FX Daily Strategy: Europe, November 22nd

Geopolitical Risk Intensifies

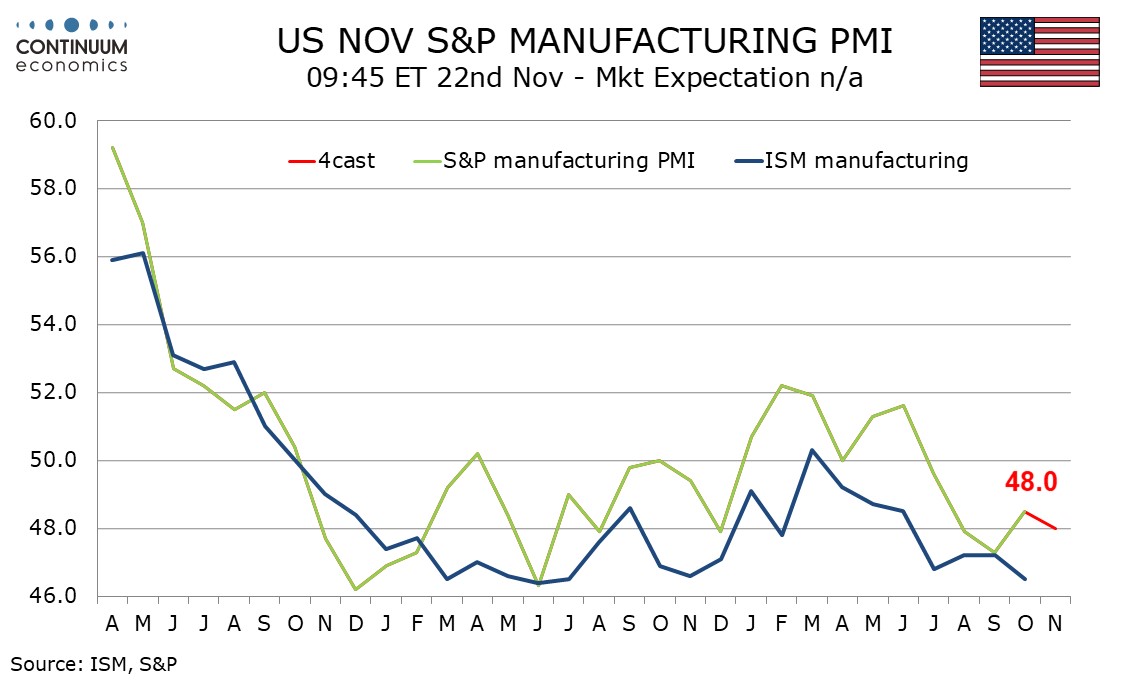

U.S. November S&P PMIs to show a marginal slippage

Japan CPI Moderate Less than Expected

Geopolitical risk intensifies again after the West authorized Ukraine to strike targets within Russia with long range misses. Russia has responded by nuclear threats and seems to have launched an intercontinental ballistic missile, targeting critical infrastructure in the central Ukrainian city of Dnipro. While the west has restrained from nuclear retailiation, it seems likely there will be further escalation in the Ukraine-Russia front unless a deal is brokered by Trump soon. The cheerful equities market does not seem to have priced in any possibility of a world war, which should be kept in our mind of a potential correction.

We expect November’s S and P PMIs to show a marginal slippage in manufacturing to a still weak 48.0 from 48.5 but with services unchanged at a healthy 55.0. The manufacturing index would still be above the preliminary October reading of 47.8, but down from the final 48.5. While the improvement in the second half of October is supportive for further recovery in November a softer October ISM manufacturing index argues in the opposite direction.

The S and P service indices has now been stable around 55 for six straight months and we do not expect much change in October. ISM services data has recently been more volatile, moving above the S and P index in October, though this rise, led by a sharp bounce in delivery times, may prove difficult to sustain and is probably not a signal for November’s S and P services PMI.

Japan National CPI on Friday will likely show further moderation as the pick up in consumption remains slow and low real wage. The Japanese household remains reluctance to consume at high price and is only slowly moving out of traditional spending habits, along with business price/wage setting behavior. There has been little cues from the BoJ on the timing of next hike. We remain our call of a 25bps hike on December with a possbility of 10bps as a compromise. Ueda's latest comment on current inflation tilting towards wage pushed seems to be supportive for our call. If the last read of CPI remains high, it would be a great window for the BoJ to tighten.

Japan National October headline CPI came in stronger at 2.3% y/y, moderating from 2.5% in September. Ex fresh food and energy rose to 2.3% from 2.1% y/y. It would be favorable for our call of a December BoJ hike. It continues to point towards stronger underlying inflation with headline inflation moderating but ex fresh food & energy rose.

On the chart, the consolidation beneath congestion resistance at 156.00 has given way to renewed selling interest, as overbought intraday studies unwind, with the break back below 155.00 adding weight to sentiment. Focus is turning to support at the 154.00 break level, but daily readings are turning down once again and overbought weekly stochastics are flat, suggesting potential for a later break. Focus will then turn to the 152.50 break level, where by-then oversold daily stochastics could prompt fresh consolidation. Meanwhile, a close back above congestion resistance at 155.00, if seen, will help to stabilise price action and prompt consolidation beneath 156.00.