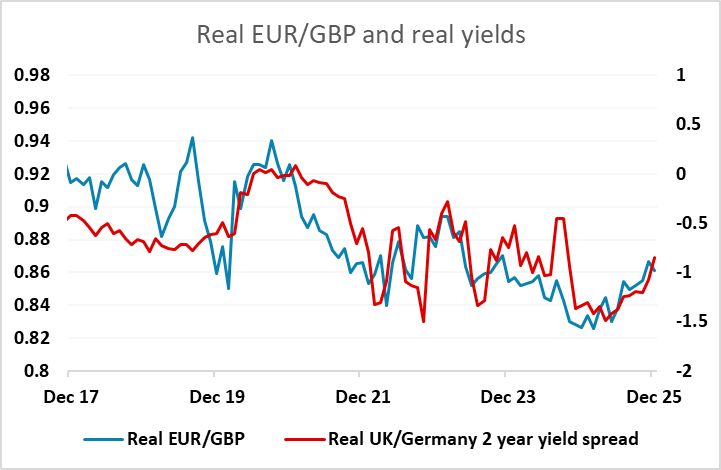

It does seem as if the September CPI outcome will prove to be the CPI inflation peak. Indeed, although October figure fell a little less than the consensus to 3.6%, the looming November numbers may show a same-sized fall to 3.4%, a six-month low. We see the core rate seen also dropping 0.2 ppt but to an 11-month low of 3.2%. These numbers are will below the market consensus of 3.5% headline and 3.4% core, and suggest we could see EUR/GBP advance beyond 0.88.

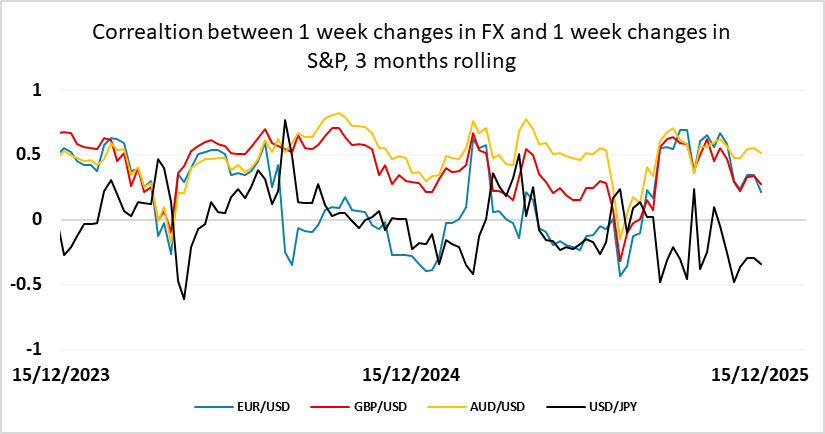

EUR/USD tested above 1.18 on Tuesday but fell back as equities softened after the weaker than expected US PMI data. The European data had also been softer, but the weakness in the US data led to some weakening in equities which generally undermined the riskier currencies. The JPY continues to look the best placed of the majors in these circumstances, with a rate hike still odds on this week and, more importantly, risk sentiment starting to turn a little weaker. The US numbers aren’t particularly bad, but still suggest modest growth and slowing employment growth, which are insufficient to justify the current equity valuations even with AI optimism. Softening equities can be expected to continue to weigh on riskier currencies if we don’t see any significant response in lower US yields.

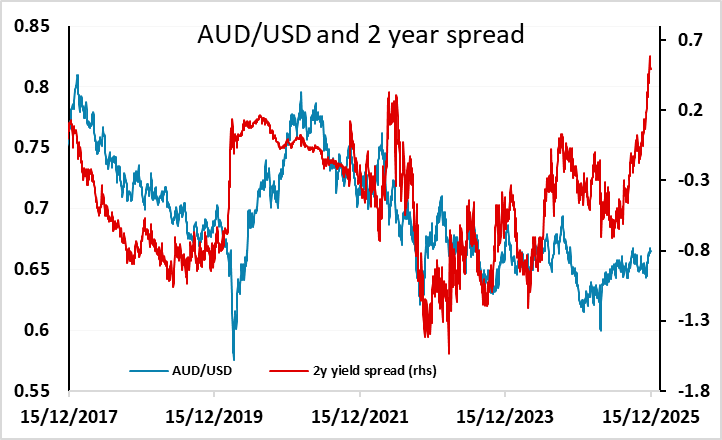

We continue to see value in the AUD, even though its upside will be restricted as long as equities struggle. Yield spreads reman extremely favourable, and modest softening in equities ought not to be enough to prevent a retest of the highs of the year above 0.67. But in a more risk negative environment, the JPY ought to be the best performer.