FX Daily Strategy: APAC April 1st

RBA to leave rates unchanged

AUD performance likely to depend more on equities

ISM risks on the downside

Risk negative sentiment to continue to support USD and JPY

RBA to leave rates unchanged

AUD performance likely to depend more on equities

ISM risks on the downside

Risk negative sentiment to continue to support USD and JPY

Tuesday sees a thin calendar with the RBA meeting providing some early interest, although in practice it seems very unlikely that the RBA will surprise the market with a rate cut. The RBA cut the cash rate by 25bps to 4.1% at the Feb 18 meeting and will feel no urge to cut when inflation is comfortably sitting in the centre of the target range. The RBA see the cash rate to be at 3.6% by year end 2025 and at 3.4% June 2026, but the market is pricing in a little more easing than this, with year end priced at 3.35%, so if anything the risk for rates is to the upside if, as seems likely, there is no rate cut this time around. But the RBA do currently see rates as restrictive, and after the weak employment report last time, they may present a more dovish view.

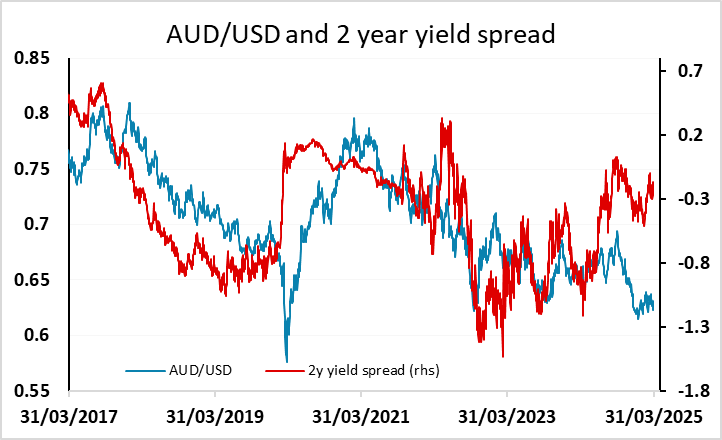

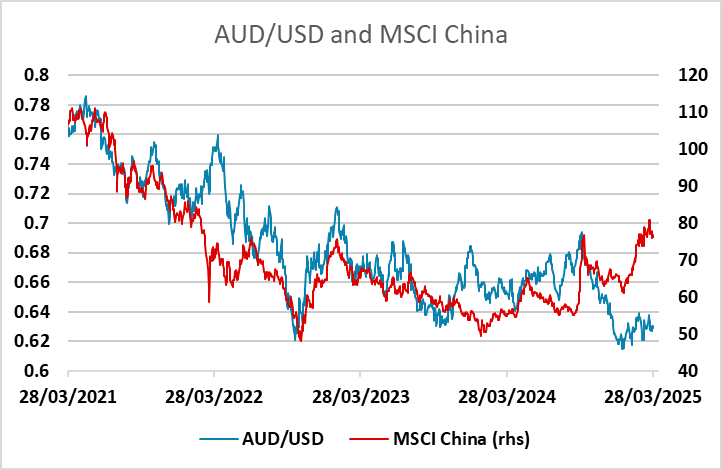

In any case, the AUD outlook is unlikely to be much influenced by the RBA unless they deliver a surprise cut. Whether they cut twice or three times more this year it won’t change the fact that AUD/USD looks cheap relative to yield spreads. But this will only be AUD positive if the equity market, particularly the regional Asian markets, show a more positive tone. This seems unlikely ahead of the tariff announcement on Wednesday, so for now expect the AUD to remain under pressure, although the 0.62 level should continue to represent good support unless there is more severe negative rusk sentiment.

