FX Daily Strategy: APAC, Oct 15

GBP weaker after mixed UK labour market data

GBP risks on the downside given the lack of BoE easing priced in

NFIB survey unlikely to disturb firm USD tone

AUD still supported as long as risk sentiment holds up

SEK risks on the downside on CPI

EUR support from French pension delay unlikely to extend

JPY still has significant scope for recovery

Fed Beige Book a greater focus given the lack of US data

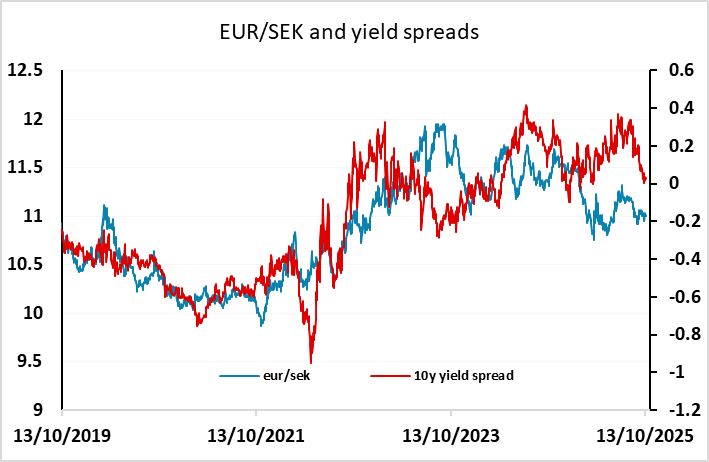

Wednesday’s calendar is once again looking quiet. Swedish final September CPI data could have an impact, as the preliminary data have not been particularly reliable. Risks on any impact are towards the SEK downside, as inflation has been soft and further declines could suggests a need for further easing. As it stands, market pricing only suggests a 20-30% chance of another cut this year, so there is scope for that to increase. EUR/SEK remains a little below the levels suggested by current yield spreads, and NOK/SEK even more so, so we continue to see some downside risks for the SEK.