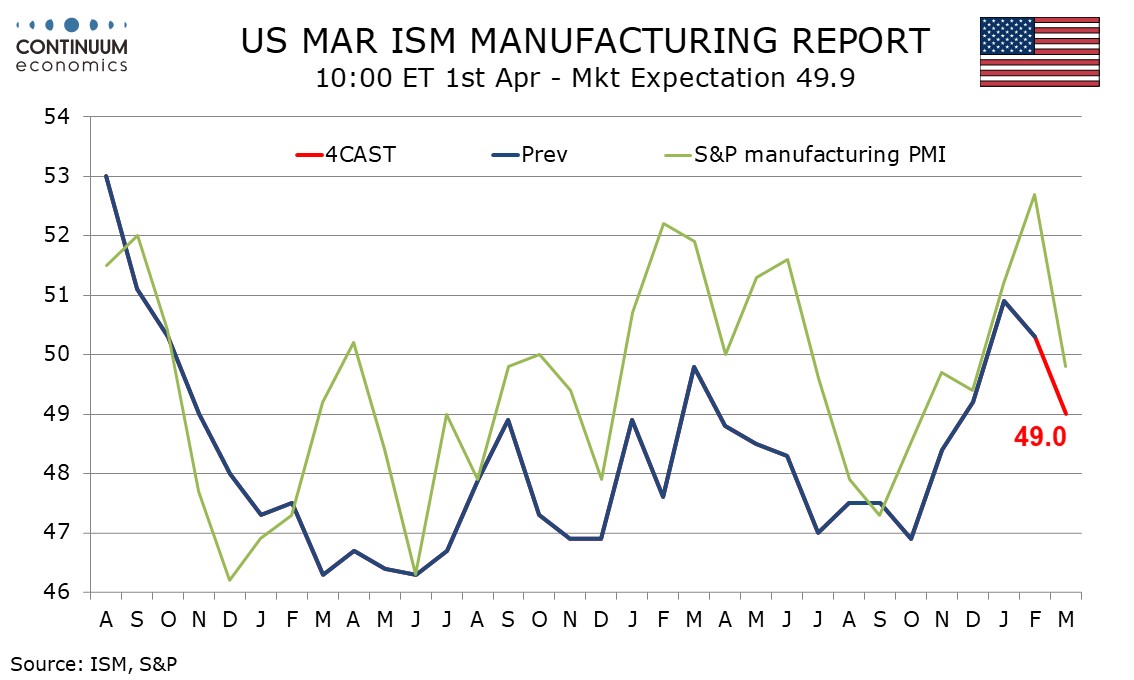

Datawise, the US ISM manufacturing survey will be the main focus. We expect a March 1SM manufacturing index of 49.0, slipping back below neutral for the first time in three months, after positive readings of 50.3 in February and 50.9 in January. March’s S and P manufacturing index slipped back below neutral after two positive months and regional surveys are generally weaker, with the Philly Fed’s less positive, the Richmond Fed’s turning negative and the Empire State survey very weak. However, the manufacturing sector is less significant than the services sector, so we doubt this will have a major impact ahead of Wednesday’s tariff announcements.

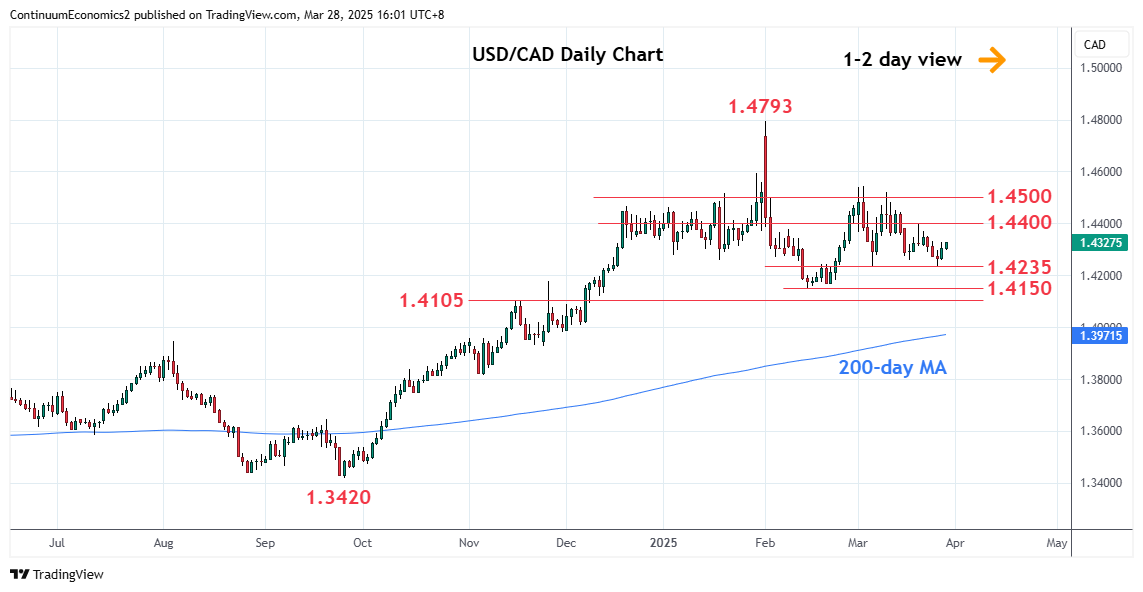

The USD benefited from the general equity market weakness on Monday, and it is hard to oppose the risk negative tone at this stage. For the US, the recent rise in the trade deficit is a drag on growth, and while it is in large part due to tariff related timing of imports, as well as some precious metal imports than won’t impact GDP, Q1 GDP is likely to be the weakest for some time and unlikely to be much better than flat on the quarter. While a Q2 rebound is likely, tariffs are expected to be growth negative as whole, so it is hard to justify current still very high equity market valuations. This suggests the USD will remain strong, and the JPY can also be expected to perform well, with the riskier currencies likely to remain under pressure. The CAD has so far proved surprisingly resilient to the tariff increases already announced, but may be the most vulnerable of the majors in this risk negative environment.