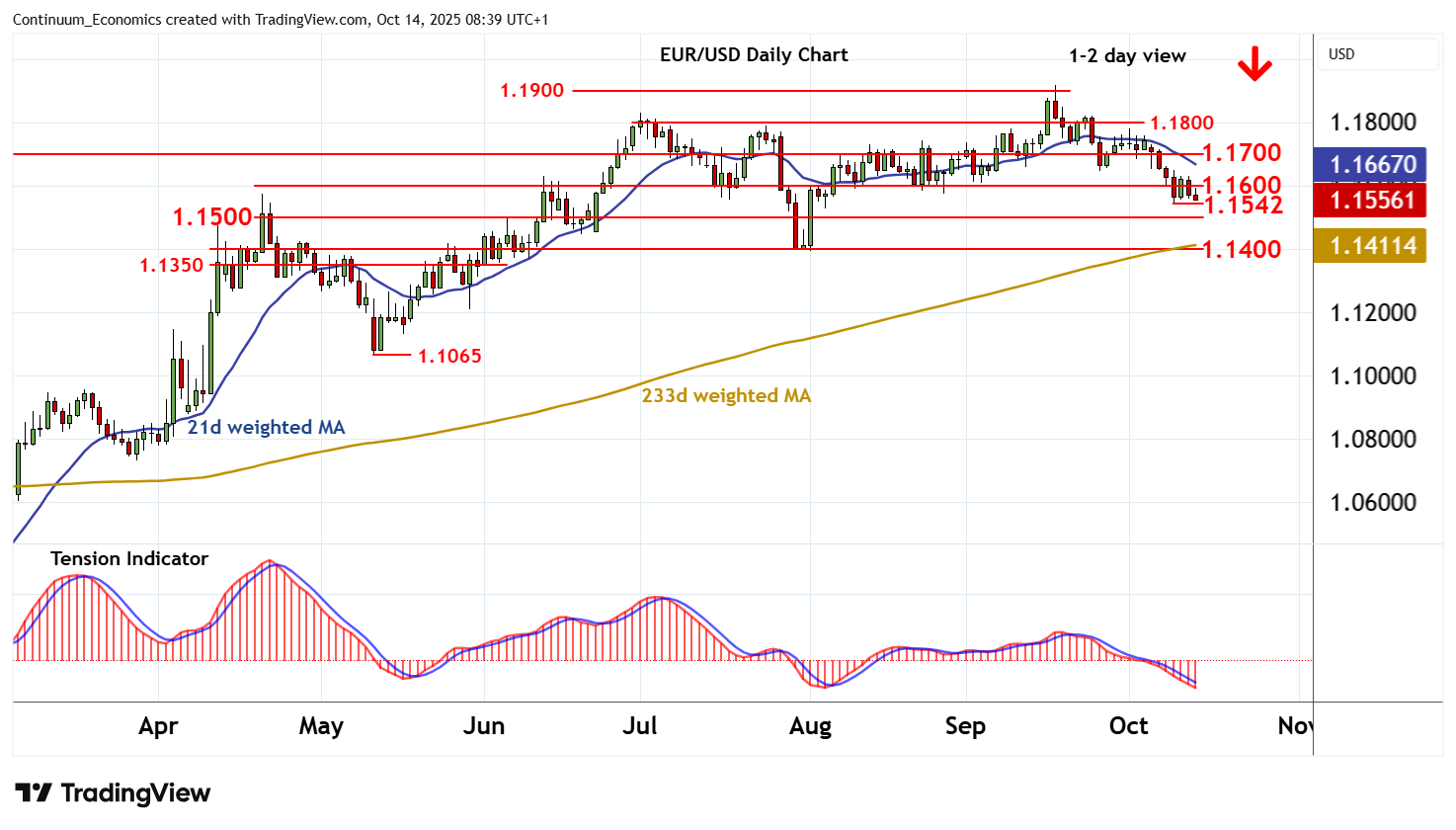

The EUR gained a little support on Tuesday from the decision by French PM Lecornu to suspend pension reform until the next presidential election in 2027, in order to get support from the left for his budget. While he still faces a no confidence motion this week, there is now more chance of getting a budget through, although not one that will make a serious dent in French fiscal problems. We still see some downside risks for the EUR, as the economic data has been soft in both France and Germany of late, but declines sub-1.15 look unlikely without a new factor emerging.

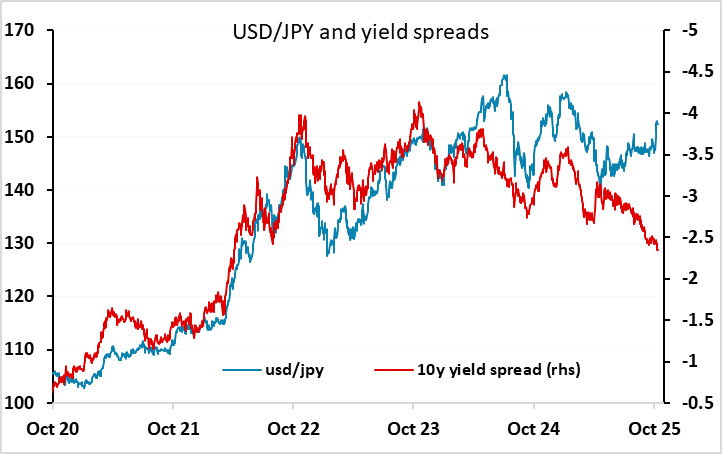

Markets will still be looking for developments on the Trump tariff threat to China. Equity markets are marking time having sold off on the initial announcement, and the general expectation remains that a deal will be reached at some point around the deadline of November 1st. However, history suggests that Trump may allow the deadline to pass before making a deal (even if the deal is quite favourable to China), and this could mean jitters persist for the rest of the month. Thus far, the JPY has only benefited very modestly from the softer equity market, with a risk premium still required due to uncertainty around Japanese politics. We would expect this to be gradually reduced, as we doubt the new government will introduce particularly radical policies, as the LDP does not have a majority so will have to make compromises if Takaichi is to be installed as PM. The JPY remains the main anomaly in what is otherwise a fairly quiet FX market, with both yield spreads and risk premia suggesting substantial scope for a JPY recovery.

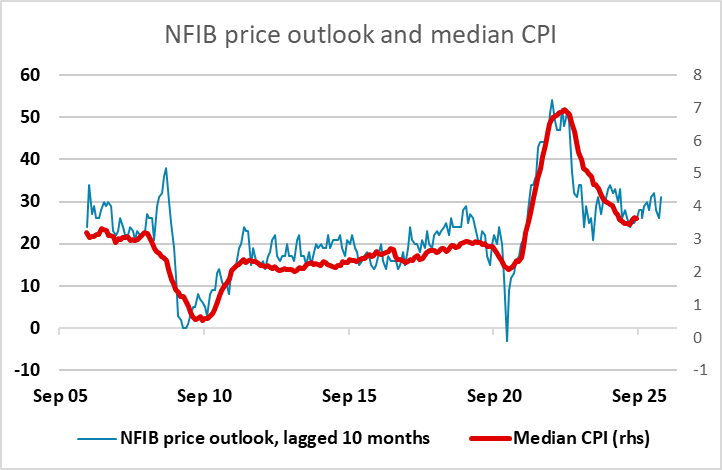

Given the lack of US data because of the government shutdown, there may be more interest than usual in the Fed Beige Book, although the Fed themselves may be struggling to take a policy view because the lack of data. However, it was notable that the NFIB report on Tuesday showed inflationary pressure rising a little, suggesting that tariffs may be having some effect. The NFIB survey does tend to lead CPI and suggests that hopes of an inflation decline in the coming year may be disappointed. If the Beige Book shows any hawkish bent because of such concerns, the equity market and the riskier currencies would likely suffer, but we doubt there will be any strong conclusions made given the lack of data.